Equities: Where institutional investors now find relative strength

Although multi-factor strategies cannot escape the difficult market conditions, quantitative analysis can be used to achieve outperformance compared to the benchmark. The value factor in particular is able to deliver relative strength in the weak overall market. Where does quantitative investors' confidence come from for the second half of 2022?

The first half of the year was extremely challenging for the international equity markets. The MSCI World lost -15.3% YTD (as at 28 July 2022 in USD). On the other hand, equities that we categorise in the value, quality and momentum groups performed relatively well.

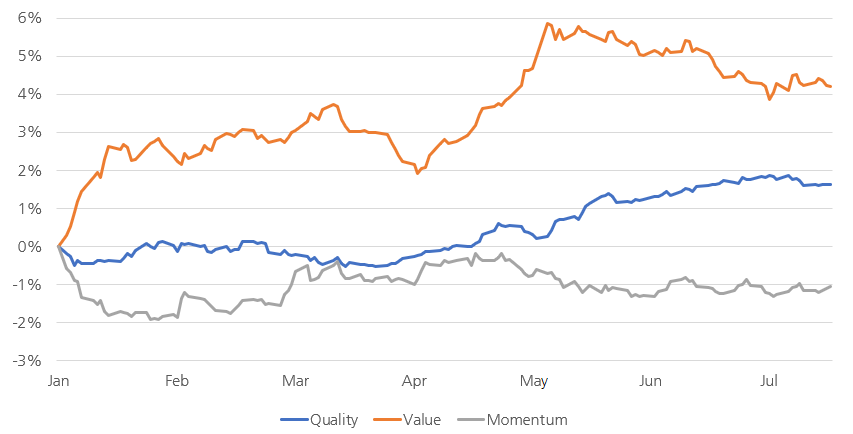

Performance of the value, momentum and quality factors in 2022 compared to the MSCI World

We note the following insights:

- The value factor continues to approach its old strength and fuels the hope that its return will last.

- Quality stocks are comparatively robust in the current bear market.

- Momentum also knows how to please investors. Excluding during the change of interest rate regime in January 2022, this factor has had its usual stabilising effect.

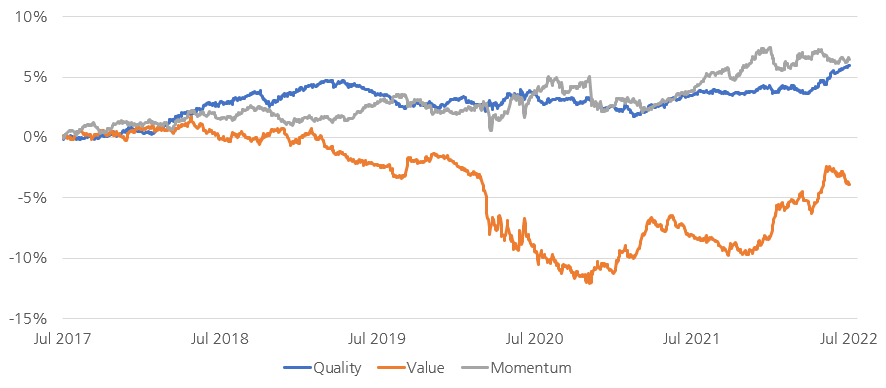

The rebound of the value factor since the end of 2020 is impressive. With the announcement of the effective coronavirus vaccine, value stocks had regained their foothold after difficult years. Quality and momentum demonstrate different strengths depending on the market environment (see chart below).

5-year performance of the value, momentum and quality factors compared to the MSCI World index

Value equities: on the bright side

The expected cash flows of value equities are usually closer to the present. Against the backdrop of a sustained turnaround in interest rates, the outlook for value equities remains pleasing. The US Federal Reserve is showing a rapid pace of interest rate hikes, while the Europeans are hesitant to follow suit.

Valuation of value equities remains attractive

The following chart visualises the valuation ratio of expensive and cheap equities over time – measured by the price/earnings ratio. The lower this figure, the more value equities are neglected and the greater their potential is compared to high-priced equities. At present, the valuation ratio is still close to its lows.

Value equities are favourably priced

Fighting recession fears with quality

In addition to interest rate hikes, central banks are using quantitative tightening to combat inflation. They are selling bonds or allowing them to expire without replacement, leading to a reduction in their total balance sheet assets. The tightening of monetary policy, together with higher interest rates, aims to bring about stricter lending by banks. Companies with high debts, low cash generation and business oriented towards growth must therefore prepare for tougher times. More restrictive lending does not affect high-quality companies which are less reliant on external financing, function in an exemplary manner and consistently generate high cash flows. This becomes even more important as there are more and more signs of a "hard landing". The quality factor can prove itself against this backdrop. This has been confirmed by the recent weeks of heightened fears of recession.

Growth equities: burdened by rising interest rates

While value, momentum and quality continue to write their success story, growth equities are currently feeling the heat. The correction on the stock markets has been progressing since the beginning of the year and has hit the American technology index, the Nasdaq, in particular, which has meanwhile lost almost 30 percent this year. Until recently, high-valued growth equities have now become victims of the misconception that any expansion of the money supply will not result in inflation and that a zero-interest-rate policy can be continued indefinitely. Supply bottlenecks and rising energy prices have made the spectre of inflation a reality and prompted central banks to raise key interest rates. Long-term interest rates also rose sharply. It is well known that the rise in long-term interest rates is toxic for growth equities, as a significant part of their valuation is based on expected profits that lie far off into the future. If interest rates rise, these profits must be discounted at a higher rate, which reduces their present value. In addition, the higher capital market costs are holding back growth.

Summary: Back to normality

While current events may seem painful in the short term, they are nothing more than part of a long-delayed normalisation process, coupled with a revaluation of equities and other asset classes. Investors with a multi-factor strategy consisting of value, quality and momentum retain all their trump cards, while the financial system frees itself from the difficult situation.