Multi-Factor-Investing: Value and Quality deliver

We analyse the current performance of the factors value, momentum and quality. With these three factors, Zürcher Kantonalbank’s Asset Management implemented a successful in-house variant of quantitative investing in 2006, which today has a nice long-term track record.

In the rough stock market environment of 2022, our systematic, global multi-factor strategy performed well. The factors “Value” and “Quality” were particularly popular on the market. What is behind their robustness? Which information is correct for quantified investors, who rely on a factor-based investment strategy, confident for the 2023 investment year?

Performance of the value, momentum and quality factors in 2022 compared to the MSCI World Index

Who would have thought that we would fall into the next crisis mode as the coronavirus pandemic abates? Completely new information had to be processed on the financial markets in 2022. The Ukraine conflict has shaken the basic features of the global community and brought the most violent war atrocities back onto Europe’s map. The associated increase in energy prices is partly responsible for the return of inflation, which was thought to be a thing of the past and which continues to keep us busy to this day.

Relative factor strength continues

Against this backdrop, 2022 was disappointing for investors. However, we already demonstrated in the summer of 2022 how a factor-based strategy can achieve relative strength, which is particularly important for institutional investors. The relative strength of the factors of value, quality and momentum continues to hold up and rewards followers of systematic investment strategies. This may only be a weak consolation in view of a negative performance. However, especially in times of weak equity markets, the following applies: It is better to have a bird in the hand than two in the bush. The factor strategy thus makes a quantifiable contribution in the context of risk management. And it can make a meaningful contribution to risk-adjusted performance – especially with our strict tracking error-reduced variants.

Factor investing is a quantitative investment strategy, often called systematic investing or smart beta investing. Company key figures or equity price trends are examined for patterns and success factors. The aim is to identify above-average stocks. The most well-known, promising characteristics – referred to as “factors” in this financial analysis sector – have gained considerable popularity since the 90s under the heading Value, Growth, Size, Quality, Momentum and Low Volatility. The effectiveness of the factors has been scientifically proven.

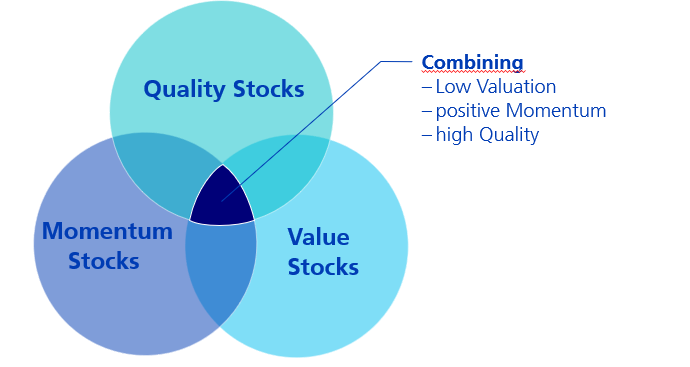

Combination of factors leads to success

While equities, which we filtered out with the “momentum” success factor, performed slightly below average, “quality” and “value" pleased with attractive factor premiums. Both factors had a significant impact on the market in 2022 – i.e. equities of companies that were filtered out as attractive using these criteria actually outperformed and thus delivered the desired factor premium. However:

- Not every factor and the stock bundle chosen with it is constantly yielding success in the interplay of emotions that the stock markets give us.

- That is why we practice strict diversification across the three key factors of value, momentum and quality.

The factors that we have chosen with the underlying equities or companies together demonstrate the strength we desire – i.e. outperformance. Quant thus systematically unlocks additional returns from the market. As at the end of November, the Swisscanto (CH) IPF I Equity Fund Systematic Responsible World Enhanced achieved a pleasing surplus return compared to its benchmark, the MSCI World ex Switzerland of +1.16% (-9.35% vs. -10.51%, gross in CHF). The portfolio provides our investors with a clear argument for active management in the case of controlled risks. Especially in a severely demanding market.

Looking ahead to 2023

At present, the balance of factor premiums and the diversification potential thereby regained are right. This has not always been the case in the recent past: In the meantime, the shortfall in the value factor, which was not so far behind, was so pronounced that it called into question the sustainability of the multi-factor approach in the short-term – regardless of “quality” and “momentum”. This phase has clearly been overcome. Quant investors are seeing higher returns again. And there is a simple, mathematical reason for this: Higher interest rates enhance the relative valuation of traditional value companies in the context of traditional equity valuation (discounted cash flow models).

Value factor in the context of inflation ans recession fears

In view of inflation, the central banks see themselves challenged to react with rising key interest rates and forced withdrawal of liquidity. The rising interest rate level led to a change in favourites on the equity markets, especially in the first half of the year. While investors have said goodbye to strongly growing companies with high profit potential, value stocks have become the focus of investors’ favour. The negative effect of rising interest rates is less pronounced for them, as earnings expectations are usually more moderate. Although the interest rate screw was also significantly tightened in the second half of 2022, most recently in mid-December, value stocks were unable to continue their upward trend. The vigorous action of the central banks to take consistent action to combat inflationary pressures was not expected everywhere and led to initial fears of recession. Historically, “value” behaves below average in an economically tense environment.

Nobody wishes to afford the luxury of not offering quality in their portfolio

The prices called for quality stocks were impressive at the beginning of 2022 and the valuation level also reflected high profits in the distant future. The end of the low-interest phase not only reduced these prospects, but interest rate securities are now again an investment alternative with yields well above zero. Nevertheless, trust in “quality” is quickly regained and will continue for the time being. Economic concerns may have contributed to this. Nobody wishes to afford the luxury of sacrificing quality. This adds stability to the multi-factor strategy.

