Chinesische Staatsanleihen: Wachsenden Markt mit Indexfonds erschliessen

China ist die zweitgrösste Volkswirtschaft der Welt. Der Anleihenmarkt des Landes wächst stark. Noch sind viele internationale Investoren in chinesischen Anleihen unterinvestiert, obwohl der Marktzugang während der letzten Jahre deutlich einfacher wurde. Chinesische Staatsanleihen bieten einem global diversifizierten Obligationen-Portfolio sowohl historisch als auch aktuell attraktive Eigenschaften. Wir haben unsere Indexpalette um einen indexierten Baustein für chinesische Staatsanleihen ergänzt.

Text: Vincenz Hoppeler

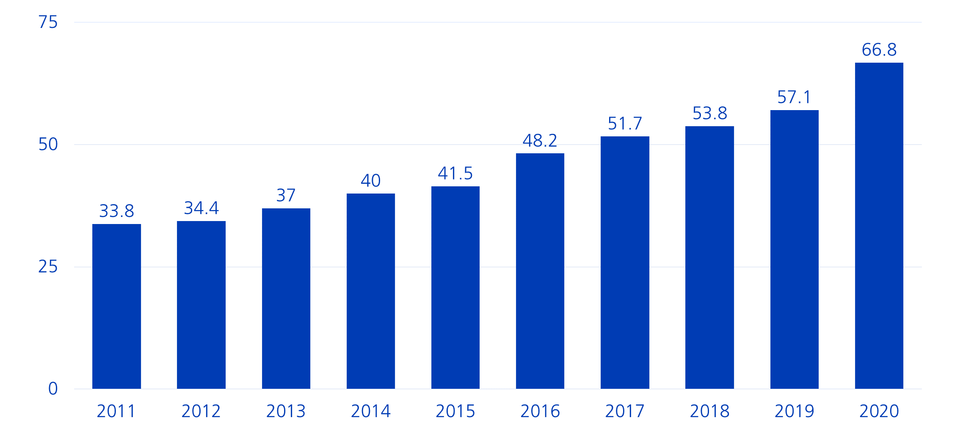

Mit einem Volumen von mehr als 19 Billionen US-Dollar ist der chinesische Anleihemarkt nach dem US-Anleihenmarkt heute der zweitgrösste der Welt. Mit einem zweistelligen Wachstum während der letzten Jahre gehört er gleichzeitig zu den am schnellsten wachsenden Anleihemärkten. In dieser Entwicklung spiegelt sich die zunehmende Staatsverschuldung Chinas wider. Trotz des Anstiegs der vergangenen Jahre ist das absolute Niveau der chinesischen Staatsverschuldung im internationalen Vergleich bisher tief.

Chinesische Staatsverschuldung in Prozent des BIP

Zugang zum Anleihenmarkt verbessert

Der Zugang zum chinesischen Anleihenmarkt war historisch relativ eingeschränkt. Die Fortschritte für internationale Anleger, die bei der Öffnung des chinesischen Finanzsektors erzielt wurden, führten zu einem grösseren Interesse an chinesischen Onshore-Anleihen. Mit der Einführung der Kanäle China Interbank Bond Market und Bond Connect wurde der direkte Zugang massgeblich erleichtert. Bond Connect besticht heute durch das relativ schnelle Antragsverfahren und die Erleichterung des elektronischen Handels über etablierte Offshore-Handelsplattformen und wird deshalb von den Investoren bevorzugt.

