Corporate Hybrid Bonds: Segment mit attraktivem Rendite-Risiko-Profil

Corporate Hybrids sind nachrangige Anleihen, die von erstklassigen Nicht-Finanzunternehmen emittiert werden. Da diese Anleihen von den Ratingagenturen teilweise als Aktienkapital angerechnet werden, stärken die Emittenten mit dem Hybridkapital ihre Bonität. In der Kapitalstruktur der Emittenten sind Corporate Hybrids nachrangig gegenüber anderen Schulden und vorrangig gegenüber dem Aktienkapital.

Text: Hagen Fuchs , Daniele Paglia

Im Falle eines Konkurses würden die Anleger der Anleihen somit erst nach den übrigen Gläubigern bedient. Im Gegensatz zu vorrangigen Schuldpapieren erhalten Hybrids aufgrund ihrer Nachrangigkeit ein etwa zwei Stufen tieferes Rating. Dafür sind die Renditen bei Hybrids höher als bei vorrangigen Schuldpapieren.

Typische Struktur einer Corporate Hybrid-Anleihe

Corporate Hybrids weisen eine sehr lange oder unendliche Restlaufzeit auf (Perpetual), haben aber in der Regel nach 5 bis 10 Jahren einen ersten Kündigungstermin (Call Date). Der Coupon ist bis zum ersten Kündigungstermin fixiert, danach werden Basiszins und Kreditrisikoprämie gegebenenfalls neu fixiert.

Gemäss Marktkonvention werden Corporate Hybrids auf das erstmögliche Call-Datum gepreist. Dies, weil die Emittenten einen sehr grossen Anreiz haben, die Anleihen auf den ersten Kündigungstermin zurückzubezahlen: Tilgt ein Emittent den Hybrid nicht per erstem Call-Datum, so verliert die Anleihe beispielsweise bei der Ratingagentur S&P die Eigenschaft der Anrechenbarkeit ans Aktienkapital. Der Hybrid wird dann aus der Sicht des Emittenten zu einem sehr teuren Senior Bond.

Corporate Hybrids sind keine Bail-In-Instrumente wie beispielweise Coco-Anleihen und unterliegen somit keiner automatischen beziehungsweise vom Regulator erwirkten Wandlung.

Starkes Wachstum und Beständigkeit auch in der Krise

Der Markt für Corporate Hybrids ist in den letzten Jahren stark gewachsen und hat sich zu einem reifen Anlagesegment entwickelt, in dem diversifiziertes Anlegen möglich ist. In den letzten 10 Jahren hat sich der Markt für Corporate Hybrids versechsfacht. Die aktuelle Grösse entspricht mit ausstehenden Anleihen im Umfang von USD 188 Mrd. ca. 2/3 der Grösse des CoCo-Marktes. Investoren können derzeit unter 180 Bonds von 81 namhaften Emittenten auswählen.

Emittenten am Markt für Corporate Hybrids

Während der durch die Corona-Pandemie ausgelösten Verwerfungen im ersten Quartal 2020 wurde der Markt einem ersten, extremen Stresstest unterzogen, den er mit Auszeichnung bestanden hat. Trotz hoher Marktvolatilität waren Corporate Hybrids immer liquide handelbar und rational gepreist. Damit präsentierten sie sich in deutlich besserer Verfassung als High Yield und Emerging-Markets-Anleihen.

Green Bonds, ESG-Kriterien und CO2-Reduktion

Auch aus Nachhaltigkeitsperspektive kann das Corporate-Hybrids-Universum mit einigen Vorteilen auftrumpfen: Bereits über 10% des Emissionsvolumens von Corporate Hybrids besteht aus Green Bonds, also Anleihen, die zur Kapitalbeschaffung für Aktivitäten zu Gunsten von Umwelt und Klimaschutz dienen. Die Tendenz ist steigend. Zum Vergleich: Im globalen Markt für Unternehmensanleihen beträgt der Anteil von Green Bonds derzeit weniger als 2%.

Zudem haben die Emittenten von Corporate Hybrids neben einer im Vergleich zum globalen Durchschnitt niedrigeren CO2e-Intensität auch deutlich bessere ESG-Ratings.