Momentum factor defies volatility

How aggressive can central banks be in controlling inflation without jeopardising the stability of the financial system? The increased price fluctuations on the stock markets in recent months show that this is a fine line for the central banks. Such an environment generally poses challenges for the momentum factor, which had previously been well mastered. Due to the course of the year to date, momentum stocks are less sensitive to interest rates and, therefore, are extremely advantageously adjusted to an environment of higher interest rates. Resets occur when “Growth” briefly returns.

Investors are well prepared with an investment in our three-factor model

- Value stocks continue to trade at extremely attractive prices and thus still have upside potential.

- The phasing out of unlimited liquidity and eternally low interest rates is increasingly putting the importance of valuation back in the spotlight.

- Hardly anyone believes that inflation will fall back to pre-crisis levels.

- Structural factors such as the weakening/slowdown of globalisation or the declining proportion of people of working age in the overall population make economic activity more expensive.

- In an inflationary environment, quality companies profit more than average as they pass on prices and thus successfully defend their margins.

- Finally, with decreasing uncertainty in the further development of growth, inflation and monetary policy, it can be assumed that volatility will also decrease, which again gives the momentum factor more opportunities for development.

Why every investor should consider systematic multi-factor strategies in their investment strategy

When looking for investment success in financial markets, every investor – whether private or institutional – is confronted with a vast amount of information. Following a realistic self-assessment, investors quickly realise they cannot process this wealth of information on their own and condense it into investment success. In order to understand what drives the performance of a portfolio, it makes sense to take a look at the factors and how they can be used. How do you sort through the wealth of information?

The answer: this flood of information is filtered by computers. Factors are used as filters to screen available company and price data. These factors are scientifically recognised as success factors. Discoverers of these success factors, including Benjamin Graham or French & Fama, are now considered legends in the investment community. Consequently, a large investment universe, such as the MSCI World Index with its 1,600 companies, is thus turned into a selection of companies for investment. The financial industry refers to factor-based investing as simply factor investing. We like to call it systematic investing. If several factors are used for stock selection at the same time, this is called multi-factor investing. The chart below shows that multi-factor investing is becoming increasingly popular. As of the end of 2022, the volume of assets in funds and ETFs was almost 90 billion US dollars worldwide.

Multi-factor investing is increasingly in demand (figures in billions of US dollars)

Factors and their performance

| Factor | Performance | Danger | Return | Risk |

| Momentum | yesterday's winners are tomorrow's winners | bubbles | 9.4% | 14.8% |

| Value | low valuation, e.g. low Price-to-book-ratio | low valuation because of bad business | 7.9% | 17.9% |

| Quality | attraktive balance sheet ratios | too expensive | 8.7% | 13.9% |

| Low Volatility | defensive shares are popular | underperformance in upswing | 7.6% | 11.1% |

| Size | premium for the dynamics of small companies | high vulnerabilty in economic downturns | 8.0% | 17.0% |

| MSCI World Index | 6.6% | 15.6% | ||

| Source: MSCI, MSCI World Index and MSCI World Factor Indices, gross return and risk in USD, 29/12/2000 - 31/12/2022 | ||||

Factor timing along the business cycleThe various factors do not always deliver outperformance. Sometimes value stocks are more in demand, then momentum stocks again. For this changing dynamic, the analysis firm Investment Metrics has tried to establish a system along the business cycle, as shown in the diagram below. Role of the various factors in the business cycle |

||||

We do not engage in such overweighting or underweighting of factors within the business cycle as part of our strategy. For us, the factors of value, momentum and quality always remain equally weighted. However, we do not have a buy-and-hold strategy. As part of our active strategy, we screen large equity universes and search for and find those equities that offer investors the best combination of value, momentum and quality in various economic situations. The strategy is adjusted once per month. The turnover of our systematically managed portfolios is 10% per month with a low target tracking error and 15% with a higher target tracking error.

Why do we limit ourselves to the factors of value, momentum and quality and dispense with size, growth and low volatility?

Our set of factors partly covers the factors of size, growth and low volatility. Due to the selected portfolio construction, the portfolio already implicitly has a size bias. The size premium is also far less resilient than the premiums of value, quality and momentum.

The low volatility premium is already included in the quality factor. In addition, as part of portfolio construction, volatility is already limited relative to the benchmark. The following chart shows how many sub-factors are taken into account in our model.

Broad coverage of market phenomena through numerous factors and sub-factors

Why do we practise active management and do not offer factor investing as a "Smart ETF"?

The answer to this question is obvious given the multitude of screened and combined factors. Based on our in-house model, we offer a multi-factor strategy that does not merely provide a simple scoring of factors, as is usually the case with smart beta ETFs. In our equally weighted consideration of the three factors of value, quality and momentum, we find the golden mean, i.e. a combination of factors that allows the risk-adjusted returns to be maximised.

We provide you the intersection of value, momentum and quality

On top of that, we add value in terms of sustainability!

In 2020, Zürcher Kantonalbank's Asset Management decided to align all its actively managed funds with the Paris climate target and ESG criteria. This fundamental decision is also consistently implemented within the framework of systematic multi-factor investing – without affecting the original requirements of country or sector neutrality and tracking error. Such an extensive and comprehensible integration of sustainability and a traditional quantitative strategy has so far been unrivalled on the market.

What are the costs?

We have consistently positioned the costs of our systematic strategies in the middle of the costs of active and passive strategies. We offer multi-factor investing in several variants.

How to find the right product

We offer a wide range of solutions for all investors who wish to exploit the outperformance of the factors of value, quality and momentum in the long term. You can find all our systematic equity funds at a glance here: