Three dominant trends for the next three years

The next three years will be characterised by «de-interest», «de-globalisation» and «de-carbonisation». These three terms represent both opportunities and risks for investors. We use these opportunities and risks to derive insights for your asset allocation.

Text: Nicola Grass

The everyday life of portfolio managers is shaped by a constantly high deluge of information. Their task is now to extract the relevant data and condense it into information and trends that will strongly influence the financial markets in the future. We have gone through this process and derived three main theses for the next one to three years:

Three main trends: de-interest, de-globalisation and de-carbonisation

1. De-interest

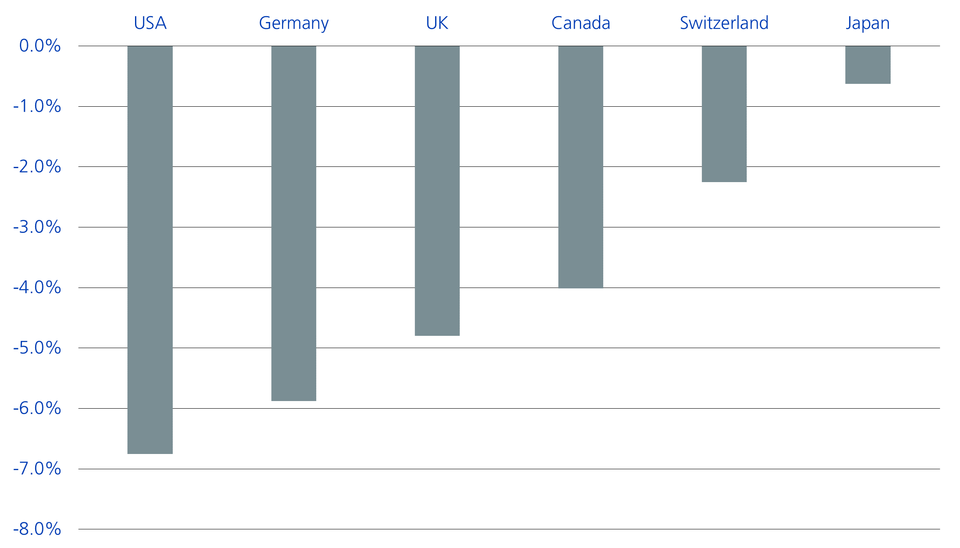

Ever since the coronavirus crisis, when even in the USA real yields dropped into negative territory for all maturities (see chart below), the acronym TINA (There Is No Alternative) has become ubiquitous. Due to the sharp price increases last year, cash balances in bank accounts in practically all regions of the world lost value in real terms. Anyone who was not invested has become poorer.

Real loss of value of cash

The sharp rise in equity indices is a direct consequence of this. Now, however, monetary policy is turning around. After dozens of emerging market central banks already raised interest rates significantly last year, some central banks of developed countries (e.g. USA, Canada, Norway and the UK) will also increase key interest rates this year. In addition, inflation rates are likely to normalise somewhat again in the second half of the year at the latest due to base effects and a more relaxed situation in global supply bottlenecks. Real yields are likely to rise – at least at the short end.

Real yields likely to remain negative

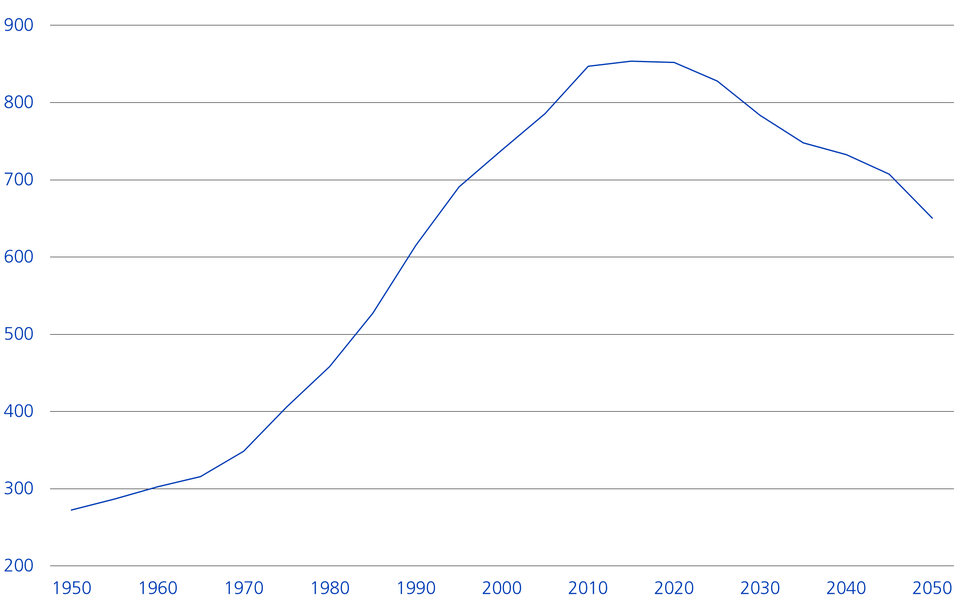

Due to structural trends, we expect higher inflation rates in the long term relative to the past decade. De-globalisation and the energy transition are leading to rising prices, and the demographic shift is also causing global price pressure (see chart below). China is now also projected to see a sharp decline in the number of people in employment, after the People's Republic brought almost 500 million workers into the global economy in recent decades. This will put an additional strain on the already very tight labour market and could lead to rising wages1.

Number of 20-to-60-year-olds in China (in millions)

The 2-percent inflation target of central banks is likely to be consistently exceeded in the next few years. However, due to the very high public debt and the dynamic valuation of the financial markets, we still see little room for significantly higher interest rates. The economic system relies on the drip of low interest rates. An unexpectedly rapid departure from the low interest rate policy would have painful consequences. It is therefore expected that real yields will remain negative in most regions and across different maturities. This assumption continues to support the equity markets. For this reason, we also prefer real assets (equities, commodities and real estate) over nominal assets (bonds) in the medium term.

2. De-globalisation

Even before the coronavirus crisis, there was already a change in direction in global trade. In relation to global economic output, trade in goods topped in 2010 and has continuously decreased since then (see chart below). The peak of globalisation has therefore probably passed.

Global trade in goods in % of GDP

The coronavirus pandemic has accelerated this trend. The ongoing supply bottlenecks are prompting companies to bring parts of their supply chains back to the countries of sales. According to the latest Swiss Manufacturing Survey by the University of St. Gallen2, almost 25 percent of the Swiss companies surveyed have adjusted their supply chains as a result of the coronavirus. Moreover, criteria such as delivery time and reliability take precedence over price, the survey also finds. This increases prices and could lead to more jobs in the developed world. Companies such as General Motors, General Electric, Thermo Fischer or Lockheed have already decided to relocate production back to the USA.

Local, not global

Especially for technology goods, such as semiconductors, the cooling relationship between China and the West is also causing de-globalisation in production chains. Chip manufacturer Intel, for example, has announced that it will invest around USD 20 billion in two new semiconductor factories in Arizona. Trade is therefore more focused on free trade zones and alliances and extends less than before over the entire planet. Companies that already produce in their sales market and therefore do not have to adapt their supply chains are the winners of this development. These are mainly small-cap companies, which is why we prefer them in the medium term. What you should have on your radar: the re-nationalisation trend could be a problem for emerging markets. They face economic losses. In view of these assumptions, the risk of geopolitical tensions increases.

