Equities: Exchange rates back in play

Currency fluctuations are increasing due to interest rate rises. This has a direct impact on the performance prospects of equities. How have Swiss equities and others fared so far?

Text: Thomas Bruhin, Jürgen Siemer, Nicola Grass

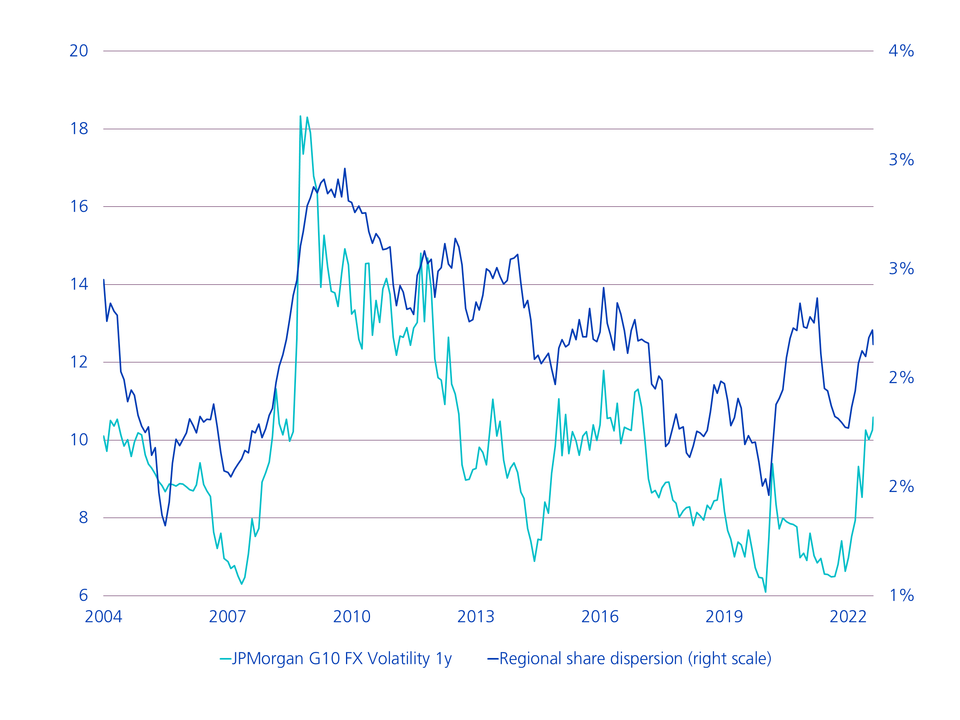

With the exception of the severe upheavals during the coronavirus crisis in March 2020, the past few years have been characterised by very low volatility in currencies. In order to stabilise the markets during the coronavirus crisis, the main central banks cut their key interest rates to 0 % and below, and carry trades (see info box below) were sharply scaled back. The performance of the various regional equity indices also differed surprisingly little over the last five years.

This calm is now over. The cause: many central banks around the world have switched to a policy of interest rate hikes due to inflation. The Swiss National Bank ended the 8-year negative interest period last June and recently raised the key interest rate to 0.5 %. The European Central Bank also began a turnaround in interest rates last summer. The Federal Reserve has already raised interest rates five times this year. The interest range of the Federal Funds Rate is currently between 3 % and 3.25 %. The interest rate hikes are thus increasing the volatility of the currencies of the G10 countries (see chart below). The interest rate differential is once again an important factor. For example, the USD has already appreciated against the EUR by 26 % and against the JPY by as much as 40 % since the beginning of 2021. The CHF has also become significantly stronger. As a result, the returns of the regional equity indices now differ again more strongly (high dispersion).

Return of volatility

Most Swiss companies barely affected

For Swiss companies, in the most recent half-year earnings publications, exchange rates scarcely represented a significant influence on the operating result. For instance, globally positioned Nestlé reported a positive currency contribution of 0.1 %. Roche recorded the same growth rates in CHF at both the revenue and earnings levels as at constant exchange rates, with the rise in the USD offsetting the impact of the weaker EUR and JPY.

In general, it can be said that the vast majority of listed Swiss companies should be able to cope well with the current currency situation thanks to a balanced distribution of sales across the two major currency blocks of USD and EUR and production sites that are increasingly distributed geographically over the last few years.

On the other hand, companies that achieve above-average sales in the eurozone and process a high proportion of production in Switzerland are more heavily affected. At Stadler Rail, for example, currencies reduced the operating result by a third, with additional currency losses also occurring in the financial result.

