European equities in the grip of inflation and recession risks

European equities are feeling pressure from three fronts: high inflation, rising interest rates and high energy prices. Inflation rates are double-digit in some European countries. Record-high electricity and gas prices are paralysing the economy. The European Central Bank has declared war on inflation and is increasing interest rates in huge steps. What can investors expect from European equities in this environment?

Roland Koster, Senior Portfolio Manager

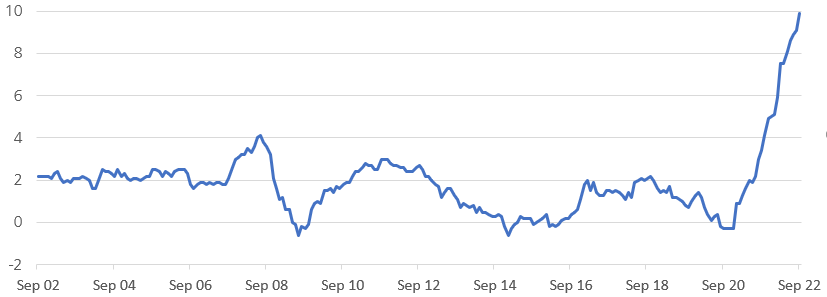

Rising commodity prices and supply bottlenecks resulted in rising inflation rates already in 2021. The conflict in Ukraine has prompted a massive acceleration in price increases. The economic sanctions implemented by the Western states against Russia and the subsequent countermeasures have triggered tremendous price increases for electricity and gas. The current inflation data for the eurozone shows price increases at an annual rate of 10%. An absolute record high.

Eurozone: consumer price inflation (in %)

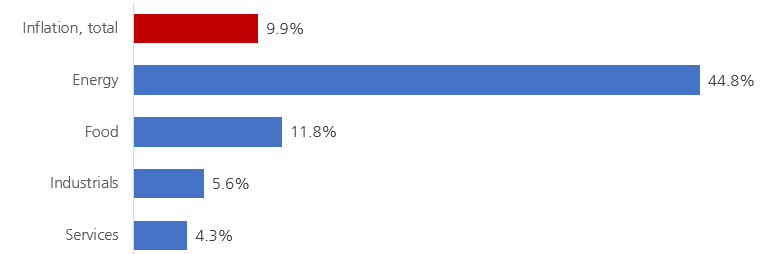

The main reason for this is the increased energy costs and significantly higher food prices.

Eurozone: components of current inflation

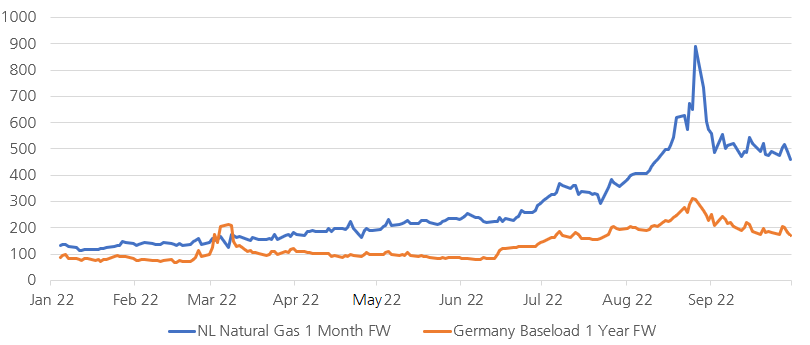

Record-high electricity and gas prices

For Europe, the high dependence on Russian natural gas is having an enormously negative effect. Electricity generation from natural gas has become significantly more expensive. France, the most important nuclear energy exporter, has also taken half of its nuclear reactors off the grid – due to unplanned outages. Although the situation is stable, it remains fragile due to the expensive acquisition of liquefied natural gas (LNG), the start-up of coal-fired power plants and energy-saving measures.

Gas and electricity prices in Europe in 2022

The chances that Europe will make it through the winter without massive energy savings are not bad at the moment. On the one hand, gas and electricity prices have fallen somewhat, the level of European gas storage is now 92% and the French nuclear power plants are expected to be back at full capacity by the end of the year. However, gas supply looks very difficult for 2023. With the current supply situation, it can no longer be guaranteed that the gas storage facilities will be refilled next summer. In the short term, but especially in the medium term, the "double urgency" with regard to energy efficiency and stable and, above all, renewable energy supply is therefore coming back into focus – on the political agenda as well as in corporate investment. Energy efficiency has a deflationary effect in the context of rising prices, but only in the medium term.

Consumers and businesses under pressure

The rising cost of living is putting enormous pressure on broad sections of the population. The English call it "the cost of living crisis" – because many people have to choose between a hot meal or a warm home. Consumer confidence in the eurozone even fell significantly below the level at the time of the pandemic. Leading indicators for industry are also on the decline. Governments have already set aside billions to cut energy prices. Germany recently passed a EUR 200 billion package to relieve the burden on consumers and businesses.

Dilemma for the European Central Bank

Fighting inflation or preventing the impending recession? Despite the looming recession, the energy shortage is preventing a rapid decline in inflation rates to the ECB's target – inflation at around 2 percent. Inflation rates are currently still far too high to support the economy with monetary or fiscal measures. The price would be an uncontrolled currency collapse, as has already been observed in Japan and the United Kingdom. In the United Kingdom, the poorly communicated fiscal policy and the subsequent interventions by the Bank of England on the bond market gave cause for debate. This is not conducive to sound economic growth for the important EU trading partner.

Favourable valuations after price declines, but recession risks prevail

This difficult environment has clearly already left its mark on the equity markets. Cyclical sectors in particular have suffered significant price losses. A recession is already partially discounted in the prices. Historical comparisons suggest further potential for correction in the event of a recession.

Sector-Performance MSCI Europe Index (01.01.-30.09.22)

Energy |

+21.9 |

Health |

-12.8 |

Non-cyclical consumer goods |

-12.9 |

Communication |

-16.4 |

Utilities |

-19.1 |

Finance |

-20.2 |

Commodities |

-22.0 |

Cylical consumer goods |

-29.3 |

Industrials |

-29.4 |

Technologie |

-36.3 |

Real Estate |

-43.4 |

Source: Bloomberg

Maintaining defensive positioning and buying cyclicals in phases of weakness

For the moment, we continue to favour defensive FCF gems in Europe, less cyclical sectors such as communication, non-cyclical consumption and health. High-dividend equities also offer attractive investment opportunities. In the cyclical sectors, we prefer companies that benefit from the expansion of electricity grids, renewable energies or investments in energy efficiency. These companies should benefit from the planned billions in investment in European energy independence, regardless of economic risks. These structural and, in particular, sustainable investment themes offer investors a certain degree of visibility and can be further expanded in phases of weakness.