Return gap: why small pension funds have less performance

In the review period of more than ten years, large pension funds generated more returns for their insured persons. On average, small funds generated 0.6 percent less returns than the large funds. Politically, this ultimately means further pressure on pensions. This evaluation as part of the Swisscanto Pension Funds Study shows the reasons for the gap in returns.

Text: Iwan Deplazes

Relevance of the third contributor

The Swiss pension system is under pressure. Second pillar pensions have been falling steadily for years. The pressure to further reduce benefits is high among pension funds and politicians. Before further reductions in pensions or political measures have to be implemented, it is worth taking a look at the income side of pension funds, specifically at the third contributor. In addition to employers' and employees' contributions, the return achieved on the financial markets represents the third source of income for the pension funds («third contributor») and is therefore responsible for the «capitalised pension» success model. It is helpful to look not only at the insured persons in the pension funds, but also at the employers and politicians.

Do economies of scale lead to better performance?

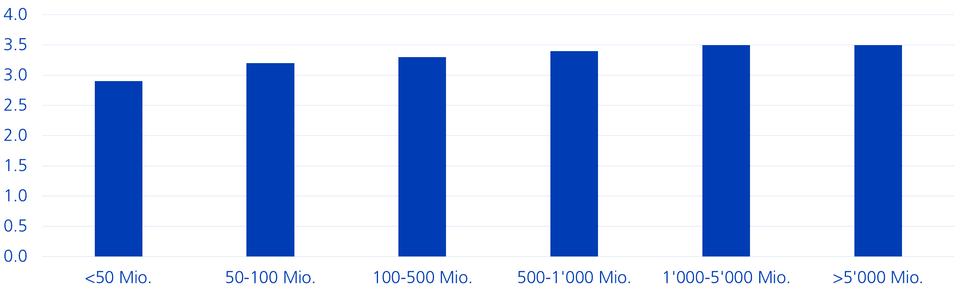

In the review period of more than ten years, the large funds with assets of more than CHF 1 billion generated more than half a percent more returns for their insured persons than small pension funds with less than CHF 50 million in assets. While the net return of the small funds is on average 2.9 percent p.a., large funds achieved an average of 3.5 percent p.a. (Figure 1).

Figure 1: Average net return as a percentage p.a. 2008–2020

How do these differences in performance arise? Several factors are examined in the following that are central to performance: the investment strategy of the pension funds, the risk/return profile, the risk capacity and the costs of asset management.

The board of trustees is responsible for the investment strategy

How does the investment strategy come about? Who determines how high the expected risk may be? In accordance with the applicable Swiss legislation, these issues are the responsibility of the board of trustees. The board of trustees must take into account the structure of pension obligations and risk capacity when making its most important decision, defining the investment strategy.

Pension obligations essentially consist of the pension capital of the active members and that of the retirees. The higher the share of the pension capital of the active members compared to that of the retirees, the greater the structural risk capacity of a pension fund.

The investment strategy has a significant influence on the risk/return profile of a pension fund's investments. Various studies show that in the long term, at least 80 percent of the return on portfolios is determined by the investment strategy. The other 20 percent is generated by sector/securities selection and timing.

