The right mix against high inflation and rising interest rates

The sharp rise in inflation is forcing the US Federal Reserve to raise interest rates. Which strategy can ensure successful returns in such an environment?

Stefan Fröhlich

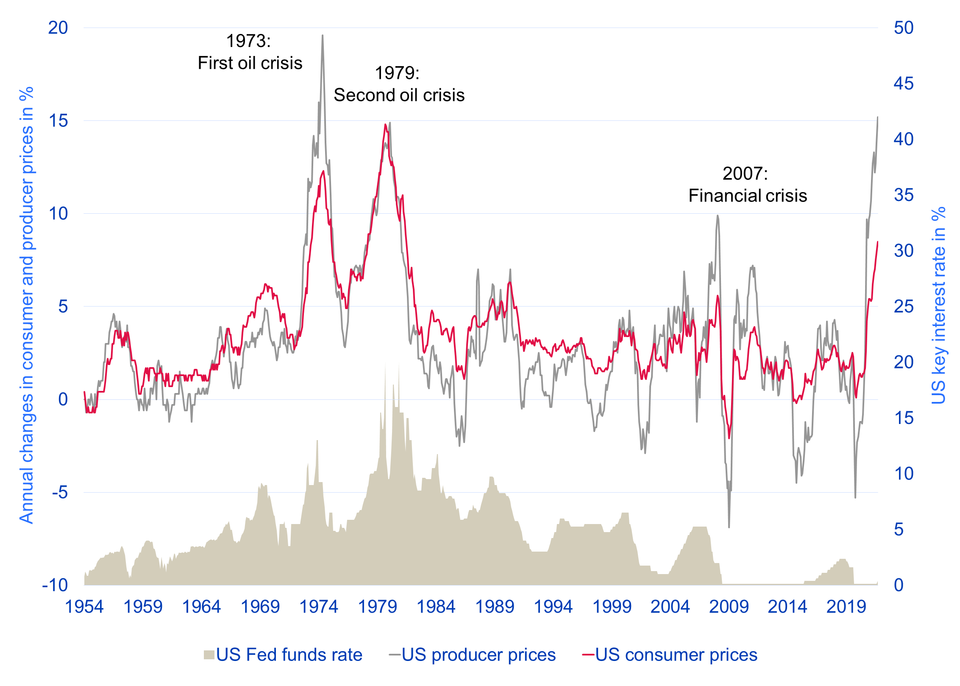

After four decades of falling interest rates, the US Federal Reserve is reaching for interest rate hikes. Its objective is to fight the rapid and sharp rise in inflation. In the USA, consumer prices have risen by 8.5% year-on-year and producer prices have even risen by 15%, which corresponds to the highest values in the last 40 years (see chart below). The pace of this price spiral is as fast as it was in the 1970s. What are the main drivers of inflation? On the one hand, the phase of globalisation, which has been ongoing since the 1980s and has been highly deflationary as a result of global trade and competition, seems to be ending. Prices are also being driven by supply bottlenecks, caused in particular by the coronavirus crisis and the war in Ukraine.

Meanwhile, it can be said that the era of ultra-loose monetary policy is over and so is the associated flight to riskier asset classes. What's more, the Fed must be cautious about further tightening monetary policy, otherwise it risks a recession.

US consumer and producer prices (annual change)

Rising interest rates – toxic for equities?

Since 1975, investors who have invested in the MSCI World Index have received an annualised return of 7.9% in CHF. During periods when the Fed hiked its key interest rate, equities delivered an above-average annual return of 10.2%, while in periods of falling interest rates, they delivered a negative annual return of -4.3%.

We maintain that rising interest rates are therefore fundamentally positive for equity returns as long as interest rates remain within a healthy range.

Value stocks are particularly attractive at the moment

Since last autumn, value stocks have performed significantly more strongly than growth stocks. The tenth of equities in the MSCI World Index with the lowest valuation has achieved a breath-taking surplus return of 28% since the beginning of the year compared to the tenth of equities with the highest valuation.

Value stocks are typically found in the financial sector as well as in the energy and commodities sectors. These companies are currently in demand because their earnings are closer to the present and their dividend payouts are generally higher than those of growth companies.

