Focus on commodities, Switzerland and sustainability

High inflation, rising interest rates and expensive commodity prices are affecting companies' earnings reports. We see opportunities, for example in defensive sectors, commodities and sustainable energy.

Text: Michael Häberli, Rocchino Contangelo

The reporting season for the first quarter of 2022 is drawing near. It traditionally starts with US banks. In the banking sector, we are relatively cautious with respect to the investment banks, as IPO activity flattened in the past quarter due to stock market uncertainty. On the other hand, we are more constructive for regional banks, which are expected to benefit from further interest rate hikes.

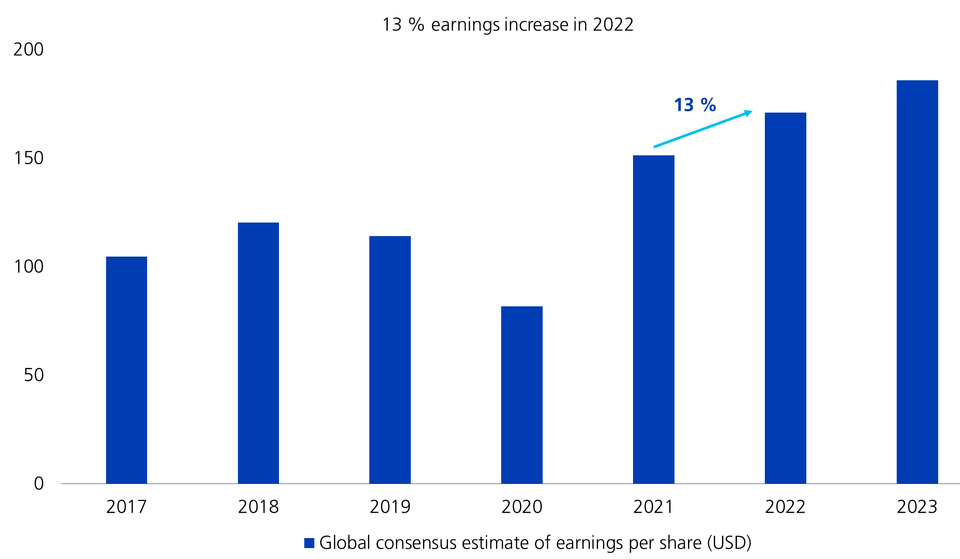

The financial impact of ongoing supply chain problems, rising energy prices, high wage inflation and overall inflation as well as declining economic growth have the full attention of investors in this year's reporting season. It remains to be seen whether companies feel comfortable enough in this uncertain environment to provide guidance for 2022 as a whole. Given the various uncertainties, it is likely to be challenging to meet earnings growth expectations of 13% (YoY) in the MSCI World (see chart below). Companies with considerable free cash flows, however, have a good chance of exceeding analysts' expectations. This is also where our research and investment focus lies.

MSCI World +13 % earnings growth

Exercise caution with cyclicals

As the peace negotiations between Russia and Ukraine are unfortunately becoming drawn out, cyclical risks in Europe are increasing. In addition to the high inflation rates, the economic slowdown in Europe is gaining more and more attention. The increasingly hawkish signals from the European Central Bank (ECB) are likely to exacerbate the risk of declining economic growth.

Against this backdrop, we are relatively cautious on European financials and cyclical equities. We are more constructive in companies that benefit from the increased inflation. We are therefore taking a positive stance towards companies in the consumer staples, health, commodities/raw materials or energy sectors.

In Europe, we are particularly constructive for the defensive Swiss market. Globally, we favour the North American market as well as the commodity-heavy stock markets of Canada and Australia.

Good cards for the sustainable energy sector

Despite international efforts to reduce dependence on Russian gas, a comprehensive and rapid import ban is not very realistic. A gas embargo against Russia would further accelerate inflation and in some cases lead to production cuts.

Nevertheless, international policy is seeking to reduce dependence on Russian energy supplies by demanding an increased focus on renewable energy sources such as wind and solar, as well as energy-efficient solutions. This political backing plays into the hands of companies that offer climate-friendly technologies and solutions. These include the Swiss companies Belimo, Gurit, Meyer Burger, Zehnder and ABB or global players such as Northland Power, Owens Corning, SolarEdge, Carrier Global, Vestas and Schneider Electric.

Watch the Market Minute video (in German) to find out more about the current earnings reporting season, how much more inflation is likely to increase and how investors can prepare themselves.

Legal notice: The publications were prepared by the Buy-Side Research of the Asset Management of Zürcher Kantonalbank. The information contained in this document has not been prepared in accordance with any legislation promoting the independence of financial research, nor is it subject to any prohibition on trading following the dissemination of financial research.