Risk capacity: the foundation of the investment strategy

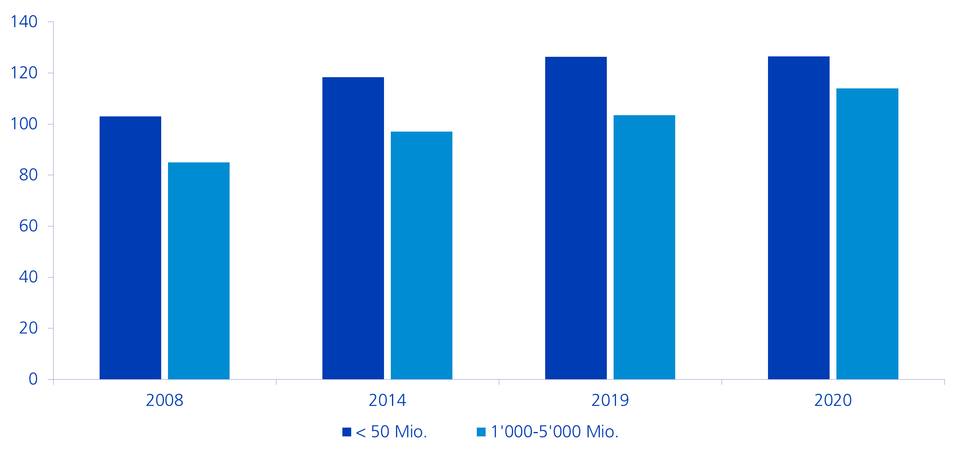

In addition to obligations, the risk capacity of each pension fund forms the basis for determining the investment strategy. In order to be able to compare the risk capacity of funds with different technical interest rates and different proportions of retiree pension capital, the risk-bearing coverage ratio is calculated. The comparison shows that the risk-bearing coverage ratio of small funds (Figure 2) was higher in the years examined than that of large funds. Astonishingly, small funds therefore have a higher risk capacity than large ones. This is mainly due to the higher coverage of the non-guaranteed benefits with the small funds. In theory, the small funds could therefore take a higher risk on the markets and thereby realise a higher return potential.

Figure 2: Comparison of the risk capacity in investment policy

Low risk appetite despite high risk capacity

Does the higher than expected risk capacity of the small pension funds go hand in hand with a higher expected risk of the investment strategy? Our analysis shows that the average investment strategy of the small funds has a more defensive risk/return profile compared to all other funds.

More defensive investment strategies

The fact that small funds accept a lower risk is demonstrated by the investment strategies, which are largely responsible for the fluctuations in returns in the pension fund portfolios. The investment strategies of the larger funds are more globally diversified. The smaller the fund:

- the higher the average percentage share in domestic investments such as bonds in CHF and domestic equities;

- the smaller the share of strategic foreign currency exposure;

- the higher the strategic share of comparatively defensive domestic equities compared to international equities.

Large funds appear more agile

Over the period under review, large funds have adapted more closely to changes in the markets. For instance, small funds reduced the share of bonds in CHF by 27 percent, but the largest funds did so by 44 percent, i.e. significantly more strongly. Small funds increased the proportion of domestic real estate most frequently during this period. Therefore, they re-allocated between defensive asset classes. Large funds (> CHF 1 billion AuM), on the other hand, increasingly invested in alternative investments, an asset class with higher potential for returns.

Large funds use the justification of expansion more frequently

The OPO 2 (BVV 2) guidelines specify ranges for pension funds regarding the shares of asset classes. In order to deviate from the limits, the funds invoke the justification of expansion pursuant to Art. 50 (4) OPO 2. A comparison shows that a majority of the small funds (< CHF 500 million in assets) operate within the limits, while the majority of larger funds with over CHF 500 million in assets operate outside the limits, at 60 percent. Small funds use the justification of expansion in 70 percent of cases for the defensive real estate asset class. In the case of large funds, the majority use the justification of expansion for real estate, but also for the more volatile asset class of alternative investments.

Asset management costs

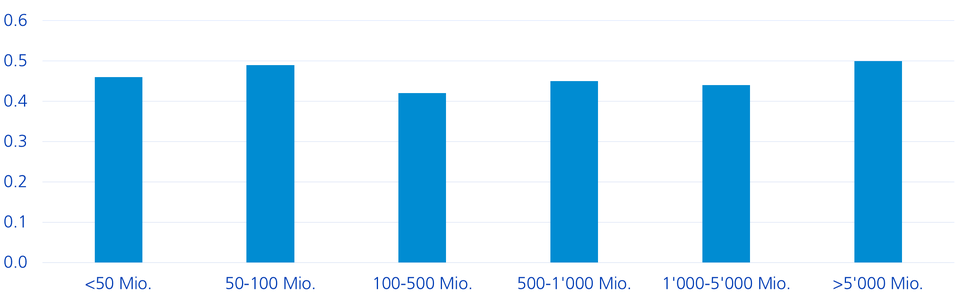

Higher asset management costs could be a reason for the lower returns of small pension funds. However, a comparison of the average capital-weighted asset management costs over the period 2013 to 2020 (Figure 3) shows that the differences of a few basis points are too small to explain the lower returns of small funds.

Figure 3: Asset management costs (capital-weighted)

Summary: risk capacity not exhausted

The strategic requirements are the responsibility of the board of trustees. Overall, it is striking that small funds invest defensively, although their risk capacity would allow for a more aggressive investment strategy. They do not exhaust their risk capacity and adapt less to new market conditions. They also comply more closely with OPO 2 requirements.

The Swisscanto Pension Funds Study can be found here.