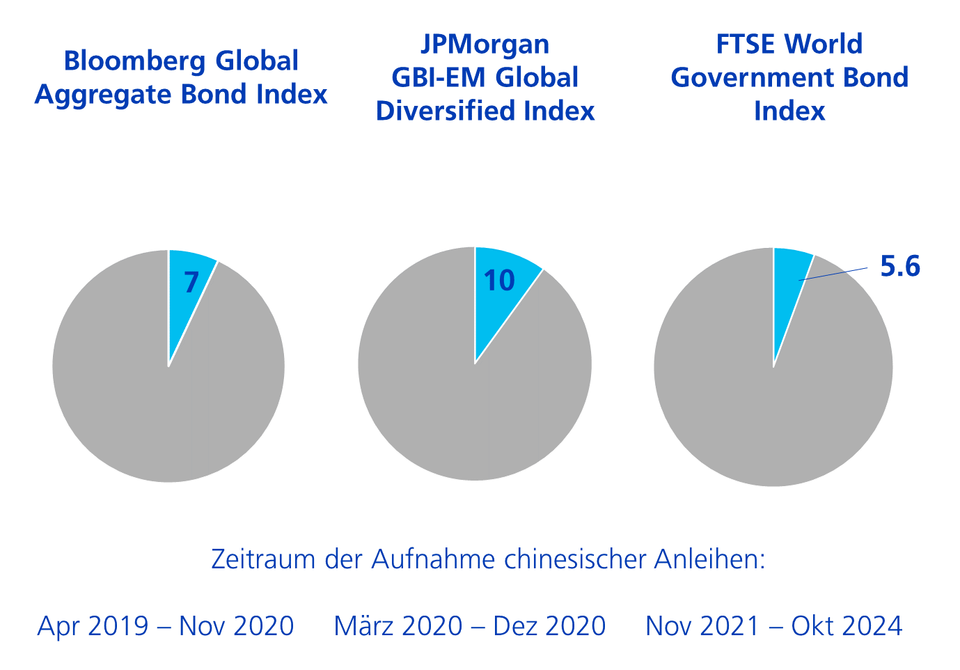

Aufnahme in internationale Bond-Indizes

Der erleichterte Marktzugang hat sich auf die Zusammensetzung verschiedener globaler Obligationenindizes ausgewirkt. So begannen der Bloomberg Global Aggregate Bond Index im Jahr 2019 und auch der J.P. Morgan GBI EM Global Diversified Index (2020) mit der schrittweisen Aufnahme von Onshore-China-Anleihen. Ab November 2021 werden chinesische Obligationen über einen Zeitraum von 36 Monaten nun auch schrittweise in den FTSE World Government Bond Index aufgenommen. Damit werden chinesische Anleihen in drei wesentlichen globalen Obligationen-Indizes mit einem spürbaren Gewicht vertreten sein (vgl. Grafik).

Gewichtung chinesischer Anleihen in internationalen Bond-Indizes

Es ist davon auszugehen, dass die Zuflüsse in chinesische Anleihen sowohl durch die Aufnahme in die Indizes als auch durch ein steigendes Interesse internationaler Investoren weiter zunehmen werden.

