Green bonds also sprout on Swiss soil

Green bonds are still relatively small in the domestic bond landscape. However, they are multiplying in size and quantity considerably.

Text: Sandro Grimm

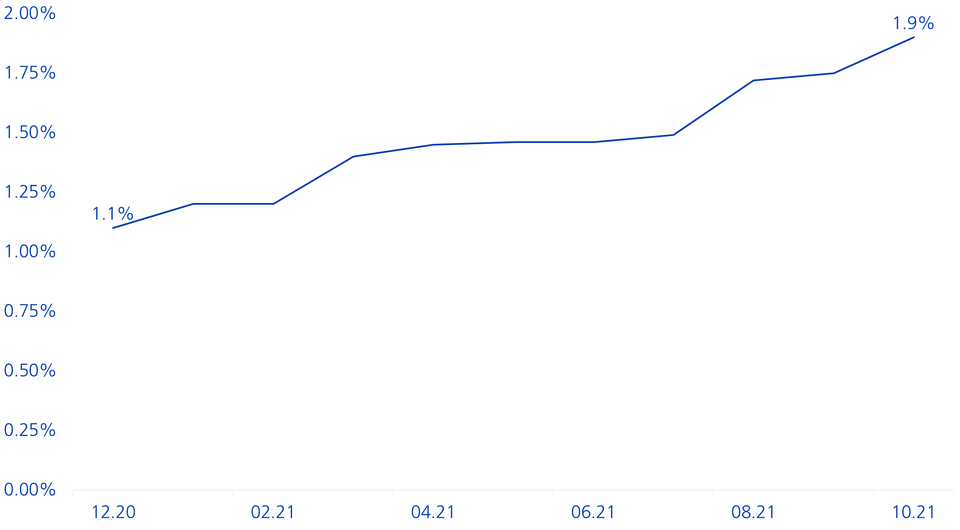

Since the start of the year, more than 20 green bonds with a total volume of around CHF 4.3 billion have already been issued on the Swiss capital market. For comparison: As of the end of 2020, 35 green bonds with a volume of CHF 7.1 billion were outstanding. Investor demand for green bonds significantly exceeds supply on the primary market. Demand in the secondary market is correspondingly high.

Share of green bonds in the overall market

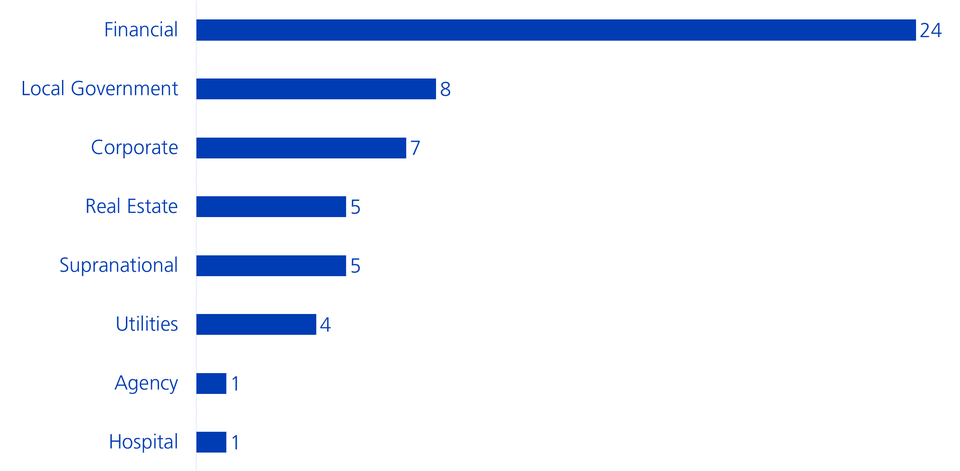

Various sectors are «sowing» green bonds

In Switzerland, most and proportionally the largest issuers of green bonds currently come from the financial sector (banks and insurance companies). Public-sector issuers (cantons and supranational organisations) also make use of the better financing conditions of green bonds compared to conventional bonds. Sustainable projects can be financed more cheaply with the «Green Bond» label. Real estate companies are also issuing more and more green bonds to accelerate the energy-efficient modernisation of their real estate portfolios. According to the Federal Office for the Environment (FOEN), buildings in Switzerland are still responsible for around 40 percent of energy consumption and emit a quarter of Switzerland's annual greenhouse gas emissions. Electricity producers are also financing the expansion of their renewable energy production, such as wind energy, photovoltaic systems and hydropower plants, with green bonds at attractive conditions.

Number of green bonds per sector

Still more «fertiliser» for green bonds

The largest borrowers in the Swiss franc bond market with a 44-percent market share are the Swiss Confederation, the central mortgage bond institution of the Swiss cantonal banks and the mortgage bond bank of Swiss mortgage institutions. None of which have issued green bonds so far. However, it is only a matter of time before these players also enter the market. European countries such as Germany, the United Kingdom, Spain and France are already financing sustainability projects with green bonds and will significantly expand their programmes in the near future.

The fact is more and more issuers are creating a carefully reviewed green bond framework in search of capital in order to satisfy investors' demand for sustainable investments. Investors are clearly prepared to finance sustainable growth. This makes green bonds an important instrument for supporting the 17 UN Sustainable Development Goals (SDGs).

Tools against greenwashing

Green bonds are intended to raise funding specifically for sustainable projects. Thus, preventing the misappropriation of investor funds is key to strengthening and maintaining the credibility of green bonds. The Green Bond Principles of the International Capital Market Association (ICMA) help to identify and prevent greenwashing. The four main pillars of the ICMA standard are:

- Use of proceeds

- Process for project evaluation and selection

- Management of proceeds

- Reporting

Issuers of green bonds are primarily favoured by investors if they have the use of funds examined by independent third-party companies in addition to the ICMA guidelines. Swisscanto Invest requires an independent second opinion as part of its own investment process before any investment in green bonds and examines the precise purpose of the funds borrowed in detail. This process is essential to reduce greenhouse gas emissions to net zero by 2050 (or earlier). Swisscanto Invest is both part of the Net Zero Asset Managers Initiative and a partner of the Climate Bonds Initiative (CBI).

What the «greemium» is all about

Investments in green bonds generally entail a yield discount compared to conventional bonds. In the technical jargon, this discount is known as the «greemium» and can be explained by the following factors:

- High demand: The high demand for green bonds has an impact on their yield. For green bond issues, the yield is therefore around two basis points lower on average than comparable conventional bonds from the same issuer.

- Limited supply: Green projects and assets are still a scarce commodity for many companies.

- Sustainability of the business model: Green bonds from companies with an established business model based on ESG criteria have a lower greemium than green bonds from companies that still have to align their business model with the Paris climate targets.

- Administrative costs: The establishment of a green bond framework, the annual reporting and the audit of the use of funds by independent third-party companies incur costs. These can be offset with lower risk premiums.

Interestingly, the greemium is rather persistent. It can even be observed in the secondary market and continues to exist years after issuance.

We integrate green bonds

Zürcher Kantonalbank integrates green bonds – bonds with an explicit, green purpose – into the existing bond range of its Swisscanto Sustainable and Responsible bond funds in line with the growth of the asset class.