Last month, we rated the probability of a bear market rally in the seasonally strong July as high. Indeed, both the equity markets and the bond indices were then able to make effective gains, thereby slightly mitigating the annual losses of a mixed portfolio.

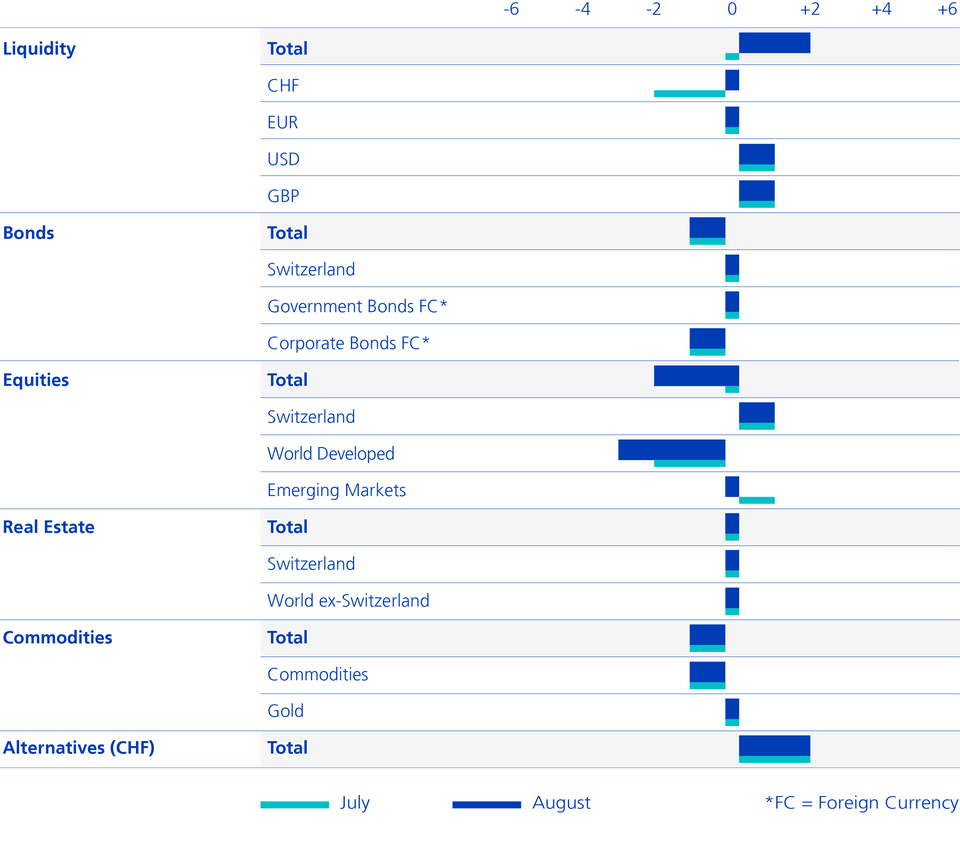

Due to falling inflation rates and a weak economy, financial market participants in the USA are now expecting the Fed's first interest rate cuts in the first quarter of 2023 already. As a result, in particular the past winners and big losers of this year (e.g. Tesla, crypto, ARK ETF and Nasdaq) rebounded in July. We expect negative earnings revisions to follow and downward pressure on equities is likely to increase again. We also remain underweight in commodities and corporate bonds, where no recession is priced in yet. We are maintaining our neutral stance regarding government bonds as yields are trapped between recession fears and continued high inflation rates. As has already been the case for the entire year, the liquidity and catastrophe bond allocation remains at an elevated level.