«There are only winners with home care»

Caring for people in need at home increases their well-being, reduces costs and therefore opens up attractive investment opportunities. These are the key takeaways of an analysis, written by Andreas Giger, Senior Equity Analyst. He takes the pulse of the home care market during an interview.

Basis of the interview is a recently published Theme Assessment on Home Healthcare.

Andreas, what exactly is home care?

Besides health, this service for people in need includes everyday aspects such as assistive personal care and domestic services.

What is your main argument for investing in the home care market?

Given the ageing population and cost pressures in healthcare, the home care sector offers above-average and profitable growth, independent of the general economic cycle, with valuations at moderate levels.

The volume of the home care market is estimated at around 400 billion dollars, with annual growth rates of up to 10 percent. What are the primary drivers?

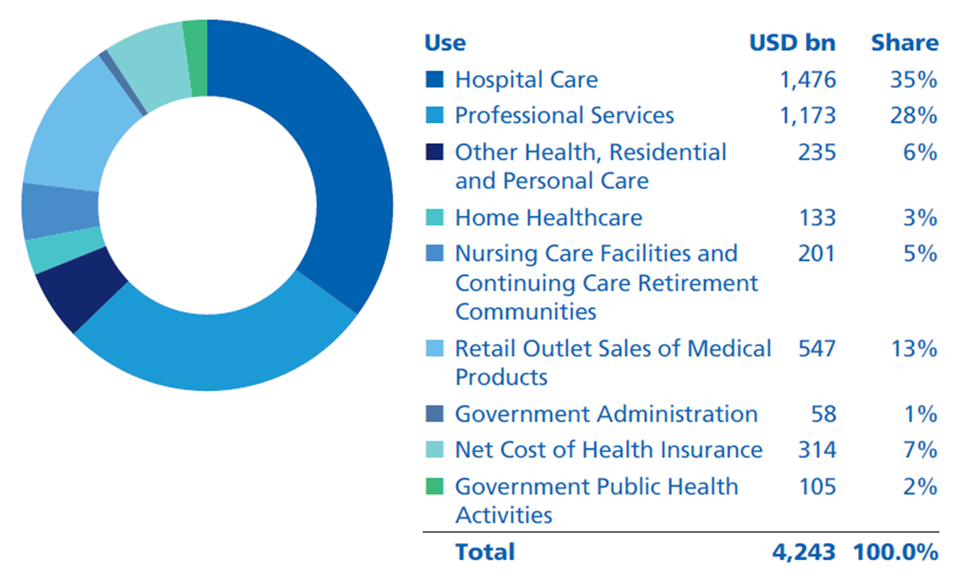

There are considerable market volumes. However, the share of home care in relation to total healthcare expenditure is just three percent (see chart below). Nonetheless, there is no question that the proportion of the elderly population is growing in all industrialised countries, and so is the demand for healthcare services. The question of financing has not yet been resolved. Home care is therefore a cost-saving measure that does not comprise on quality. In the USA, this process is likely to be more dynamic and faster due to the economic incentive systems. In other countries, the process is even more dependent on public processes. But the economic arguments are the same and will lead to similar solutions in favour of home care, regardless of political orientation. Improving affordability is also in the public interest.

US healthcare expenditure by us (2022 estimates in USD bn)

And what are the main risks for the home care sector in general?

The main risk has become clear in the past two years of the pandemic. Home care companies faced staff shortages during this time and therefore rising labour costs. In addition, the recent US government proposals for the annually updated Medicare compensation payments were negative for the sector and resulted in disgruntled sentiment. Although the decision-making process is not yet complete and a more advantageous end result is still possible, this has once again shown that politics is also an important factor. In general, the long-term financial viability of healthcare as a public good is also under scrutiny. Even though high-quality healthcare enjoys broad support in public opinion, budget reductions and healthcare benefit cuts loom in the longer term in view of the generally tense situation of government budgets.

Is it correct to assume that the Covid pandemic is providing a boost to the home care sector, especially telemedicine?

That's correct. The pandemic has certainly accelerated the development of technology as well as the general acceptance of modern means of communication and digitalisation in healthcare.

The majority of key companies are domiciled in the USA. How have their evaluations developed and which are the most important players?

The valuations of investable equities were downgraded before the general price correction of growth stocks started in 2022 due to the wage-cost problem already mentioned. In addition to Amedisys, which is still an independent market leader, we have an expanded group of specialised stocks, such as Chemed, Addus HomeCare, Option Care and AdaptHealth.

«Pure» home care companies have a relatively small market share. How likely are mergers and acquisitions in this sector?

Recently, there have been isolated acquisitions by vertically integrated healthcare providers in the USA. Consolidation within this specialised industry is also progressing. I believe that this trend will continue, as the sector is still highly fragmented and there is a large number of unlisted organisations. It is striking that the leading listed US companies have consistently achieved better values in terms of service quality and patient satisfaction than the industry average since the introduction of a rating system a few years ago. This underlines the intrinsic value of the specialised home care business model.

The healthcare industry in general and care in particular primarily represent costs to society. Home care has a cost-reducing effect, but the penetration rate is low in many countries. Why is this?

This is probably related to the regulation and tentative modernisation of the often bureaucratic remuneration processes for medical services. Economic incentive systems such as performance-based remuneration to service providers or the established HMO models should make a positive contribution in this context.

Please find further information in our «Home Healthcare» theme assessment.

The publications were prepared by the Buy-Side Research department of Zürcher Kantonalbank's Asset Management and not by the "Financial Analysis" department in the meaning of the "Directives on the Independence of Financial Research" issued by the Swiss Bankers Association. The publications are therefore not subject to these guidelines.