How to identify and avoid greenwashing

At the Pension Fund Day of Zürcher Kantonalbank, Fabio Pellizzari commented on the topic of greenwashing in sustainable investments. He has clear messages on how to avoid greenwashing.

Interview with Fabio Pellizzari

Fabio Pellizzari, investors are disappointed and the term "greenwashing" quickly makes the rounds when companies from the oil industry, for example, appear as a key fund position in a fund that purports to be sustainable. Is this justified?Fabio Pellizzari, investors are disappointed and the term "greenwashing" quickly makes the rounds when companies from the oil industry, for example, appear as a key fund position in a fund that purports to be sustainable. Is this justified?

Fabio Pellizzari: The accusation of greenwashing is in most cases due to a misunderstanding. Investors – especially private investors – have false expectations of sustainable investments. With a little more financial knowledge, the jungle of sustainability approaches would soon stop being as impenetrable as it may seem to some now. The task of the financial industry is to counter such false expectations, as well as the accusation that a "green" image is only cultivated in order to achieve more profit, with transparent information.

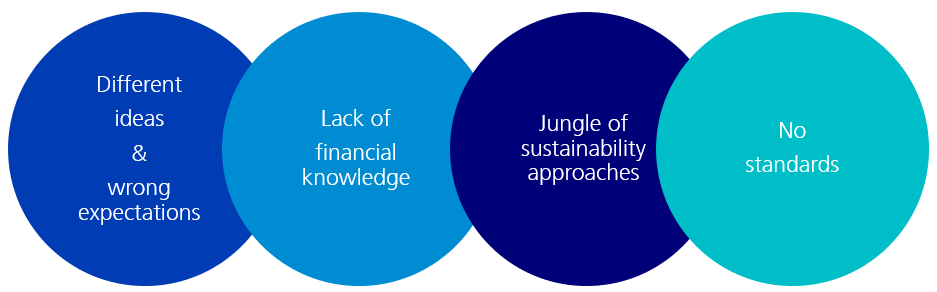

Common reasons for greenwashin allegations

But there are also clearly identified cases of greenwashing, right?

Fabio: Yes, that's correct. There are some bad apples in an overall credible industry. It is therefore important to keep some points in mind that can be helpful in identifying greenwashing:

- The positioning of the fund contradicts market practices, e.g. in the handling of controversies or the use of customary exclusion lists

- Misleading or deceptive information is provided about a product

- Greenwashing can also occur with investment advice. This is the case if the advised or sold "green" product does not match the declared customer preferences or risk profile.

As Head of ESG Strategy & Development, what are you doing to combat greenwashing?

Fabio Pellizzari: It is in the bank's best interest to avoid greenwashing. Greenwashing can become a compliance and reputational risk for the overall business. At Zürcher Kantonalbank, we counteract this with transparent investment processes and continuous sustainability reporting.

What must the industry do?

Fabio Pellizzari: Standards will help to identify the bad apples. I would be glad if the financial sector could do this by means of self-regulation. In terms of investors, financial education should include the most important sustainable concepts such as exclusion criteria, investment stewardship and the use of ESG criteria. With transparency, standards and education against greenwashing (zkb.ch) l Finally, as with any form of communication, there are transmitters and receivers. Communication is successful when it is possible to avoid misunderstandings on both sides and minimise disturbing background noise. In the case of the latter, I explicitly appeal to the press, which is currently using the term greenwashing in an almost inflationary way.

The issue of sustainable investment is so central because political, social and economic interests should go hand in hand to meet the challenge of climate change. Isn't that why the interest is so great?

Fabio Pellizzari: 11% of the assets of Swiss public funds are currently invested sustainably. It would be interesting to talk about the 89% that are not invested sustainably.

Four key messages to avoid greenwashing

- Greenwashing is a significant risk for financial providers. Its avoidance is in the bank's best interest.

- The origins of greenwashing accusations are manifold. We see different preconceptions, false expectations, a lack of financial knowledge and a lack of standards.

- Crucial to preventing greenwashing is the conviction of top management with appropriate governance and professionalism at the point of sale.

- In addition to the financial industry, the media, politicians and investors themselves are also called on to face this challenge.