Say goodbye to TINA and hello to TARA

We say farewell to TINA – There Is No Alternative. TINA has been a reliable partner in recent years and has always supported the stock markets. Investors were able to keep pushing the market higher by buying the dips. Bonds were unattractive due to zero interest rates and weak earnings prospects. Following the sharp rise in interest rates in 2022, investors are now opening themselves up to alternatives. TINA has to go. And we say hello to TARA – There Are Real Alternatives. Does TARA offer reliable prospects?

Text: Phil Gschwend

TINA, or "There Is No Alternative", was a term used by investors in the low-interest-rate environment to justify a sub-optimal portfolio allocation with an excessive weighting in equities. Since the earnings prospects of bonds were very low or, in the case of Switzerland, even negative, professional investors often had no other choice but to increase the risk and make a higher strategic equity allocation. This resulted in "TINA": equities continued to be bought despite high valuations because investors simply did not have a suitable alternative.

Debt has a price again

A 2-year US government bond is currently yielding 4.75% and – according to the current market assessment – the US key interest rate will peak at 5% in the second quarter of 2023. In Switzerland, the SNB brought an end to negative interest rates in September 2022; further interest rate hikes are set to follow. Debt has a price or interest rate again.

This also applies to equities

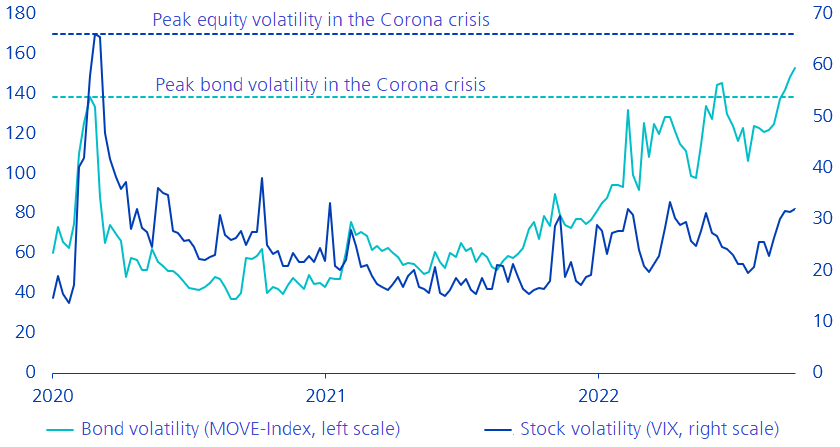

Various equity valuation models evaluate whether the excess returns of equities are sufficient compared to the risk-free interest rates at the respective volatility levels. As we experienced, compared to bonds, the volatility of equities remained at low levels, as can be seen in the chart.

Equity volatility largely in the normal range, bond volatility rises sharply

Not only has volatility remained moderate for equities, but published corporate earnings have also been good so far. However, negative earnings revisions are increasing; this is also leading to higher volatility in equities – no longer just in individual cases.

Have global equities as an asset class now reached an attractive valuation level in the medium to long term?

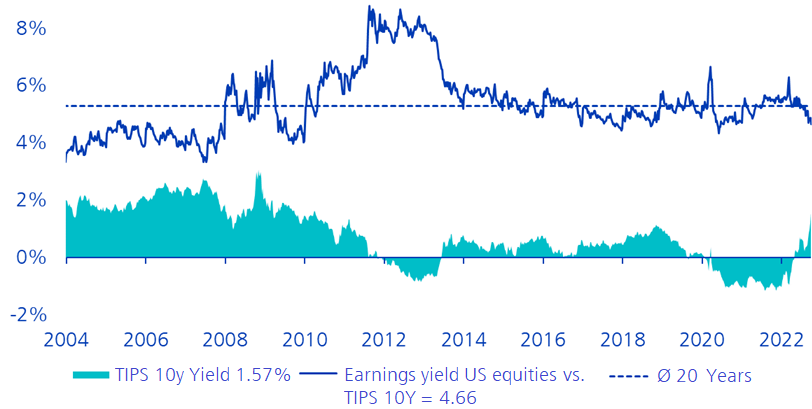

To answer this question, we look at the leading market, the USA. Here, the risk premium for equities has not yet reached an attractive level compared to bonds. How do we measure this? The US earnings yield (1/price-earnings ratio of the US stock market) currently looks unattractive compared to the yield on 10-year TIPS (inflation-protected US bonds) (blue line). This is due to rising real yields (turquoise). This means that the real earnings expectations of equities are not particularly attractive by historical standards. It is worth looking at other asset classes in such an environment.

