Making blind spots visible

Making relevant data visible and combining it with broad-based expertise on investment-related information – this is what the second part of our three-part series on strategic asset allocation explores.

Text: Roger Rüegg

The first article on strategic asset allocation (SAA) dealt with the risk model as the basis of a training plan. In this article, we also want to draw a parallel to sport. While athletes follow an individually tailored training philosophy, investors are also guided by a range of investment philosophies.

Our aim is to derive a substantiated market opinion from the large number of assessments from different perspectives. To this end, we take a panoramic view of our portfolio managers and gather their market expectations. In a further step, a multi-asset committee determines market uncertainties on the basis of scenarios. The results are then reviewed and accepted by the multi-asset experts.

Surveys as a tool against blind spots

According to Ray Dalio, one of the most successful hedge fund managers, there are two barriers that prevent good decisions: blind spots and the ego.

We make blind spots as visible as possible by conducting an internal survey of our more than 50 portfolio managers in the asset classes of equities, bonds, real estate and commodities. This way, we get a broad view of the prevailing market opinions.

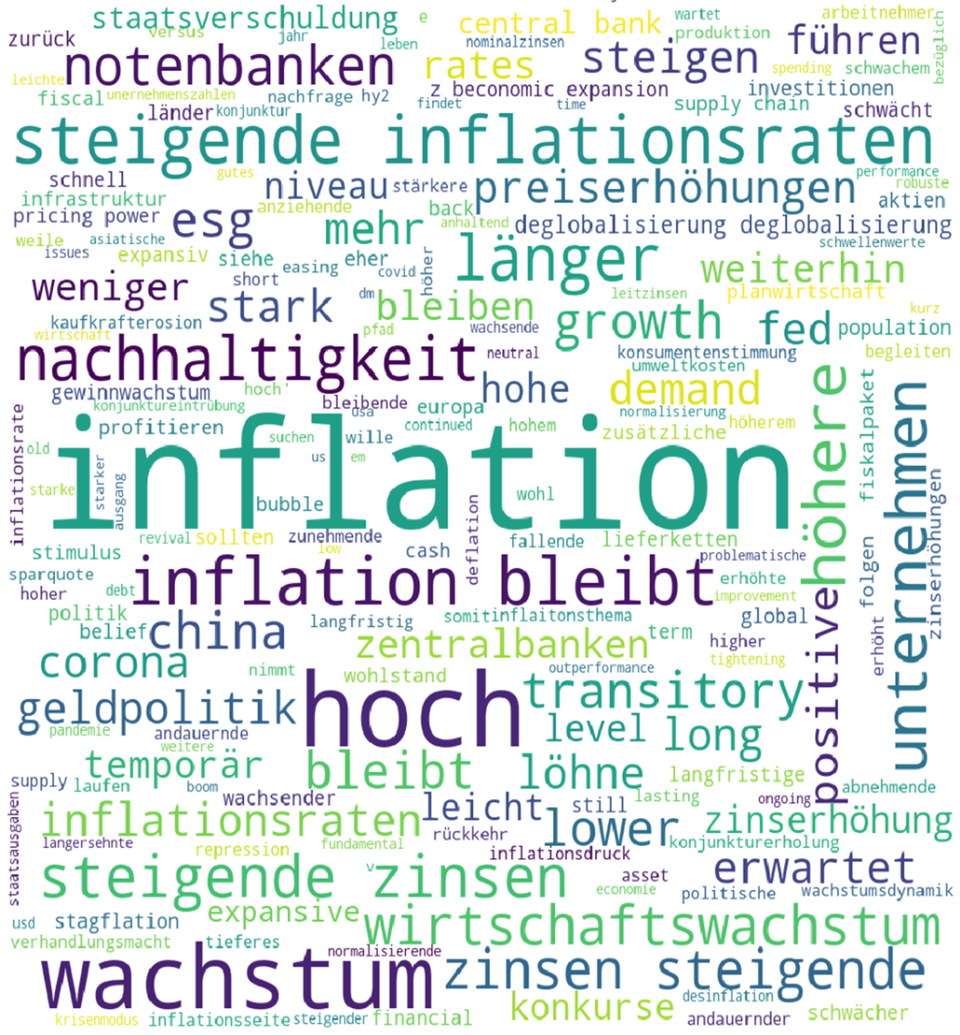

In the survey, we ask about the medium-term drivers of the market, the potential risks with their probability of occurrence, the optimal investment positioning and the most attractive investment themes. We use word clouds and classifications to visualise the inputs. An example of a word cloud for the most important drivers for 2022 is shown in the following graphic (only in German). It is based on expert input on key points for 2022.

Key points from investment professionals for 2022

Every one of our portfolio managers can get involved in the investment process, in keeping with the quote from Stephan Hawking: "Quiet people have the loudest thoughts." Our broad expertise in the wide range of asset classes gives us a comprehensive view of the prevailing market opinions. In our view, it is more effective to involve a limited number of experts than the entire market consensus. The latter often results in an unqualified mean value.

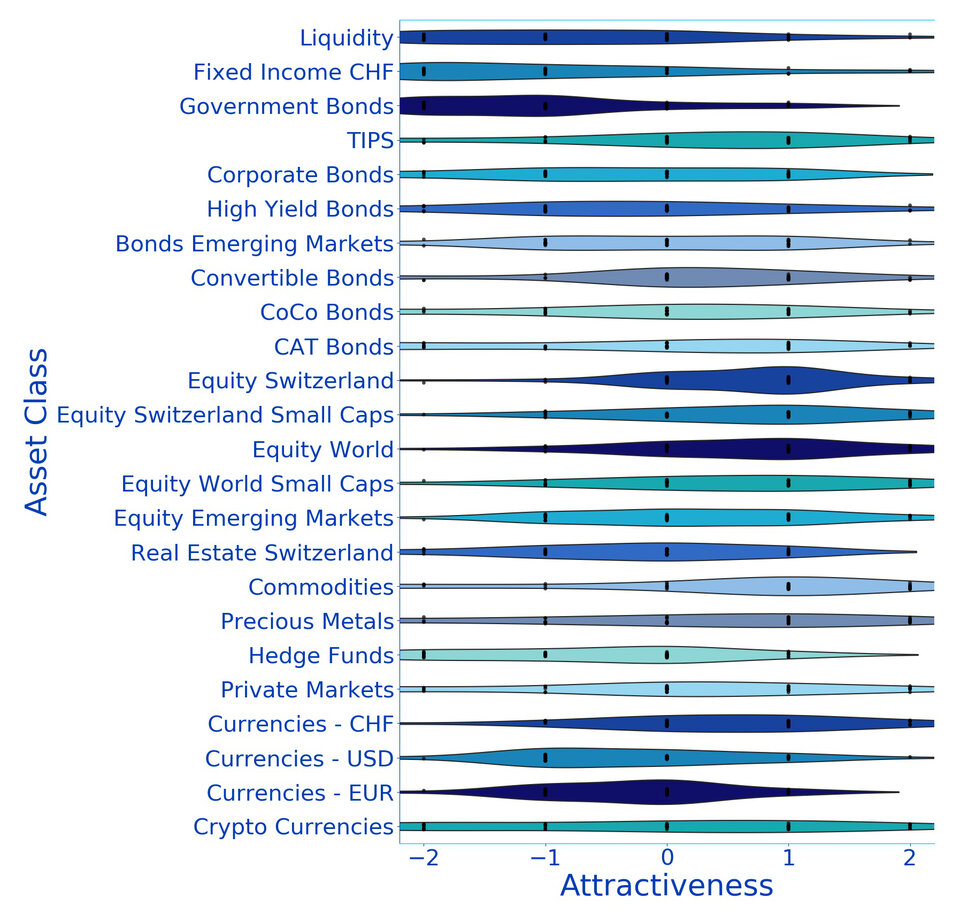

The positioning seen as optimal by our portfolio managers for the coming year provides important input on future expectations. For example, as it turned out for the first quarter of 2022, rising interest rates and higher commodity prices were correctly forecast by the majority. The positionings for each asset class are aggregated and represented graphically for the multi-asset committee.

Optimal positioning of portfolio managers for 2022

Multi-asset investment committee handles uncertainty with scenario analyses

When it comes to investing, a market opinion is only sound if we also reflect on the uncertainty behind it. We are therefore firmly convinced that a market opinion must always be backed up with a scenario analysis including probabilities. In doing so, we always consider how the market assesses the scenarios. The opinion of the market is our zero point, because only future positive or negative developments will move it. It is often said that investors may be surprised by the market's reaction, even though they have correctly anticipated the scenario. This is only the case because the market has already anticipated the scenario that has emerged.

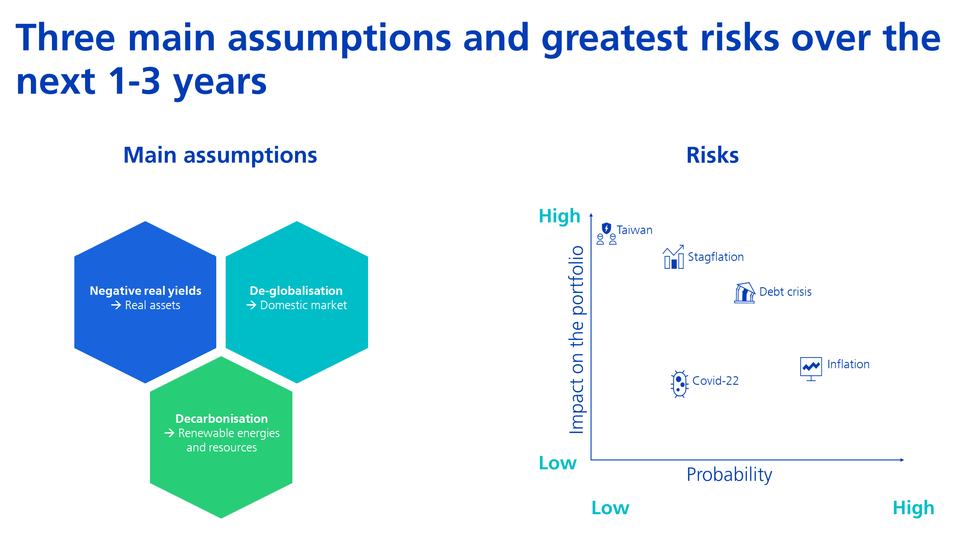

Our multi-asset investment committee comprises three people from the areas of fundamental and quantitative analysis. Using the survey mentioned above and its own analyses, the committee develops a base scenario as well as a positive and negative scenario, determining the current market drivers. In each scenario, it identifies the implications for the investment strategy and the medium-term investment themes. The scenario analysis produces the main assumptions for medium-term development, including the expected risks with their probability of occurrence.

Main assumptions and risks determined by the multi-asset investment committee for 2022

Broad-based market opinions without ego

The multi-asset committee is ultimately challenged by the entire multi-asset team. The three scenarios with the main assumptions and their implications for the investment strategy are subjected to a thorough review and adjusted if necessary. This results in our broad-based market opinion without ego, which is incorporated into the strategy analysis for the underweights and overweights.

As with an individual training plan, in the final step we address the crafting of an investment strategy according to the individual needs of our customers. In our third article on SAA, you can find out how we now value the robust earnings expectations.