ROIC (I): Key parameter in our stock selection

As part of our global equity research, we deal with ROIC on a daily basis. But what does this mean? ROIC stands for «Return on Invested Capital». For us, ROIC is a key parameter in our fundamental stock selection. In a series of articles on ROIC, we highlight the advantages of the key figure and our approach.

Text: Rocchino Contangelo

ROIC assesses the efficiency of a company in allocating the capital it controls to investments or projects that are reflected in the amount of profits generated. The ROIC indicator gives an impression of how well a company uses the money raised from equity and debt investors to generate returns. ROIC is just one of many metrics used to assess a company's performance – a key metric for us to track down investment opportunities.

Here ROIC is derived from a more well-known metric, the return on equity:

Return on equity (ROE) = Net profit / Equity capital

Total return on invested capital (ROIC) = Net operating profit after tax / Total capital

According to market estimates, ROIC will increase in the near future

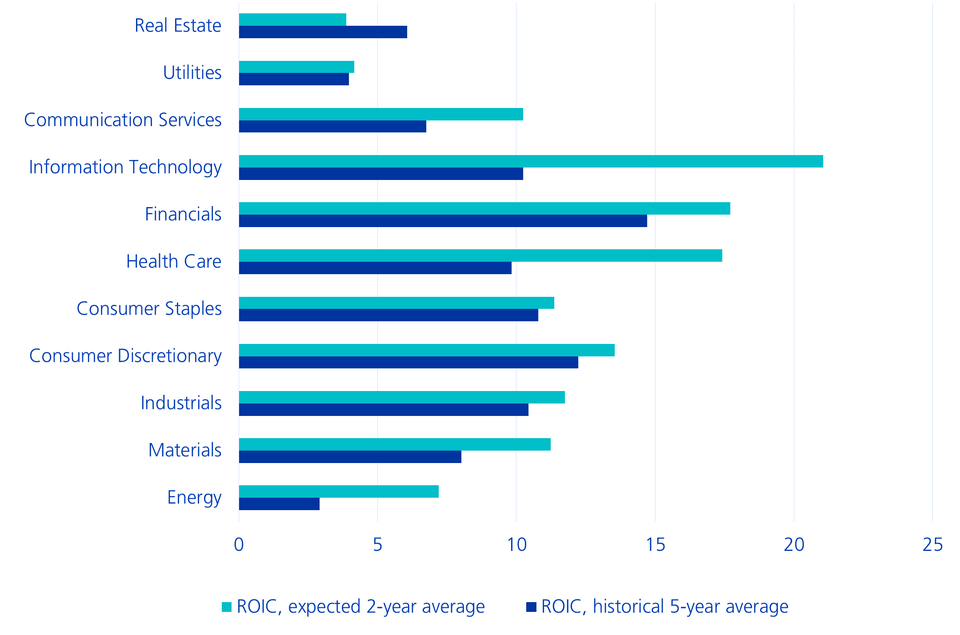

ROIC can be used to assess how a company's profitability develops over time. Among other things, the ROIC metric can be used to determine whether a company has a strong market and competitive position compared to the industry. The average ROIC of different industries is shown in the chart below, with information on the average ROIC of the past five years and the expectations for the next two years (as of the end of June 2021). In the vast majority of sectors, significant increases in ROIC are expected in the coming years thanks to the economic recovery, for example in Citrix, Ericsson, Accenture, Bristol-Myers Squibb, ING or Keycorp, to name but a few examples. Analysts estimate that the ROICs will increase from a 5-year average that is currently around 10 percent, to around 13 percent on average. From today's perspective, there is only one exception to this generally positive expectation: the real estate industry.

ROIC in different sectors and time periods

We use the ROIC indicator for stock selection in our investment universes. We look for companies that already have stable and high ROICs or those with the potential for value-generating ROICs, i.e. returns above the respective cost of capital. There are companies that achieve ROICs of 15 to 20 percent or even more. Companies that are very profitable or generate value over a longer period of time and have a high ROIC in the double digits have a market and competitive advantage.

Important for investors

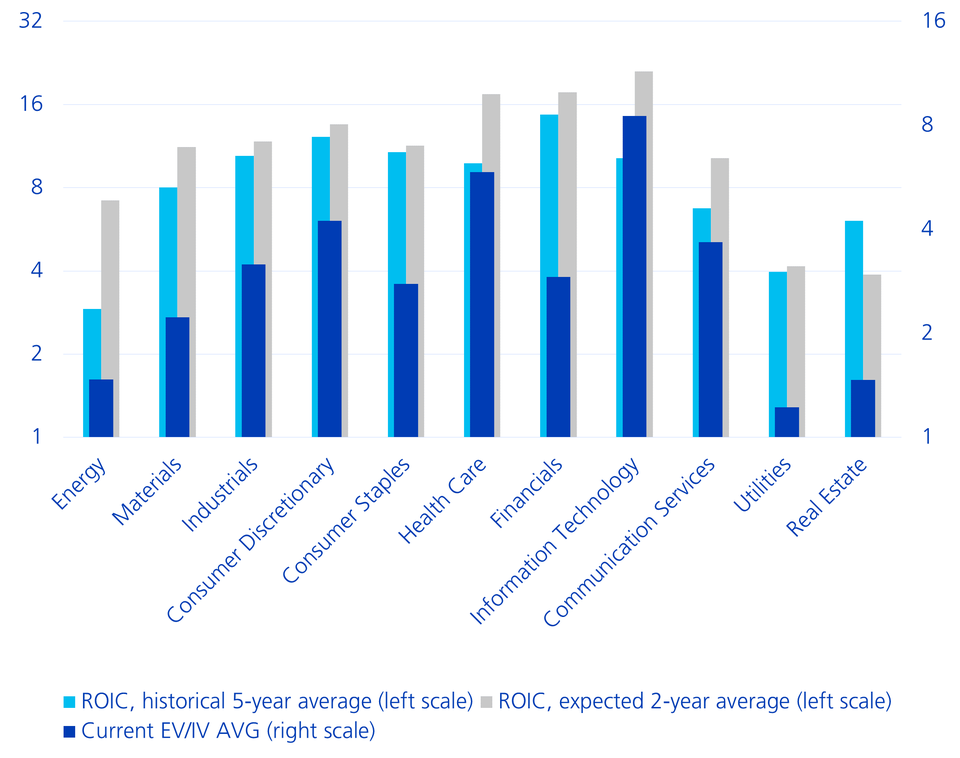

This current situation is of interest to investors because these leads are conducive for companies to successfully defend a market position in the long term. This is because ROIC is also an indication of the «quality» of the business in question. It is equally important for investors to gain an idea of whether these highly profitable companies with double-digit ROICs can continue to grow with high value generation or whether the strong position is possibly at risk due to increased competitive pressure. The fact that there is a high correlation between the (stock market) valuation of a company and the amount or expected development of its total return on capital has been proven in scientific studies and is demonstrated in the following chart.

ROIC in % vs. company valuation (ratio of enterprise value to invested capital as a valuation multiple)

Discrepancies between historical/expected ROICs and enterprise value of invested capital need to be justified. We then clarify whether these are potentially investment opportunities as part of our more extensive classic fundamental equity analysis. Thanks to the know-how and industry expertise of our analysts, the fundamental momentum in profits, ROICs and also with regard to ESG can be recognised at an early stage. This is specialist knowledge and foresight that no computer can replace.