Our protection strategy protects portfolios and makes them (even) more sustainable

A classic collar strategy can reduce high portfolio losses. Our protection strategy, however, offers even more advantages, especially when it comes to sustainability.

Text Claude Hess

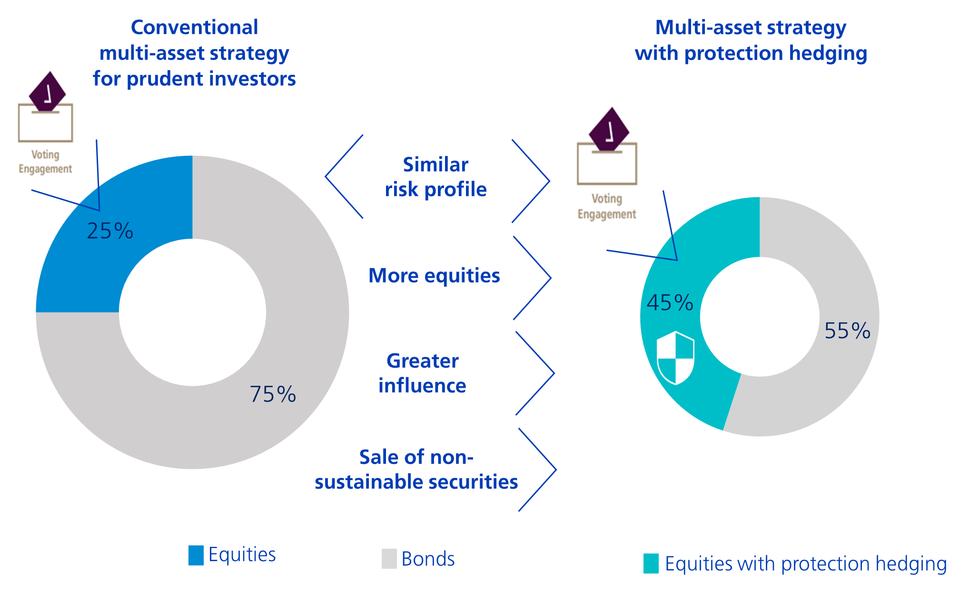

Risk-averse investors have a choice. Either they invest in a portfolio with a high proportion of bonds and a low equity allocation. Or they remain invested (without additional risk) in a portfolio with a higher equity allocation, which is hedged using a collar strategy. As a reminder: a collar consists of buying a put option and selling a call option. With this option strategy, a framework or "collar" is placed around the existing equity position.

With our protection strategy, which is always applied as standard in our Swisscanto protection funds, investors also benefit from further advantages. As a by-product of hedging, there is an increase in sustainability (see chart below):

1. Sale of non-sustainable securities

While the active Swisscanto portfolios only contain securities that meet a certain sustainability standard (Responsible or Sustainable), an (equity) index also contains non-sustainable positions. In the S&P 500 Index, almost 5% of securities fall under Swisscanto's exclusion criteria. These are companies that produce cluster bombs and ammunition, have child labour in their supply chains or extract coal, for example. The collar creates a short position on the index and thus synthetically reduces the equity allocation. Consequently, the non-sustainable securities are sold without them being in the portfolio.

The benefits of our protection strategy

Leverage against non-sustainable business models

Selling a security tends to exert downward pressure on its price. This makes it more expensive for a company to raise money through the stock markets. Equity costs rise and non-sustainable operations become less profitable. In extreme cases, the company has the choice of abandoning its current business practice or must make it more sustainable. As a result, the collar strategy indirectly puts pressure on non-sustainable companies to make their business more responsible.

Investors who select companies with business models that are associated with social, ecological or governance issues bear a higher risk of holding the positions as stranded assets. One example of this is coal producers. In a CO2-neutral world, coal will no longer have a place in investment portfolios, as it is not foreseeable that sufficiently mature and affordable technologies will be available to absorb the CO2 from coal combustion.

This transition risk represents a considerable financial risk for an investor, which must be countered with adequate risk management. This risk can be avoided by not investing in certain securities at all. Investments in such securities are usually dispensed with in active Swisscanto vehicles. With the collar strategy, they are even sold (see section above). The collar strategy thus transforms a financial risk into a financial opportunity, as it can be used to benefit from a possible decline in prices due to the transition risk.

2. Exerting greater influence

Hedging with the protection strategy makes it possible to increase the equity allocation in the portfolio and reduce the bond allocation accordingly – without additional risk. Holders of shares have a say in the direction of business activities. Sustainable concerns can be given more weight in this way.

However, environmentally conscious investors of corresponding Swisscanto funds do not have to vote and conduct a sustainability dialogue with the companies themselves (voting and engagement). Zürcher Kantonalbank does this for them.

Summary:

Our protection strategy reduces equity losses on the one hand and increases the sustainability level of a portfolio on the other. Hedging therefore not only offers opportunities for better performance, but even eases the conscience. That's because companies that have done their homework and pursue a future-oriented and sustainable business model will benefit from combating climate change.