Carbon pricing in times of high energy prices

CO2 pricing, or carbon pricing, is meeting resistance given the current high energy prices. At the same time, CO2-intensive sectors are under pressure to invest more in renewable energies and energy efficiency. These are factors investors should consider.

Text: Dr Daniel Zimmerer

Russia’s war of aggression against Ukraine is putting an additional strain on the already tense international energy markets. Direct consequences are record-high energy prices at petrol pumps and consumers who can no longer afford heating and electricity bills. Alternative solutions are already being sought out and found. Electricity producers are increasingly switching to coal to generate electricity rather than gas. Despite the sharp rise in CO2 prices, this is currently cheaper overall. This «gas-to-coal switching» produces around 2.5 times as much in CO2 emissions and therefore comes with a bigger climate footprint.

No way around CO2 pricing

Many Western governments are already drawing the necessary conclusions and calling for the fastest possible expansion of renewable energy sources and for improvements in energy efficiency. In addition to the direct promotion of renewable energies, states' toolboxes also include carbon pricing, i.e. the pricing of carbon dioxide (CO2).

Although CO2 pricing has increased sharply in recent years, it is still the exception rather than the rule. Currently, direct taxation and the emissions trading system (ETS) are usually used to price greenhouse gases. The ETS of the European Union (EU) operates according to the cap-and-trade principle. Under this system, the regulator sets a precisely defined cap for CO2 emissions. This cap is lowered over time so that overall emissions decrease. The greenhouse gas emitters covered by the scheme purchase or receive CO2 certificates which they can use to trade with each other as required.

California and European Union leading the way

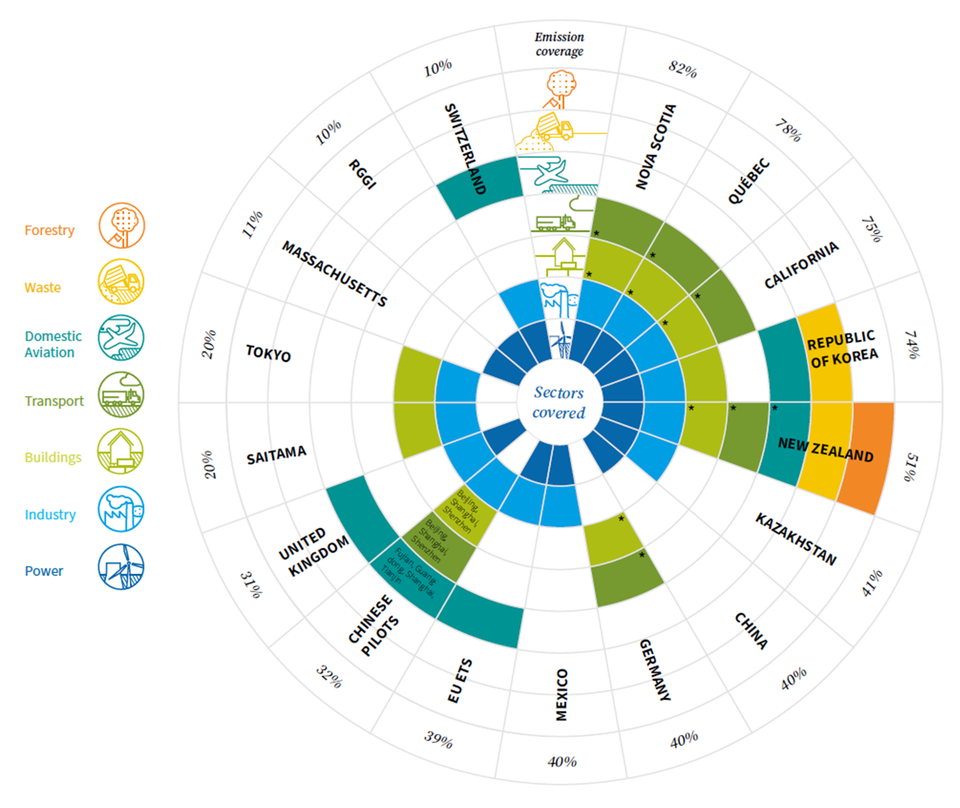

In 2021, a total of 16% of global greenhouse gas emissions fell under an ETS, with those regions with an ETS responsible for 54% of global gross domestic product. The chart below shows a selection of regions using ETS.

Coverage of CO2 emissions by ETS by region

The following are particularly of interest:

- California, whose ETS covers 75% of regional CO2 emissions and comprises the electricity, industry, buildings and transport sectors

- The European Union, whose ETS covers 39% of regional CO2 emissions and includes not only electricity and industry but also intra-European air transport (the future inclusion of buildings and transport is currently under discussion)

Free CO2 certificates for heavy industry

The sectors most affected are energy-intensive heavy industry (cement, steel, fertilisers, etc.) and electricity producers. But large parts of heavy industry are largely exempt from pricing their emissions thanks to free CO2 certificates (free allowances) in order to discourage them from leaving the EU.

European electricity producers are much more regionally anchored due to the infrastructure and their business model, which is why the regulator does not provide for free allowances for these companies as there is no risk they will leave the EU. Since the EU ETS was introduced, they have therefore been obliged to purchase an appropriate emissions allowance for each tonne of CO2 emitted, which can lead to higher electricity prices.

What is driving prices for CO2 certificates

The price of these CO2 certificates has risen sharply since the outbreak of the coronavirus pandemic, as the following chart shows:

Price in EUR of EU CO2 certificates since March 2020

There are many reasons for the increase. These include, for example, the above-mentioned reduction in the cap of CO2 emissions (i.e. fewer CO2 certificates are in circulation), the rapid recovery of the economy and the associated increased energy demand. The «coal-to-gas switching» already mentioned is also driving prices. Since electricity production with coal releases significantly more CO2, more CO2 certificates have to be acquired as a result. Last but not least, speculation on the secondary market, which was probably responsible for the most recent collapse in the price, is also playing an important role in the price of CO2 certificates.

The higher prices for CO2 certificates account for up to a third of the increase in electricity prices over the past twelve months. For example, the base load electricity price in Germany was around EUR 50/MWh in March 2021. Today it stands at around EUR 200/MWh, with around EUR 50/MWh (or one third) of the increase likely to be due to higher prices for CO2 certificates. However, this also means that around two thirds of the increase in electricity prices is due to the high price increase of fossil fuels (especially natural gas) and a lack of investment in alternative energy sources.

Energy intensive sectors under pressure

Zürcher Kantonalbank is following developments in the most important CO2 markets very closely, especially given the gradual reduction of free CO2 allowances in the EU from 2026. Energy-intensive industries in particular would come under pressure if they failed to significantly reduce emissions by investing in alternative energy sources (e.g. renewable electricity and green hydrogen) and energy efficiency.

Renewable energy and energy efficiency companies such as Enel, Orsted, Carrier, Owens Corning, Schneider Electric, SolarEdge, Rockwool and Northland Power should benefit from the shortage of free CO2 certificates.

Legal notice: The publications were prepared by the Buy-Side Research of the Asset Management of Zürcher Kantonalbank. The information contained in this document has not been prepared in accordance with any legislation promoting the independence of financial research, nor is it subject to any prohibition on trading following the dissemination of financial research.