Companies with high earnings in the USA have an advantage

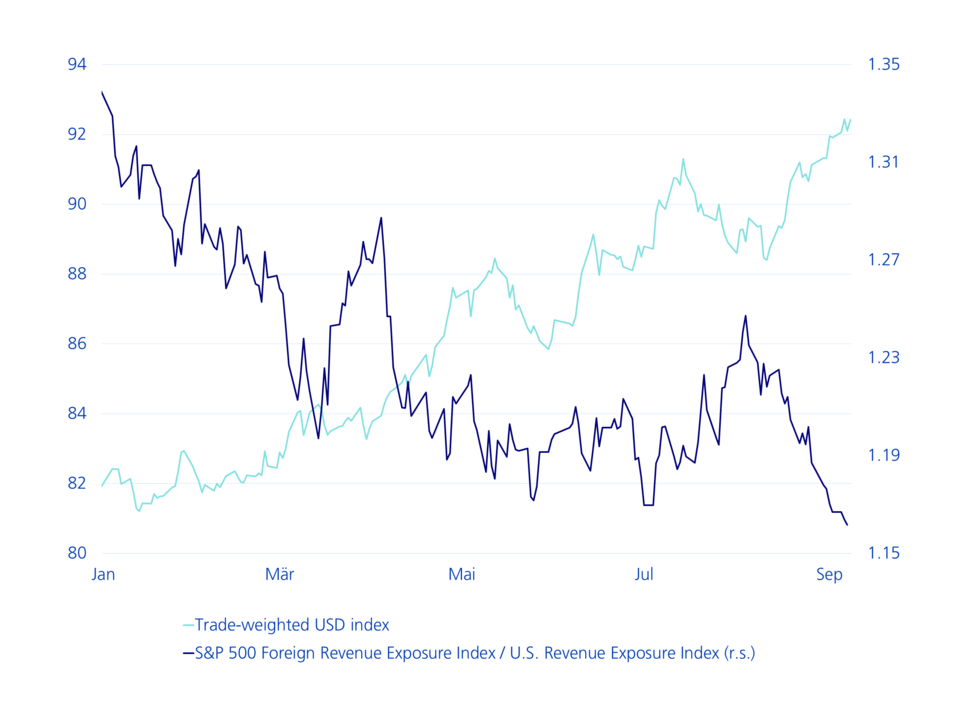

US companies with high returns in the domestic market and lower returns from markets outside the USA have reported more stable returns due to the strong USD (see chart below).

In contrast, the stronger USD led to a loss of revenue and earnings for some US companies in international business. However, revenues and profit contributions from exports are generally not very high, while contributions from foreign subsidiaries are more relevant to the earnings of US companies.

The food and beverage company Pepsi, for example, generates 44 % of its turnover and 62 % of its pre-tax profits outside its home market. There are fears that the relative contribution of foreign markets to the revenue and profit of the Pepsi Group as a whole is now likely to fall.

A strong USD is bad for US companies with significant international business

A strong USD also helps companies outside the USA with a high export rate to the USA. The Danish pharmaceutical company NovoNordisk, for example, currently generates 48 % of its sales in the USA, which is primarily due to the attractive product portfolio. Expressed in CHF, the share price of NovoNordisk has increased by 3 % in the last 12 months.

Beware of «soft currencies»

An overly weak currency relative to the USD is a challenge for investors. This applies to the JPY, for example, which performed comparatively weakly in 2022 and lost more than 20 % in value against the greenback and 14 % against the CHF. As a result, the export-heavy Nikkei index, measured in local currency, lost just 8 % this year. It is therefore one of the best equity indices in the world.

Nonetheless, the decline of the JPY usually eats away at the gains on the revenue level. One of the few Japanese companies whose share price, calculated in CHF, is higher today than at the beginning of the year is the car manufacturer Mazda Motor, which can also be explained by the fact that the company exports a higher proportion of its cars and car parts from Japan, which are then sold on the global market, compared to other Japanese companies.

What is a carry trade?

Carry trades take advantage of interest rate differences in currencies. There are two types of carry trades:

- Positive carry trades: Example: An amount in currency X is borrowed at an interest rate of 0.5 %. The borrowed amount is exchanged into currency Y at an interest rate of 4 %. As long as currency Y appreciates against currency X, or it remains stable or loses less than the interest rate difference of the currencies X and Y (here 3.5 %), this results in a profit.

- Negative carry trades: Example: An amount in currency Y is borrowed at an interest rate of 4 %. The amount borrowed is exchanged into currency X at an interest rate of 0.5 %. If currency X appreciates more than the interest difference of currencies Y and X (here 3.5 %), this results in a profit.

Please note: a change in interest rates affects the profitability of a carry trade.

Legal notice: The publications were prepared by the Buy-Side Research of the Asset Management of Zürcher Kantonalbank. The information contained in this document has not been prepared in accordance with any legislation promoting the independence of financial research, nor is it subject to any prohibition on trading following the dissemination of financial research.