Anlagekategorie mit attraktivem Rendite-Risiko-Profil

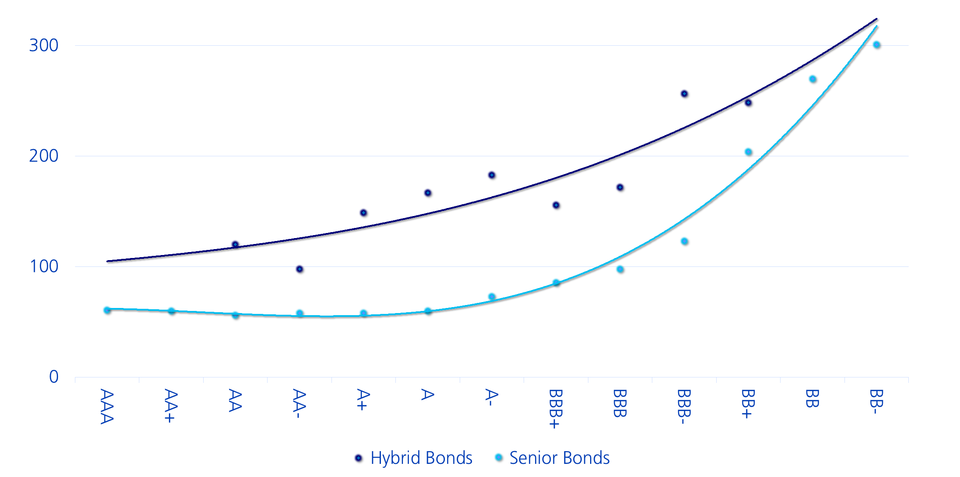

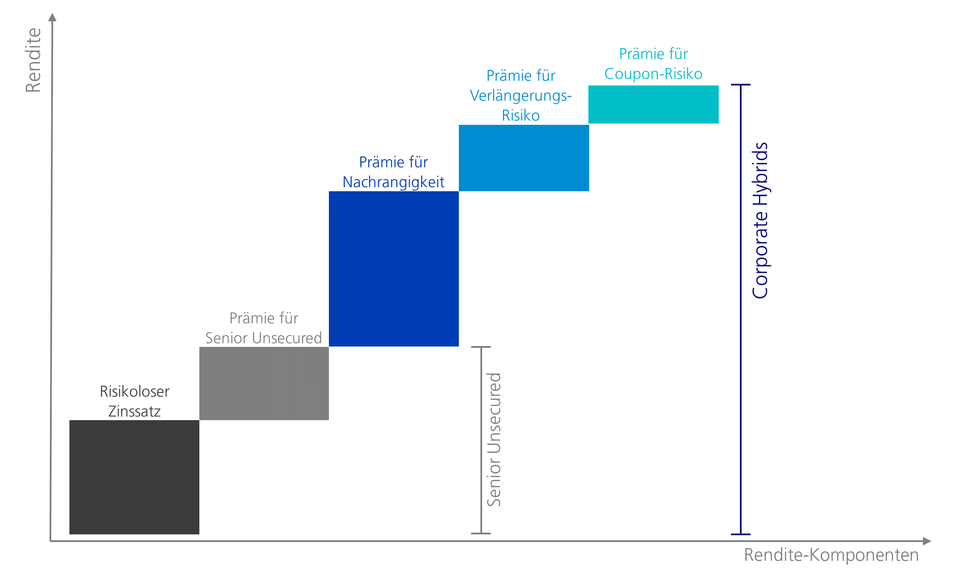

Investoren werden für die hybrid-spezifischen Risiken, wie in der Abbildung 1 ersichtlich, mit einem Renditeaufschlag entschädigt. Damit weisen sie historisch betrachtet, wie in der Abbildung 2 dargestellt, ein ähnliches Renditeniveau wie Senior Bonds von High Yield Emittenten auf, werden aber von bonitätsstarken Emittenten mit einem Investment Grade Rating ausgegeben.

Merke: Das Ausfallrisiko einer Senior- und einer Hybrid-Anleihe desselben Emittenten ist identisch. Im Falle eines Defaults ist der zu erwartende Verlust bei Hybrids gegenüber Senior Anleihen jedoch höher (Nachrangigkeit).

Abbildung 1: Rendite-Komponenten von Corporate Hybrid Bonds

Erfolgreiche Investition nur mit passendem Anlageprozess

Für eine erfolgreiche Investition in Corporate Hybrids bedarf es eines disziplinierten und klaren Anlageprozesses, der klassisches fundamentales Research und systematische Quant-Modelle kombiniert. Im Optimalfall sollten dabei sowohl eine datenbasierte top-down Selektion der zum jeweiligen Zeitpunkt attraktivsten Segmente des Hybrid-Universums als auch eine gründliche bottom-up Kreditanalyse jedes in der engeren Auswahl verbleibenden Schuldners eine Rolle spielen. Zudem müssen vor dem Anlageentscheid die spezifischen Strukturmerkmale jeder Anleihe analysiert werden.

Abbildung 2: Höhere Kreditrisikoprämie bei gleichem Emittenten-Rating