ROIC (II): Quality offers sweet return opportunities for equities

A full-bodied taste, a slightly shiny surface, a clean break, no melting in the hand and all produced according to sustainable standards – this is what sets high-quality chocolate apart. The successful search for quality stocks also requires metrics, tools and know-how. The second post in our ROIC series provides insights into the integrated quality assessment in the buy-side research of asset management.

Text: Rocchino Contangelo

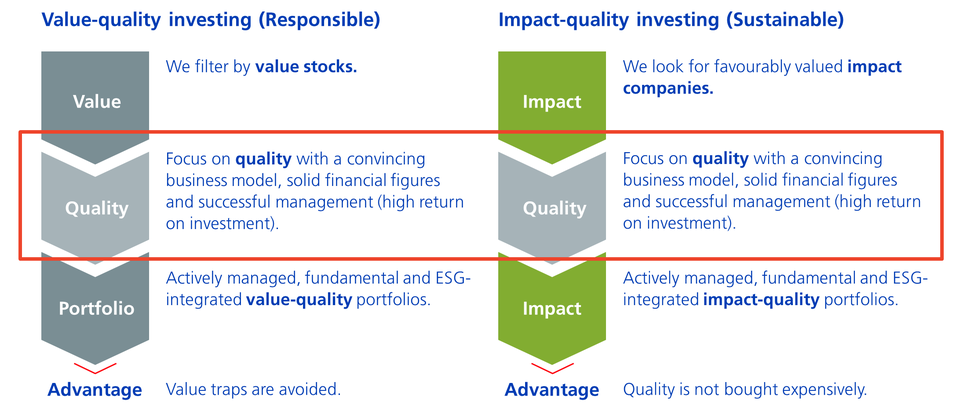

The first step is to explain how we define quality in the context of our investment approach. In a second step, quality needs to be specified on the basis of qualitative and quantitative parameters and criteria.

As is often the case, there is no general definition of quality or quality companies. For certain data providers, such as MSCI, a high return on equity (ROE), stable annual earnings developments and low debt are characteristic of quality companies

Tools for value-generating decisions

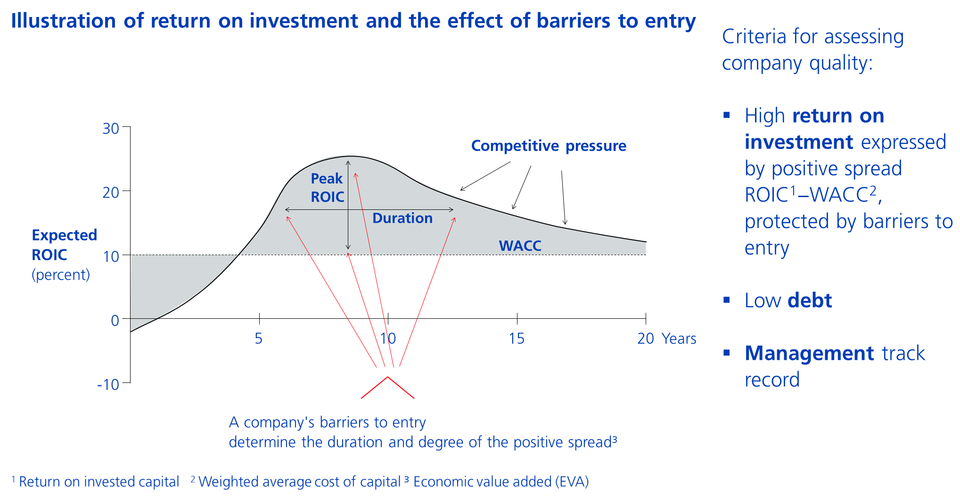

Swisscanto's approach defines quality more comprehensively. On the one hand, the management of companies must be able to make value-generating decisions. Accordingly, our quality analysis (see figure below) selects companies whose business models offer the prospect of attractive total returns on capital (ROIC). For us, promising business models have the following characteristics:

- High barriers to market entry based on a long-term structural competitive advantage (solid and profitable business model)

- Low debt

- A management team with a convincing track record

Quality is based on return on investment, debt levels and management

High barriers to entry lead to high total returns on capital

A core element of our quality analysis is based on the qualitative assessment of the business models by our analysis and portfolio management teams. Companies with a sustainability-oriented and value-generating business model usually have long, persistent and high barriers to entry. This allows them to generate an economic value added (EVA) before competitive pressure begins. Ultimately, according to our conviction, this value generation or the economic value added is reflected in the market valuation.

In our opinion, companies with the following attributes enjoy high barriers to entry:

- High scalability of products and services. In the IT or consumer sector, these include Microsoft, Alphabet, Accenture, Nestlé and Procter & Gamble.

- Cost leadership such as Novo Nordisk, Amazon, etc.

- Unique selling points. These include Roche, Pfizer, SGS and Mastercard.

Systematic ESG review

As part of our quality assessment, we also subject each security, both in our «Responsible» and «Sustainable» product lines, to a detailed ESG analysis. We systematically examine the company on all three ESG dimensions using our ESG integration tool. The tool primarily identifies ESG risks but also opportunities and is divided into four main areas: ESG, controversies, climate and impact. In the context of ESG integration analysis, the primary objective is to identify information asymmetries as well as relevant and material risks. In doing so, we focus on the following factors, among others (not exhaustive and variable depending on sector and relevance):

- Responsible use of resources (e.g. CO2 reduction through commitment and target agreement based on the Science-Based Targets Initiative (SBTi), minimising environmental influences, etc.)

- Compliance with human rights and occupational health and safety law

- Sustainable organisation of supply chains and general business practices

- Sustainable reporting (Global Reporting Initiative (GRI), value reporting, Carbon Disclosure Project (CDP), etc.)

- Abnormalities in accounting and financial reporting and their practices

- Avoidance of conflicts of interest:

- Shareholder base: equity structure with uniform rights of participation, assets and information and property rights for all shareholders (focus on standard shares)

- Composition of the board of directors: for example, whether the president function of the board of directors and the role of chief executive officer is split between two people.

- Management compensation: shareholder-friendly, clearly understandable, transparent and measurable arrangements.

- Auditing company: replacement after a maximum period of service of ten years

ESG criteria are an integral part of our active investment process. Their systematic integration enables us to identify the risks and opportunities relating to ESG trends at an early stage. We believe that companies with a good ESG profile are generally able to achieve higher economic value added (EVA) and a better return on investment compared to the benchmark.

Our impact quality approach is used for the «Sustainable» product line and is aimed in particular at companies that generate a positive impact on sustainability goals through their products or services. Read more in the third and last blog post in our ROIC series.

Two product lines with different approaches and one research system

Legal notice: The publications were prepared by the Buy-Side Research of the Asset Management of Zürcher Kantonalbank. The information contained in this document has not been prepared in accordance with any legislation promoting the independence of financial research, nor is it subject to any prohibition on trading following the dissemination of financial research.