The interplay between sustainability and private equity

The size of the private equity market can make a big difference in terms of sustainability. Private equity investors have taken the path to more sustainability in recent years and can also profit from it.

Text: Luca Riboni

The major challenge with sustainability in the private equity market is the measurability and the associated comparability of data. For the public market, the EU decided that larger companies must publish detailed information, e.g. in the form of ESG reporting, on sustainability aspects. In Switzerland, solutions are being developed in a similar direction. The goal: Render companies’ sustainability efforts visible. This visibility is designed to encourage companies to make their products and services more sustainable, which ultimately supports global sustainability. Currently, the sustainability assessment of public-sector companies is based on third-party data that analyse companies and calculate an ESG score for them.

All about ESG

ESG stands for Environmental, Social and Corporate Governance. The ESG score expresses how much a State or company does for environmental protection, society and good governance.

Zürcher Kantonalbank’s Asset Management incorporates ESG factors into the investment process.

“What gets measured, gets managed”

The statement “What gets measured, gets managed” attributed to management pioneer Peter Drucker illustrates the fundamental relationship between measurement and implementation. This means A solid data basis is a necessary condition for making decisions on a quantified basis and for carrying out meaningful ex-post analyses. Unfortunately, the private equity market greatly lags behind in this regard. Implementing ESG factors and their measurability is very costly and is often carried out only by larger listed companies, as it represents a huge financial burden for smaller private companies. Ultimately, this means: If ESG scoring is used by smaller companies, then it is based on the quantification of qualitative assessments of the company and is without standardised reporting.

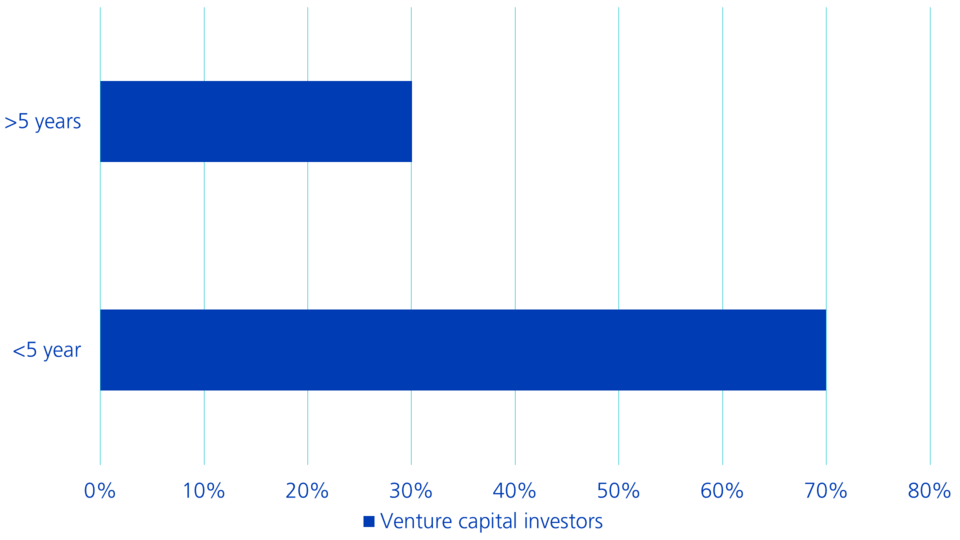

While the desire to measure ESG factors among private companies is often lacking, ESG factors are nowadays included in the decision-making and investment process of private equity investors. According to Pitchbook, around 44% of venture capital/private equity investors invested using a sustainable approach less than two years ago and around 70% less than five years ago.

Integration of sustainable investment principles with investors

Implementation date of the (fully integrated) sustainable investment principles

Private equity investors sort companies into groups as regards sustainability

However, the demand for sustainable investment solutions is not yet present at all institutions. Switzerland’s net zero target by 2050 requires a total of CHF 387.2 billion or an average of CHF 12.9 billion in investments per year (2020 basis). Investments of this amount would enable the necessary reduction of greenhouse gases in Switzerland to be implemented.

Private equity investors occupy an important position here. They pick up companies at an early stage and align their business model sustainably. A company’s performance in the areas of environmental protection, social issues and principles of good corporate governance is positively influenced. The early inclusion of sustainability criteria in the production and service processes of private companies makes sense in this respect for people and the environment, as the majority of companies are privately owned.

The private equity market, therefore, has an enormous reach and an enormous influence on our global sustainability. It lays the foundations for the future development of the company. In this regard, a study has shown that companies that are listed on the stock exchange can have a 10% higher ESG score and so are more sustainable if private equity investors are already present in the company.

Benefits of including ESG factors in the investment process

The focus on ESG factors also has great advantages for private equity investors. Private equity funds that have integrated ESG factors into the investment process tend to achieve higher returns with less risk. Including ESG factors in the investment process also means that investors are increasingly looking to invest in sustainable companies. It was found that investors reacted more strongly to negative corporate reports than to positive ones. For this reason, accurate and well-founded reporting is nowadays almost a necessity for private companies looking for investors. Investors and other stakeholders in private equity increasingly value ESG reporting, which is why private companies must increasingly deal with the topic.

In principle, it can therefore be said that the private equity market can foster sustainability through early investments in private companies, but sustainability can also have a positive impact on the private equity industry. Ultimately, it remains essential that companies design their products and services in a sustainable manner, in the process of which the measurability of sustainability plays a key role.

How decarbonisation and private equity relate to each other

Promoting sustainable solutions through private equity? You can find out how this works and what opportunities and risks it entails on our Insights Blog.