End of zero interest rates: Check hedging foreign currency investments now!

The stock markets not only enjoy periods of good weather, as we are currently experiencing again. The move away from the zero-interest-rate policy also increases the dynamism of currency movements. Active management of currency risks is becoming increasingly important. How and when can you best protect your portfolio against currency fluctuations?

Fabian Ackermann, Head of Systematic Strategies

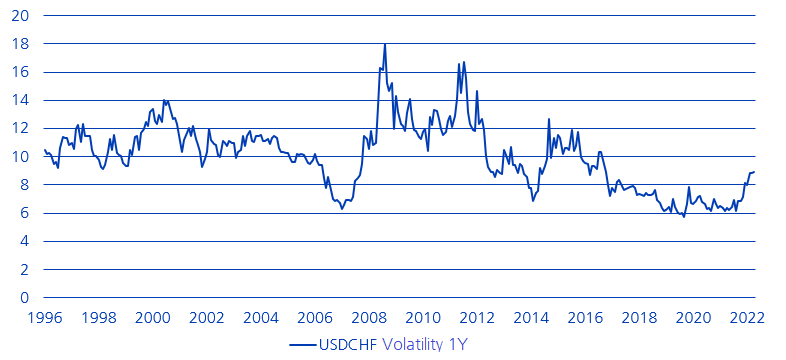

While one or two central banks are implementing the shift away from the zero-interest-rate policy in 2022 in fits and starts, others are doing so rather cautiously. As a result of these different approaches, the volatility of exchange rates has increased significantly. The volatility of exchange rates – shown in the chart using the example of USDCHF – was unusually low in the years 2019 to 2021, but increased significantly in 2022 (see chart). The expected interest rate differences of major currencies are in motion due to the different levels of agility in monetary policy. In this situation, it makes sense to analyse FX risks in greater detail.

Long-term volatility of the USDCHF exchange rate

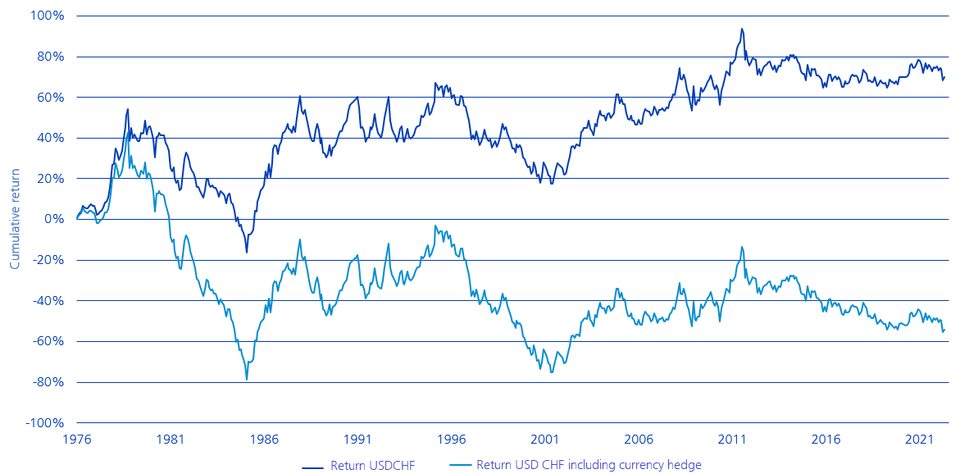

For currency risk, a consequence of the geographic diversification of investment portfolios, investors do not receive compensation in the form of higher returns, as research from the past shows. Although correctly anticipating currency movements in the short term has proven to be virtually an impossibility, a long-term pattern can still be seen, particularly in the Swiss franc. The Swiss franc is a strong currency. The appreciation of the franc against the USD has been at an average of 1.5% per year for almost 50 years.

Hedging the USD cost an average of 2.7% per year during this period – in line with the average interest rate difference between the USD and CHF. The continuous appreciation of the CHF was therefore not sufficient to compensate for the costs of currency hedging. On balance, there is a loss-making transaction of 1.2% per year on average (=1.5% appreciation minus 2.7% costs of currency hedging), which accumulates into significant losses over time (see chart below).

The bottom line: if the interest rate difference is higher than the expected currency appreciation, it is not worthwhile to hedge the currency due to excessive costs.

Conversely, currency hedging is worthwhile if the expected interest rate differences are small in phases, as exchange rate risks can then be hedged cost-effectively.

