Listed real estate funds after historic setbacks

The sharp decline in premiums is reflected in price losses in real estate funds. The development of the index of listed Swiss real estate funds (SWIIT) since the beginning of the year has been extraordinarily weak. In the first half of 2022, the SWIIT lost 14.88 %.

Text: Jan Elmer

On 5 January 2022, the SWIIT index reached a new all-time high at 529.47 points. By the lowest point on 16 June 2022 at 420.18 points, the index lost 20.64 %, which is equivalent to the largest loss (maximum drawdown) since the launch of the SWIIT.

SWIIT Index: Performance since 2019

Triggers of the historic decline in prices

- In our view, allocation problems among institutional investors such as pension funds were primarily responsible for this price setback. Since equities and bonds recorded greater price losses than real estate (direct real estate investments as well as real estate investment foundations were even slightly positive), the real estate allocation of mixed portfolios shot up. In order to reduce this allocation again, investors sold the more liquid listed real estate funds.

- The sharp and rapid rise in interest rates as well as the interest rate hike by the Swiss National Bank were secondary contributors to the price losses.

- And thirdly, the great uncertainty on the global equity markets also put pressure on real estate fund prices.

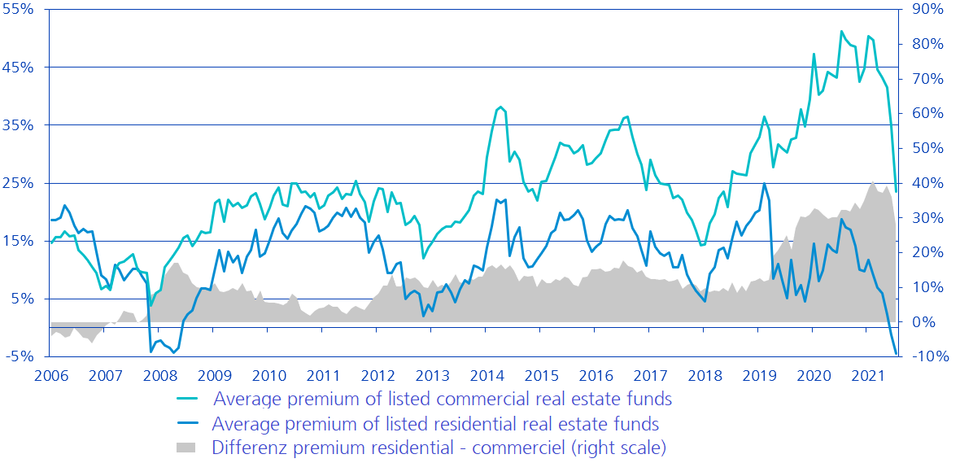

Large difference between the premiums of residential and commercial real estate funds

- Following the outbreak of the coronavirus crisis, investors primarily bought stable and secure residential real estate funds. Commercial real estate funds were avoided in this phase because the outlook for the Swiss economy was uncertain, various sectors were suffering greatly from the lockdowns and the demand for office space in the future was called into question due to increased working from home. All of these reasons led to prices and premiums for residential real estate funds rising sharply and those for commercial real estate funds not rising or falling sharply.

- However, since the end of March 2022, we have noticed that this valuation difference is declining. In the commercial sector, many rental contracts are linked to inflation, which should lead to increasing rental income. In addition, at around 3.5% on average, the distribution yields of commercial real estate funds are currently significantly higher than for residential real estate funds at 2.5%. We believe that the prospects for commercial real estate funds are currently more attractive than for residential real estate funds, and we expect this difference to decline further.

Should we expect value adjustments for commercial real estate?

- The prices of commercial real estate funds indicate a discount on the NAV on average.

- The market assumes that there will be certain value adjustments. Otherwise, there would be no discount. However, we do not expect any major or comprehensive valuation adjustments in the commercial real estate segment. On the one hand, the transaction market does not point to any falling prices. Record prices are still being paid, especially in prime locations. On the other hand, inflation protection in commercial leases offers potential for rent increases, which is positive for a property valuation. However, individual value adjustments for commercial properties in less favourable locations, with poorer quality and higher vacancies cannot be ruled out.

- In the case of funds with a discount, there is a risk that investors may wish to redeem their fund units. If the liquidity of the real estate fund is insufficient, the fund would be forced to sell certain properties. In the worst case, the fund must even be closed and liquidated.

- Careful analysis of the individual real estate funds is currently indispensable for assessing opportunities and, in particular, risks.

Are listed Swiss real estate funds an attractive investment at this price level?

Following the sharp decline in prices, we currently consider listed real estate funds to be fairly valued. The ratio between the average premiums and interest rates is also currently around the historical average again, now that the SWIIT has recovered somewhat since the low in mid-June 2022.