Chinesische Staatsanleihen: Attraktive Kombination von Rendite und Risiko

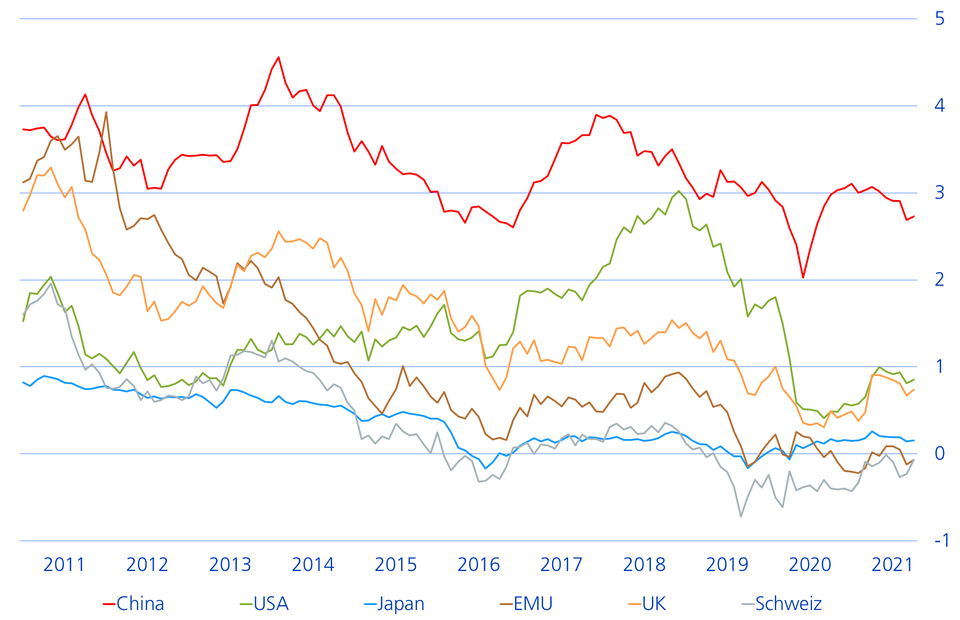

Vor dem Hintergrund niedriger oder gar negativer Zinsen in vielen entwickelten Ländern heben sich chinesische Staatsanleihen mit aktuell rund 2.73% Yield to Maturity klar ab. Mit einem Rating von A+ und einer geringeren Volatilität als vergleichbar bewertete Staatsanleihen weisen chinesische Staatsanleihen eine hohe Qualität auf.

Yield to Maturity internationaler Staatsanleihen

Die People's Bank of China (PBoC) bemüht sich derzeit um ein Gleichgewicht zwischen der Förderung der anhaltenden Erholung der Binnenwirtschaft beigleichzeitiger Haushaltskonsolidierung und Normalisierung des Kreditwachstums. Generell wird erwartet, dass eine zurückhaltende Geldpolitik verfolgt wird und bei Bedarf einzelne Wirtschaftszweige gezielt mit zusätzlicher Liquidität versorgt werden. Eine wesentliche Straffung der Geldpolitik scheint aktuell eher unwahrscheinlich.

