Pension funds need to make progress in sustainability

Pension funds play a key role in Switzerland's aspired leadership position in sustainable investments.

Text: Iwan Deplazes

Swiss pension funds manage total assets for their beneficiaries amounting to more than CHF 1 trillion. This represents huge potential! Anchoring sustainable investment strategies among institutional investors is considered an essential step in the climate-friendly alignment of financial flows, which the Swiss government is aiming for as part of the "Sustainable Development 2030" strategy.

Still no obligation to sustainability

Sustainability is currently not part of the principles of asset management according to Article 71 of the BVG – according to the school of thought. In the well-respected legal report by Niederer, Kraft and Frey "Climate risks in the asset management of pension funds", however, an implicit obligation to take climate risks into account may arise from the legal regulations.

The UN Principles for Responsible Investment are clearer: "Climate change is the ESG issue with the highest priority for investors." Climate risks as well as opportunities for decarbonisation are not only significant in the long term, but also in the short term. This is relevant for companies and therefore also for pension funds that buy their shares and bonds.

The Swiss government has examined the climate compatibility of the financial sector

In 2020, the federal government examined the financial sector – including pension funds – in terms of climate compatibility. The results of the representative study show initial progress. However, the goal of taking a leading role in the area of sustainable financial flows is still missed, according to the findings.

Some areas are stuck at the level of declarations of intent. For example, two thirds of the respondents to the federal survey stated that they are pursuing a climate strategy. Yet, more than half of institutions that claim to exclude coal from their investments continue to hold shares and bonds from companies that extract coal or produce electricity from coal.

Switching up a gear is absolutely desirable

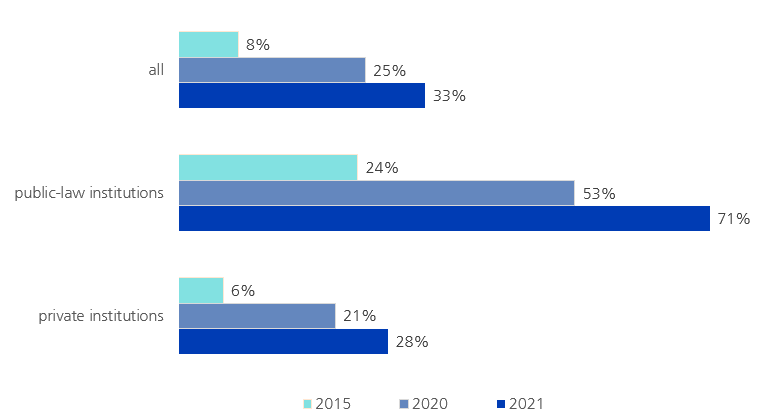

It is positive to note that Swiss pension funds are increasingly placing importance on the topic of sustainability – as evidenced by Swisscanto's Pension Funds Study. ESG criteria (environmental, social and governance) as a variant of sustainable strategies were anchored in the investment policies for 33 percent of pension funds at the end of 2021 (previous year: 25 percent, see chart). Pension funds in public administration play a pioneering role here, while private pension funds follow suit with a delay of around three years.

Proportion of pension funds with ESG criteria in their investment regulations

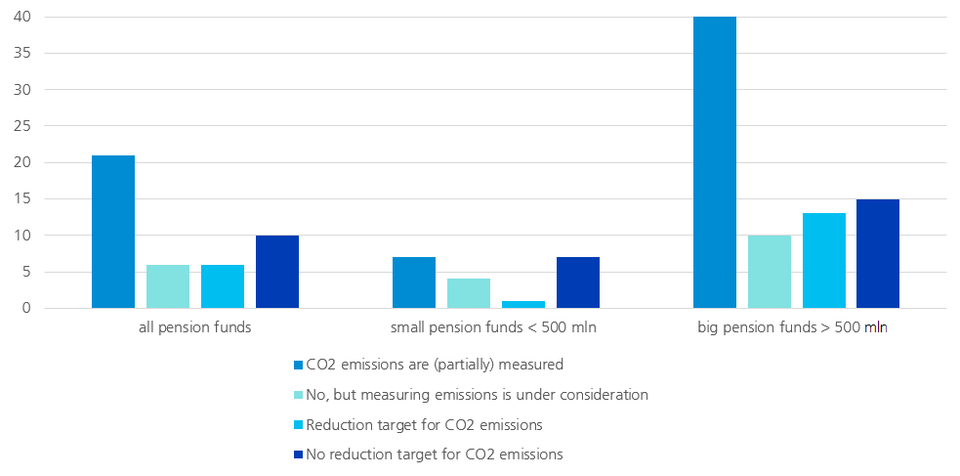

Overall, switching up a gear would certainly be desirable here. According to the Pension Funds Study, this applies in particular to the measurement of the CO2 intensities of the portfolios. Today, only 7 percent of smaller pension funds measure the greenhouse gas emissions of their portfolio investments, compared with 40 percent of large pension funds.

Pension funds are important for the aspired leadership position

All financial flows should be climate-friendly in order to promote resource-conserving, future-oriented activities. According to Swiss Banking, Switzerland is not only an important player with total assets under management of around CHF 7,878 billion, but also the number one in the cross-border asset management business with a 24-percent market share – with correspondingly high responsibility for the direction of financial flows.

The pension funds therefore play a role in Switzerland's aspired leadership position. They have the capacity to fulfil this leadership claim in an exemplary manner.

Room for improvement in the measurement of CO2 emissions

in % of all pension funds

This blog post first appeared as an article in the Neue Zürcher Zeitung on 16 September 2022.