3. De-carbonisation

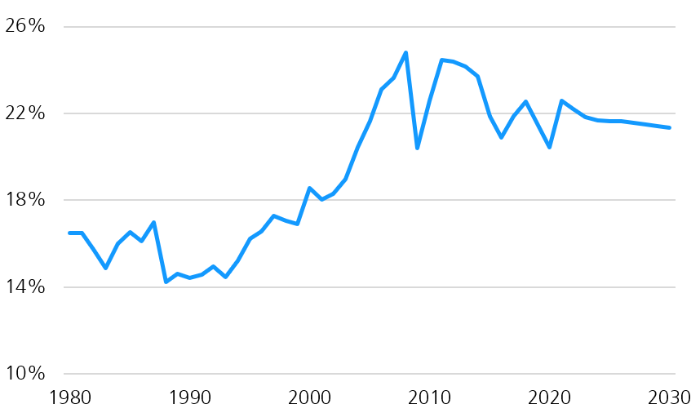

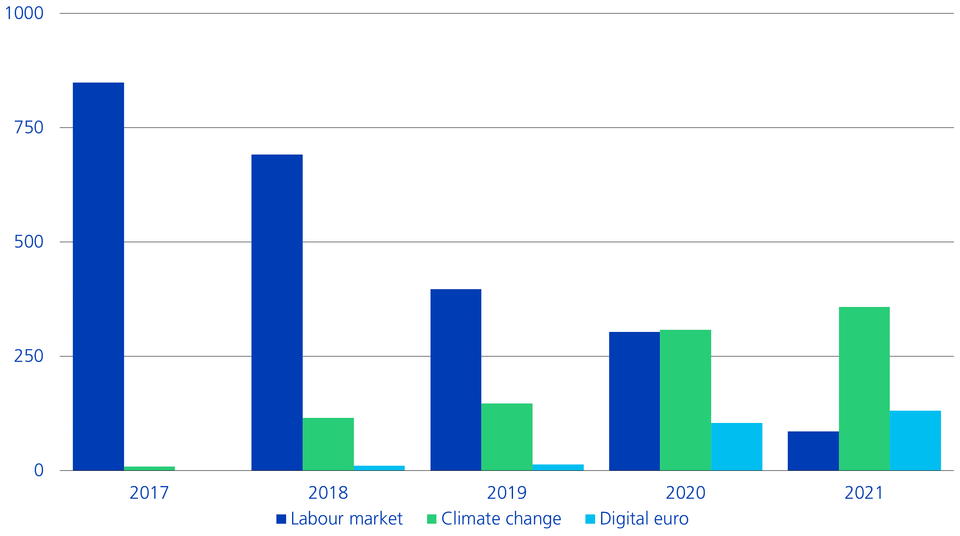

De-carbonisation describes the transformation of a greenhouse gas-intensive economy into a greenhouse gas-neutral one by promoting renewable energies and innovative climate technologies. Political and societal support for the sustainable use of natural resources has increased significantly and will continue to do so in the coming years. Influential people such as Christine Lagarde, President of the European Central Bank (ECB), or US President Joe Biden are advocates of sustainability and are aligning their political agenda accordingly. This is reflected, among other things, in the fact that the ECB is now addressing the issue of climate change much more frequently in its speeches (see chart below).

Number of mentions of the term «climate change» in ECB speeches

Although the US Senate temporarily put Biden's comprehensive «Build Back Better» plan on hold, further infrastructure programmes will follow in the USA. Investments in the dilapidated American infrastructure appeal to both parties. A political consensus should be found at least on this issue. China also wants to reduce its dependence on coal and has already set drastic measures. This means that a great deal of money will continue to flow globally to producers of renewable energies and innovative climate technologies. As a result, rare earth metals and copper will also experience a massive boom in demand, as they are indispensable for the manufacture of electric motors and batteries, for example.

Summary: These three main trends are implemented in the strategic allocation of our portfolios, which we review on a quarterly basis and reassess annually.

1"The Great Demographic Reversel", Goodhart & Pradan (2020)

2 Swiss Manufacturing Survey und Award - ITEM St. Gallen (unisg.ch)