Rising yields reduce the risk premium of equities – equities are therefore less attractive

Now that TINA is history for the time being, investors are now looking around again and discovering TARA – There Are Reasonable Alternatives. Here we briefly show which alternatives could be available for investors on the lookout:

TARA – There Are Reasonable Alternatives

- Money market: Yields rose the most at the short end of the yield curve. In the short term, this is an attractive place for an investor to park some of their assets. The short duration and high credit quality reduce sensitivity to interest rate changes and reduce the default risk

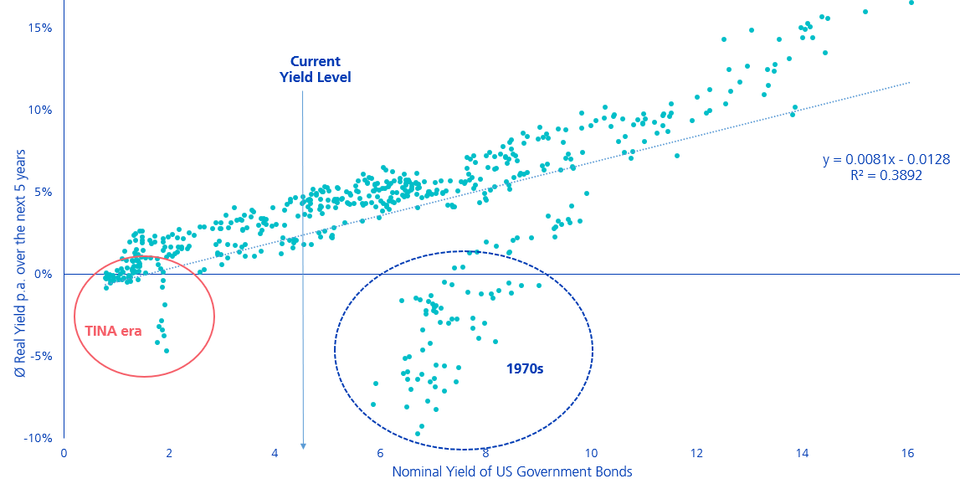

- Bonds: The sharp rise in interest rates caused unprecedented upheavals on the bond market. Historically positive returns followed the current interest rates, as shown in the following chart. Only in the TINA era and the 1970s were negative real yields achieved over the next five years.

- Real estate: The valuation difference between real estate equities and funds has shrunk significantly. Measured by the ratio of interest rates (10Y Swiss Confederation bond yield) and premium (market-weighted at 6.8% as at 24 October 2022), funds are now also very favourable and offer attractive entry opportunities.

Ø Real yield p.a. over the next five years for the respective current nominal interest rate level

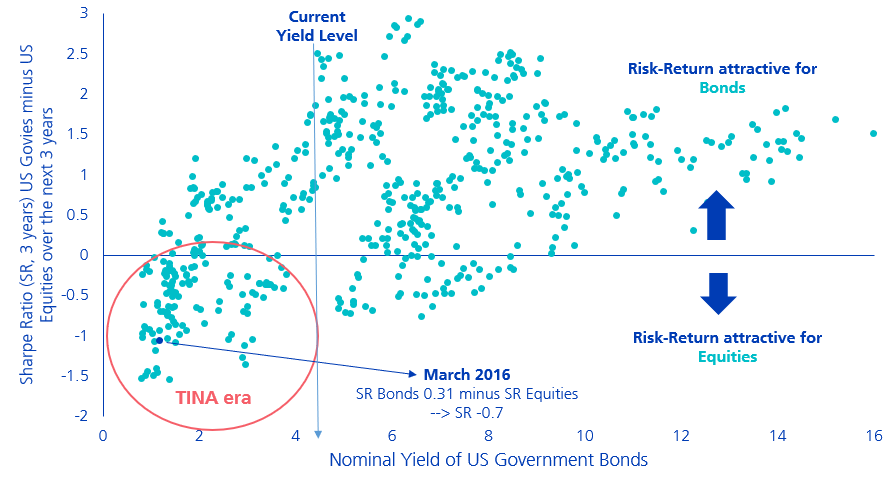

If the risk is also taken into account and bonds are compared with equities, the risk/return ratio at the current nominal interest rate favours bonds again (see next chart).

Sharpe ratio of bonds minus equities for the current nominal interest rate

Conclusion

The financial markets are writing history this year: with extremely painful losses in fixed-interest securities. This rapid upheaval provides a new starting point because the return expectations of the various asset classes are being readjusted. The fact is the TINA era is over and good alternatives to equities are popping up. Asset classes considered unattractive just a few months ago are being reassessed. TARA has now arrived.