Chinesische Alleinstellungsmerkmale

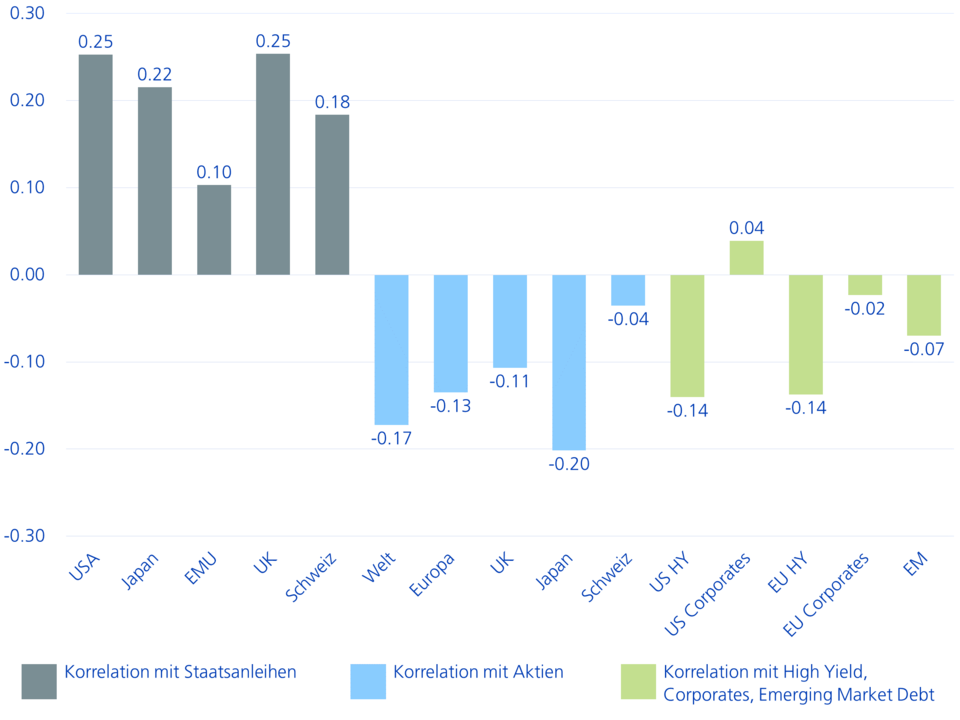

Nebst den höheren Renditen haben chinesische Staatsanleihen auch attraktive Diversifizierungsmöglichkeiten vorzuweisen. Die vergleichsweise tiefe Volatilität ist dem Umstand geschuldet, dass der chinesische Anleihenmarkt von inländischen Investoren dominiert wird und damit den globalen Marktvolatilitäten weniger stark ausgesetzt ist. Wir gehen auch bei einer zunehmenden Öffnung des chinesischen Marktes von einer weiterhin starken inländischen Nachfrage und Dominanz inländischer Investoren aus. Die chinesische Wirtschaft dürfte vom Rest der Welt relativ unabhängig bleiben; auch die chinesische Geldpolitik dürfte durch die US-Notenbank weniger stark beeinflusst werden, als dies bei anderen Notenbanken der Fall ist.

Chinesische Staatsanleihen zeichnen sich durch eine historisch relative geringe Korrelation zu anderen Anlageklassen aus. Dies bietet in einem globalen Anleihenportfolio Chancen zur Risikominimierung.

Tiefe Korrelation chinesischer Anleihen mit anderen Anlageklassen

Währung: Renminbi-Aufwertung als potenzieller Renditetreiber

Die starken Kapitalflüsse der letzten Jahre, der Zinsvorteil chinesischer Staatsanleihen und die Geldpolitik der grössten Zentralbanken haben zu einer Aufwertung des Renminbi gegenüber den Währungen der Industrieländer und auch gegenüber dem Schweizer Franken geführt. Obschon die PBoC einer weiteren starken Währungsaufwertung entgegenwirken dürfte, sollten weitere Zuflüsse in chinesische Aktien und festverzinsliche Anlagen die Währung stützen, was für Anleger in nicht währungsbesicherte Staatsanleihen einen potenziellen Renditetreiber darstellt. Aktuelle Schätzungen von FTSE Russell gehen davon aus, dass im Verlauf der nächsten drei Jahre von ausländischen Investoren rund USD 350 Mrd. in chinesische Staatsanleihen investiert werden könnten.

Chinesische Staatsanleihen unbeeinflusst von Evergrande

Die aktuellen Entwicklungen um die zunehmende Regulierung privater Wirtschaftszweige und die gezielte Abkühlung des Immobilienmarktes zeigen den weiterhin starken Einfluss der Regierung auf den chinesischen Finanzmarkt. Die aktuellen Entwicklungen rund um Evergrande haben bisher noch nicht zu einem Anstieg der Risikoaversion bei chinesischen Staatsanleihen geführt. Trotz der weiterhin bestehenden Risiken bei einer Investition in den chinesischen Finanzmarkt (politische Risiken, Risiko einer stark steigenden Staatsverschuldung, geopolitische Risiken, ESG-Risiken) hat China ein grosses Interesse daran, ausländisches Kapital ins Land zu holen. Nicht nur muss China aufgrund seines strukturell rückläufigen Leistungsbilanzüberschusses in Zukunft mehr Kapital von internationalen Investoren anlocken, sondern auch ein tragfähiges Rentensystem entwickeln, weil die Bevölkerung schnell altert. Gleichzeitig ist die Stabilität der eigenen Währung und des Anleihenmarktes eine wichtige Voraussetzung für eine verstärkte Bedeutung Chinas im internationalen Kontext. Im Jahr 2020 hat China in dieser Hinsicht eine wichtige Bewährungsprobe bestanden.

Neu: Swisscanto Index-Produkt für chinesische Staatsanleihen

Internationale Anleihe-Investoren tragen der wachsenden Bedeutung des chinesischen Anleihenmarktes zunehmend Rechnung. Wir bieten deshalb Anlegern ab sofort die Möglichkeit, mit dem Swisscanto (CH) Index Bond Fund China Govt. in den chinesischen Staatsanleihenmarkt zu investieren.