In the case of growth stocks, which can currently be found in the IT sector in particular, the expected profits lie further in the future than in the case of value stocks. Investors are prepared to pay a higher price for these growth companies in anticipation of high future earnings and accept a more expensive valuation. In a low interest rate environment, the costs of waiting for future earnings are low. However, once interest rates rise, distant profits are discounted more strongly. In the current environment, investors are therefore less inclined to accept high price premiums for growth stocks.

Value stocks should therefore benefit in times of rising interest rates – as far as the theory is concerned. Can this be empirically proven?

Analysis of style effects over time

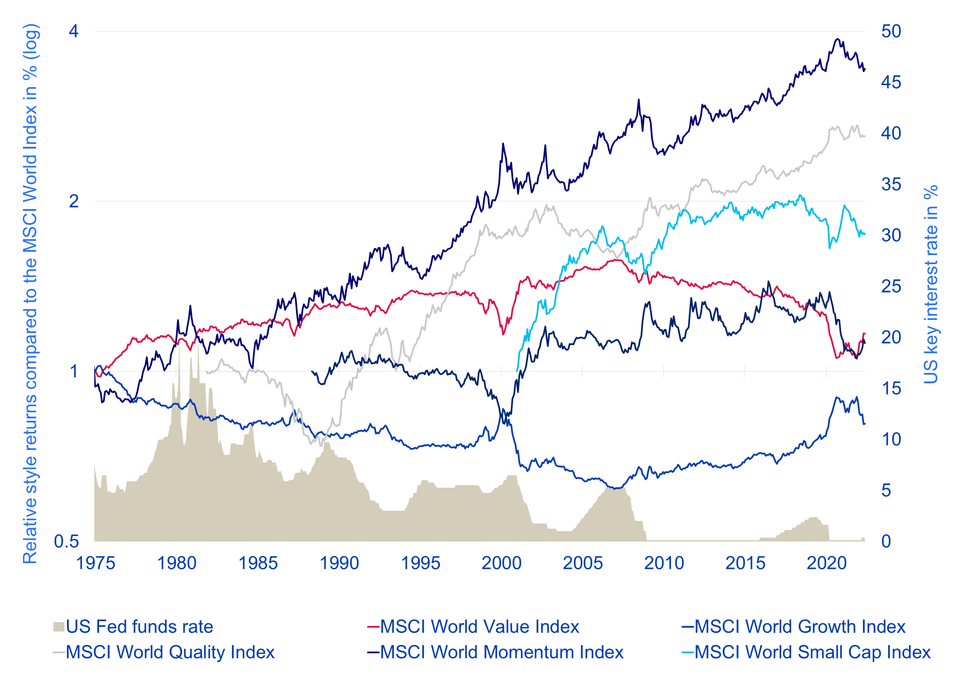

Beginning in 1975, the share price performance of the style factors momentum, value, growth, quality and small caps show that...

- Momentum stocks, which were able to generate high returns in recent months, also achieved the highest returns over the entire period since 1975. Apart from some pronounced reversals, these equities generate above-average and robust returns in both upward- and downward-trending interest rate regimes.

- Value stocks have delivered a 0.8% higher annual return than growth stocks in times of rising US rates since 1975. The opposite is true in periods of falling interest rates. Growth stocks perform better than value stocks.

- in times of falling interest rates, quality stocks achieved the highest returns. In these periods, the majority of equity markets trend downwards, which is why companies with a healthy balance sheet and above-average profitability are in demand.

- Small-cap companies are generally preferred by investors when the equity markets rise. In times of falling markets, however, investors prefer more established and large-cap companies.

Style returns relative to the MSCI World Index

Diversification is the key to successful returns

The expected interest rate is an important factor in the selection of equities and investment strategies. Nonetheless, an investment strategy of relying solely on the trend of interest rates falls short. It should be noted that each time period has its own drivers and that crisis and boom phases sprout from different soils. Diversification and the combination of several style factors that complement each other well therefore remain crucial for long-term successful returns. This can be achieved, for example, with a sophisticated multi-factor approach or with a machine learning-based approach that enables a robust portfolio with a broad-based investment model.