Stay short in May, but don't go away!

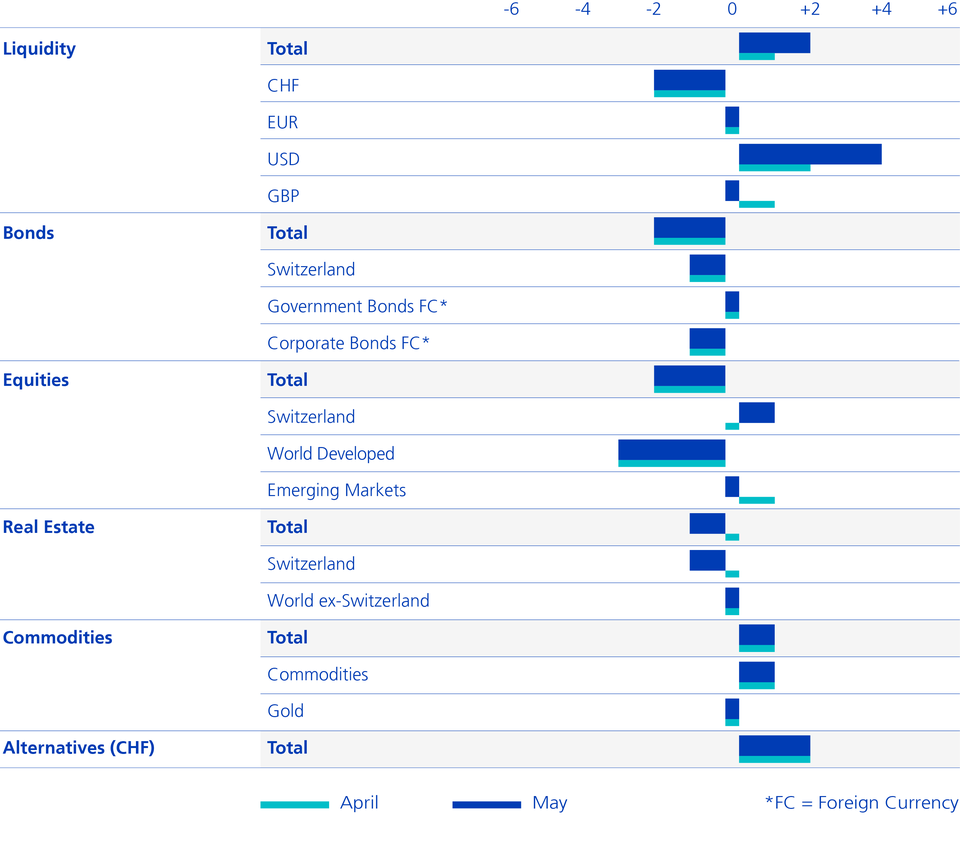

We now face considerable interest rate hikes by the US Fed, as well as balance sheet reductions and a fundamentally difficult seasonal phase for equities. This will continue to put downward pressure on equity markets, which is why we remain underweight equities. However, sentiment is now very pessimistic; economic growth is still robust and inflation rates are at a peak. Our increased cash ratio could therefore soon be put to use.

Text: Stefano Zoffoli

April was a difficult month for investors since both equities and bonds lost ground, as has been the case since the beginning of the year. The mix of sharply rising interest rates, renewed lockdowns in China and geopolitical uncertainties was too much for the previously very robust equity markets: the lows since the outbreak of the war have been levelled out. We had anticipated this movement with our equity underweight. However, we underestimated the Chinese government's stubbornness with its insistence on its zero-COVID policy. The focus on emerging markets therefore did not pay off.

We are maintaining our small exposure to Chinese technology stocks, but exposure to emerging market equities as a whole is being reduced. We are also selling our position in global small caps, as these companies are suffering from margin pressure and are not building any momentum. Yields on bonds have finally returned to a more attractive level.

- Listed Swiss real estate funds proved surprisingly robust despite the rise in interest rates

- For pension funds, bonds at the current interest rate level are once again becoming an alternative. The scarcity of investment opportunities is coming to an end.

- We now face a seasonally difficult phase for real estate funds and valuations remain high. For this reason, we are moving to slightly underweight.

- Equities of companies with pricing power have an above-average presence on the Swiss stock exchange (luxury sector, pharmaceuticals, industry with competitive offerings and the service sector). This is advantageous in view of the increased input prices.

- The highly represented pharmaceutical sector is expected to increase profits by 8% this year – despite declining COVID-related revenues. The valuation of the SMI and the Swiss mega-caps is historically favourable with a price-earnings ratio of around 16.

- The sensitivity of the SMI to the global business climate is only half that of the Euro Stoxx50. We expect the global economy to slow down to its potential growth again after the post-COVID boost.

- Yields on Australian government bonds have risen significantly and are now at an attractive level (10y at 3.1%).

- The expectations on the Reserve Bank of Australia are very high (2.75% interest rate increases over one year); we expect fewer interest rate hikes.

- The Australian dollar has gained momentum (since the start of the year: +4.5% vs. CHF) and remains in demand thanks to a robust Australian economy and high commodity prices.

- We are buying 1% more and reducing long-dated US government bonds in return, as inflationary pressures are significantly higher in the USA.

Asset Allocation Special Mandates May 2022