Investing long-term in private equity

Decarbonisation of the global economy is a mega-trend that offers attractive investment opportunities. Private equity plays a key role here.

Text: Christian Sarwa

The world's population emitted around forty gigatonnes of CO2 last year. These emissions must be reduced to net zero by 2050 at the latest in order to limit global warming to 1.5 degrees Celsius compared to the pre-industrial period. Increased warming can have catastrophic consequences for people and the environment.

The challenges are gigantic, but so too are the opportunities. According to the IPCC (2019) "Special Report: Global Warming of 1.5 C", achieving net zero within less than 30 years requires annual investments of an estimated USD 3,000 billion in decarbonisation solutions. At present, USD 500 billion is flowing into this area. Although more and more companies are committing to net-zero targets, it is still unclear how the necessary measures will be implemented from a technical and operational standpoint.

Access to borrowed capital

New technologies and business models are needed. Some technology companies and service providers are trying to make advances with decarbonisation solutions. These are innovative, young companies that have developed a product and are generating their first sales. However, these companies are often still too small or have a history that is too short to gain access to borrowed capital or the capital market. Even if companies operate profitably, cash flow is usually not enough to finance growth.

With such growth financing, there are only a few investors who are willing to shoulder the risk and take on active work on the board of directors. This is where private equity growth or venture capital funds come in. In their role as active investors, they finance the growth of innovative companies with the capital of their customers. With their network and know-how, they thus enable the scaling of key technologies for achieving climate neutrality. Companies that offer technological solutions and services for decarbonisation across various sectors will be in high demand in the future. This is because established industrial companies rely on these new technologies to reduce their own CO2 emissions and the associated costs of taxation. As a result, these companies are expected to grow significantly faster and also achieve higher valuation premiums on the market.

Decarbonisation & Private Equity

More informationen regarding our decarbonisation strategy and our engagement in private equity.

Europe in the energy crisis

The war in Ukraine is a humanitarian tragedy and is plunging Europe, in particular, into an energy crisis. As a temporary solution, the energy shortage is pushing for the replacement of Russian gas with fossil fuels. In the long term, however, energy independence is desirable.

The conflict shows the dependence on fossil fuels more than ever. At the same time, net zero still seems to be achievable for Europe, as regulatory measures are taken and funds pledged to accelerate the use of renewable energy and other clean technologies. The USA, the second largest emitter of CO2 after China, is also promoting clean energy sources worth billions with the recently adopted Inflation Reduction Act. Against this backdrop, the momentum is attractive for investments in the area of decarbonisation. This mega-trend will accompany us for decades, regardless of the uncertain macroeconomic environment today.

Capital is effectively allocated wherever high risk-adjusted returns can be achieved, while at the same time targeting social and global benefits. Private equity with a focus on decarbonisation solutions and an investment horizon of four to eight years definitely belongs in this category.

Good track record

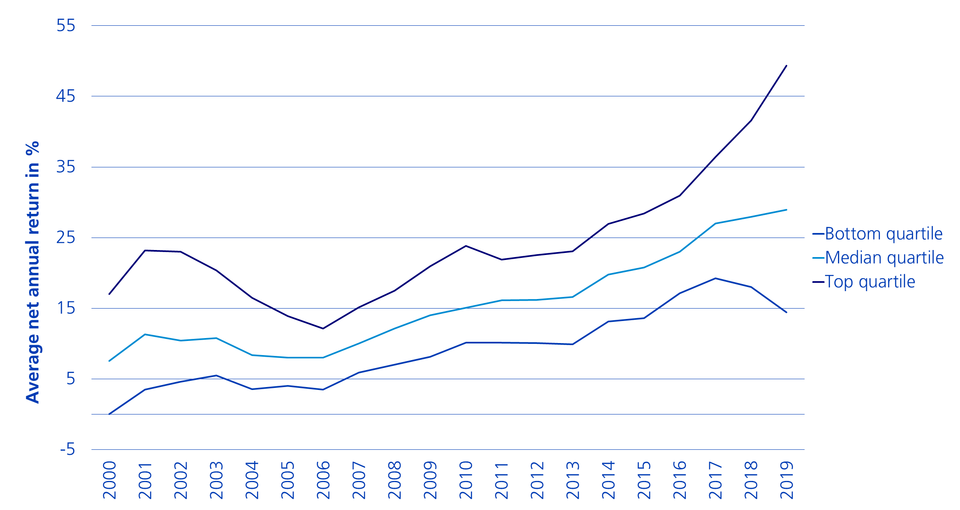

Private equity beat the average performance of global stock market indices such as the S&P 500, MSCI Europe and MSCI Asia-Pacific in both a short- and long-term comparison. Particularly in crisis years, the asset class demonstrated a high degree of resilience compared to listed companies. This is because private equity-owned companies can often respond more quickly to operational problems and a changing market environment.

Moreover, investments in innovation and growth are often thought of as more long-term than companies listed on stock exchanges. However, there are large differences in implementation among the respective private equity managers, which leads to a wide range of performance (see chart). For this reason, the selection of and access to the best fund managers is crucial for investors to successfully invest in private equity.

Differences in returns of private equity funds