Cumulative return of CHFUSD with and without currency hedging

The volatile development stands out on the chart. From an investor perspective, the following questions are therefore interesting:

- Is it possible to find reasons for this volatile development?

- Can patterns be identified?

- Can instructions be defined in order to exploit possible patterns?

To find out, we analysed historical data of the USD, EUR, GBP, JPY AUD, CAD, SEK, NOK and CHF since 1976.

Analysis of historical time series yields clear results

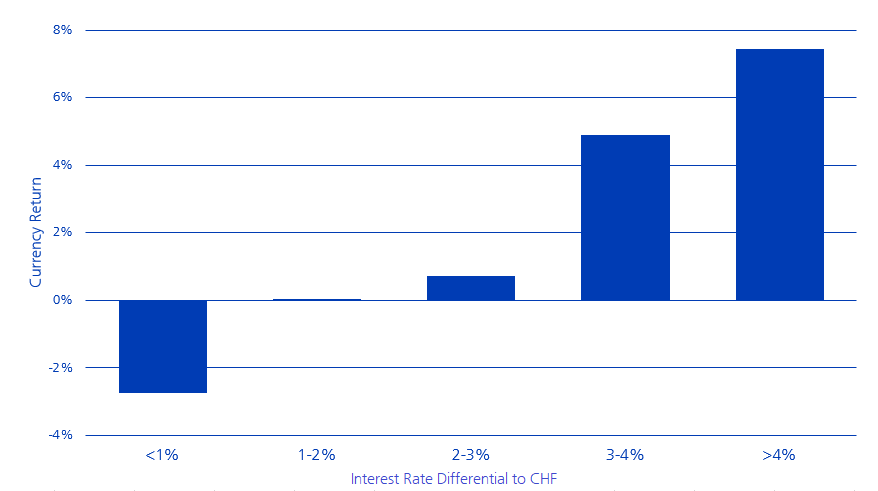

We examined how high the 1-year interest rate differences in the various currencies were at the end of each month compared to the CHF and what currency return was recorded in the following month. For the eight foreign currencies considered, a clear picture emerges against the CHF:

Average currency return with different interest rate differences, 1976–2022

Interest Rate Difference |

Currency Return from a Swiss Perspective |

Recommended Action |

< 1% |

-2,8% |

Currency hedging is worthwhile (better risk and return) |

1-2% |

0,0% |

Currency hedging is worthwhile (risk better, return neutral) |

2-3% |

+0,6% |

Currency hedging is neutral (risk better, return worse) |

3-4% |

+4,9% |

Currency hedging is not worthwhile (return considerations dominate)

|

> 4% |

+7,4% |

Currency hedging is not worthwhile (return considerations dominate) |

As we have determined in our analysis, currency hedging is not worthwhile if the interest rate differences are greater than two or even three percent. In the event of interest rate differences between 1 and 2 percent, the result is neutral – however, as a positive side effect of currency hedging, there is a reduced volatility of the portfolio. What are the interest rate differences currently?

Currency |

Interest Rate Difference as of 19/ 08/2022 |

USD |

3,13 % |

EUR |

0,58 % |

GBP |

2,75 % |

JPY |

-0,79 % |

CAD |

3,16 % |

AUD |

2,91 % |

NOK |

2,71 % |

SEK |

1,68 % |

Current interest rate differences argue against full currency hedging

With the USD, GBP, CAD, NOK and AUD, five currencies are already over 2 percent in terms of the interest rate difference compared to the CHF, and even more than 3 percent for the USD and CAD. The interest rate hike by the Swiss National Bank (SNB) on 16 June 2022 has not changed this. Why is that? The central banks of the USA, the United Kingdom, Australia and Norway are currently pushing ahead with the tightening of monetary policy. The SNB's interest rate hike is becoming more reasonable against the backdrop of this international perspective.

Movement in interest rate differences

With this set of figures, it is not surprising that the USD and CAD have clearly positive performance against the CHF in the current year. As these are already above the 3-percent mark in the interest rate difference compared to the CHF, a reduced hedge is appropriate here. For AUD, NOK and GBP, full hedging could now also be around the corner depending on the risk appetite. On the other hand, the interest rate differences for the JPY and EUR remain low. Full currency hedging should be maintained there.

We are flexible for you!

As the asset manager of Zürcher Kantonalbank, we offer currency overlay mandates with a monthly review of interest rate differences. Currency hedging (full or partial hedging) per currency can be adjusted individually in consideration of security needs and costs.