Developments in the East

Just as the coronavirus pandemic appears to be coming to an end, a war is unsettling the financial markets. Russia launched a large-scale invasion into Ukraine on 24 February with the aim of «demilitarisation». If the attacks remain predominantly on military facilities and civilian deaths are kept within limits, there is unlikely to be any intervention by NATO troops. Nevertheless, this attack is without question a humanitarian disaster and could profoundly change the political landscape. The financial markets reacted much in the way that could be expected. Equities and corporate bonds lost value, while commodities, gold and government bonds benefited.

Text: Stefano Zoffoli

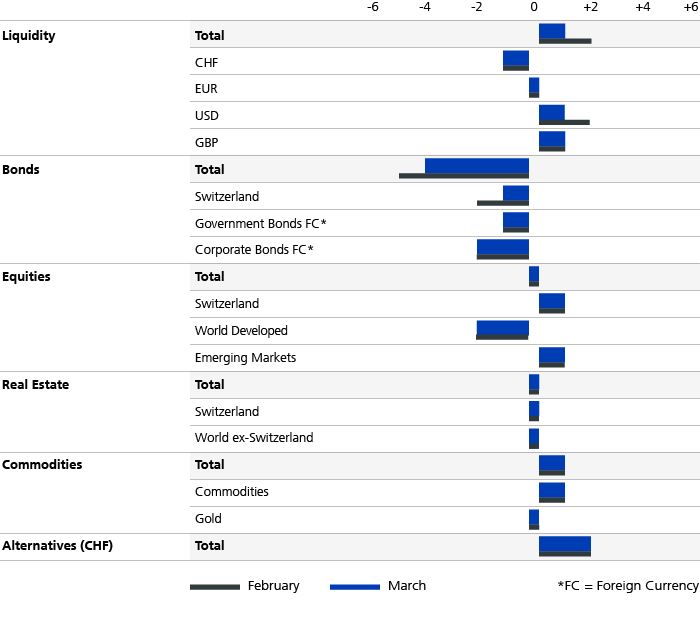

The extent of the correction in equity prices so far corresponds rather exactly to a classic geopolitical crisis, whereby losses in the past were quickly made up again. In addition, Russia and the Ukraine together account for only around 3 percent of global gross domestic product (GDP). However, with this crisis, we are ignoring the market proverb «to buy on the sound of cannons» as this war comes at an extraordinarily bad time for the global economy. Inflation concerns are on the rise again due to climbing energy prices, putting central banks in an even more difficult position. Accordingly, the US interest rate curve is no longer far from inversion, which often anticipates an impending downturn – and this is even before the first interest rate hike. At present, the robust economy is still able to cope with the effect of very high commodity prices on inflation and consumers. All in all, we therefore remain rather cautious. We are keeping the overweight in commodities, remaining neutrally positioned in equities (and moving back to North America) and buying some more Swiss franc bonds. These steps are intended to limit the possible further consequences of the Ukraine crisis.

- US tech stocks have lost around 20 percent since the beginning of the year due to rising interest rates and are therefore in a bear market

- However, the Nasdaq is now oversold and is likely to suffer less heavily from the Ukraine conflict

- As the valuation has now also been reduced to a reasonable price-to-earnings ratio of 23, thanks to the high reported earnings, we are reducing our underweight in US tech stocks

- The Canadian stock market is hovering at the top with a loss for the year of less than 5 percent (vs. -13% for the MSCI World)

- The market is namely benefiting from high commodity prices and rising interest rates thanks to the heavy weighting of energy companies, banks and mine operators

- As the fundamentals are also right, we are doubling our overweight to 2 percent

- Despite the rise of 10-year Swiss yields into positive territory, CHF bonds remain fundamentally unattractive. The strong reduction of CHF bonds during the last few years has led to widespread under-positioning.

- Demand for this classic safe haven will now pick up again due to the ongoing geopolitical uncertainties.

- We are therefore reducing our underweight to 1% and are thus somewhat more defensively positioned.

Asset Allocation Special Mandates March 2022