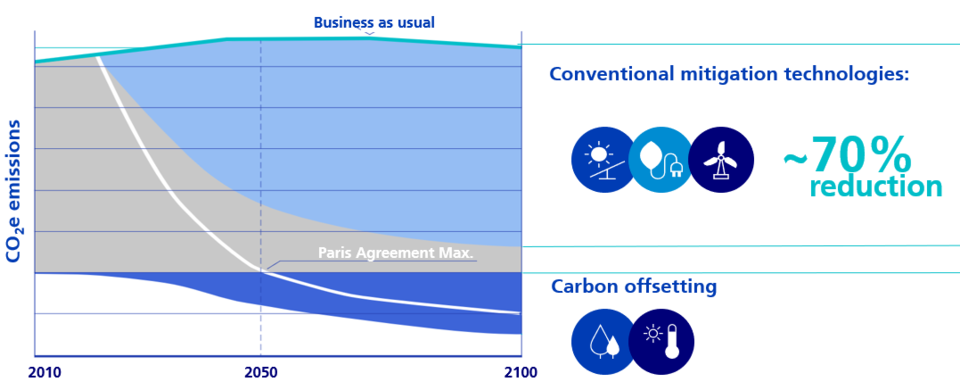

Climate change is one of the biggest challenges the world has ever faced. Things are accelerating and time is running out. In an effort to act in the face of adversity, nations have come together and pledged to limit global warming to no more than 2°C, with best efforts to keep it below 1.5°C, compared with pre-industrial temperatures, through the Paris Agreement. Its binding commitments have come live in 2020 and nations have legal obligations to follow through on their commitments. However, their commitments will not be enough. The total Greenhousegas (GHG)-emissions allowed under these individual national targets are far beyond what scientists estimate as the maximum for a successful global warming containment. It therefore falls to the private sector to do its part and help reduce pollution by at least 70 % before 2050 and enhance carbon sinking proliferation to reach carbon-neutrality.

Climate change: big challenge, big opportunity

To achieve a 70 % reduction in greenhousegas emissions by 2050, and assuming the economy grows by an estimated 5 % per annum, the global economy's efficiency must be increased at a fast pace. What does this mean for investors?

Text: Ruben Feldman, ESG Strategy & Business Development

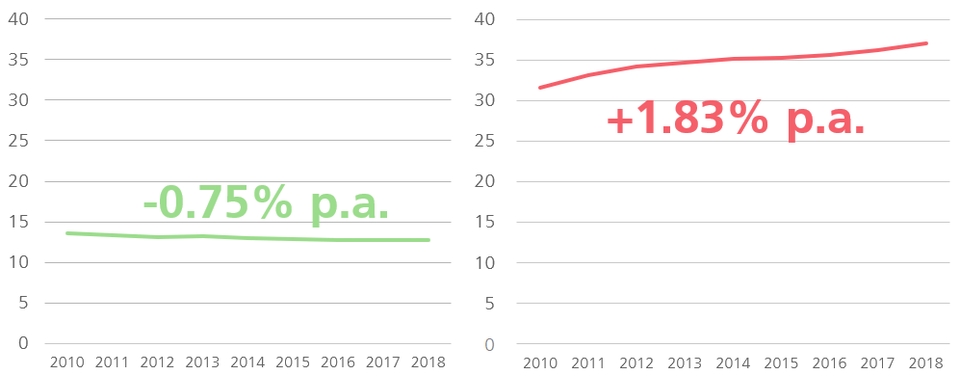

At the current rate of pollution, our carbon budget for a less than 2°C warming will be exhausted in 2038 and pollution is currently on the increase. While developed nations are reducing by less than 1 % per year, which does not meet the required 4 % per year to achieve a cumulated GHG-reduction of 70 % by 2050, developing nations are increasing their pollution by nearly 2 % on aggregate!

While the local focus of developed nations is legitimate, it is important to keep an eye on the game, which is a global one. Furthermore, developed nations must understand how much pollution they are currently financing, from both through public and private sectors, by the provision of funds but also demand for goods and services.

To achieve a 70 % reduction in greenhousegas emissions by 2050, and assuming the economy grows by an estimated 5 % per annum, the global economy's efficiency, in terms of how much pollution is created for the generated GDP, will have to improve by a factor of 15.

With this incredible challenge comes a very real set of decisions for investors. Transition risks are aplenty, which businesses will survive the fundamental change in the economy, regulatory landscape and consumer demand? Which business practices will have to be phased out and how will this affect corporate profitability or national competitiveness? That's not to mention physical risks. Which companies or nations are most likely to lose their assets during the next climate change-induced natural disaster?

But with every challenge comes opportunity. Which are the corporations and nations that will bring desperately needed solutions, or which are those that will survive thanks to a sustainable business model, while the competition drops like flies?

Investors are not entirely at the mercy of these challenges and funds can be allocated in such a way as to reduce risks, enhance exposure to opportunity and be in line with the Paris Agreement targets. Since 2020, Zürcher Kantonalbank Asset Management has committed most actively managed portfolios to follow a Paris aligned trajectory towards net zero, while implementing a holistic sustainable integration methodology. Zürcher Kantonalbank's fundamental beliefs that is has a societal responsibility, that sustainability aspects are material across all asset classes and that sustainability drives performance has helped engineering a climate strategy that takes stock of the situation and looks to the future to ensure assets are looked after in a successful and sustainable approach.