Considering sustainability criteria has long been a mainstream practice for equities or bond investments. However, with derivatives-based commodities, there is the preconception that these criteria are difficult or impossible to implement because they are based on homogeneous (standardised) and substitutable goods. We have risen to this challenge and, together with our partner rfu Unternehmensberatung, the leading Austrian ESG specialist, we have found a way to integrate ESG criteria (E = Environment, S = Social and G = Governance) into our commodity investment process along the entire life cycle.

Conventional methods are inadequate on their own

Probably the most common approach to sustainability is to exclude agricultural commodities from the investment universe. The disadvantage of this method, however, is that the positive return and diversification characteristics of the excluded assets are lost in the portfolio.

Standardisation can be circumvented by certifying and trading sustainably produced commodities such as cotton, gold or aluminium (green aluminium). This is referred to as a two-market situation, which, however, still represents niche offerings and is (still) unsuitable for institutional investors due to a lack of market size and liquidity.

The offset approach includes the social costs of CO2 emissions through offsetting with emission allowances and helps to make commodity investments more sustainable. However, this model only takes into account CO2 costs and neglects other important factors such as social and environmental aspects.

ESG rating for the entire life cycle

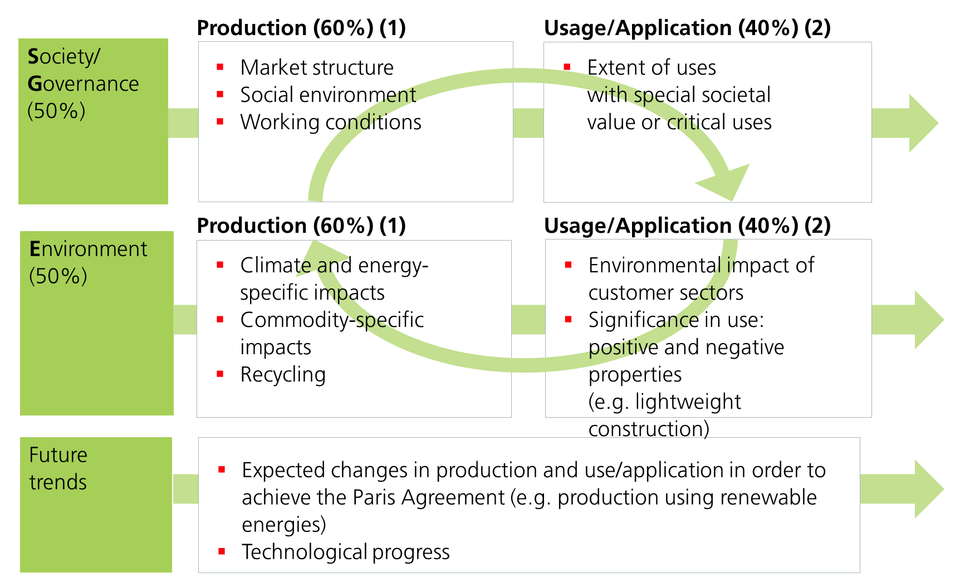

To address the disadvantages of the approaches described, we have decided to strike a balance between diversification and the consideration of ESG criteria. In doing so, the qualitative and quantitative ESG criteria are taken into account in a three-step model for the entire life cycle of a commodity, from mining and production to use and application (see diagram). This means that a holistic ESG score is calculated for each commodity, which can be used as a basis for adjusting the weighting in the portfolio.

When calculating the ESG score, the production side and the use of the commodity are analysed separately. Environmental, social and governance aspects are also considered. Another and forward-looking third component, future trends, assesses the possible contribution of a commodity to a sustainable economy. This includes the expected potential in terms of technological advances on the production and consumption side, as well as future substitution effects of commodities with low societal benefits and a strongly negative ecological footprint. The portfolio is therefore also oriented towards future developments and thus ensures that the focus is on commodities with high potential for future demand.

.r200img.600x750.jpg/1700148938938/istock-695604842-%281%29.jpeg)