Litmus test for factor premiums

Systematic multi-factor strategies have proven them-selves again after a long dry spell. Thanks in part to the recovery in value stocks, they once again deliv-ered the performance expected of them. The most recent market upheavals are now calling for the next litmus test.

What loomed towards the end of the last calendar year has now happened. The factors value, quality and momentum developed positively in 2021 without exception. Momentum gained the most in a continuously rising market (MSCI World TR Net +25.6% in CHF). The much-criticised value factor started its comeback and left quality stocks behind; at the same time, both factors were able to beat the broad market. Therefore, it is not surprising that our global multi-factor approach has delivered the best annual result since 2013.

And how did the three factors start 2022?

Value favoured by investors

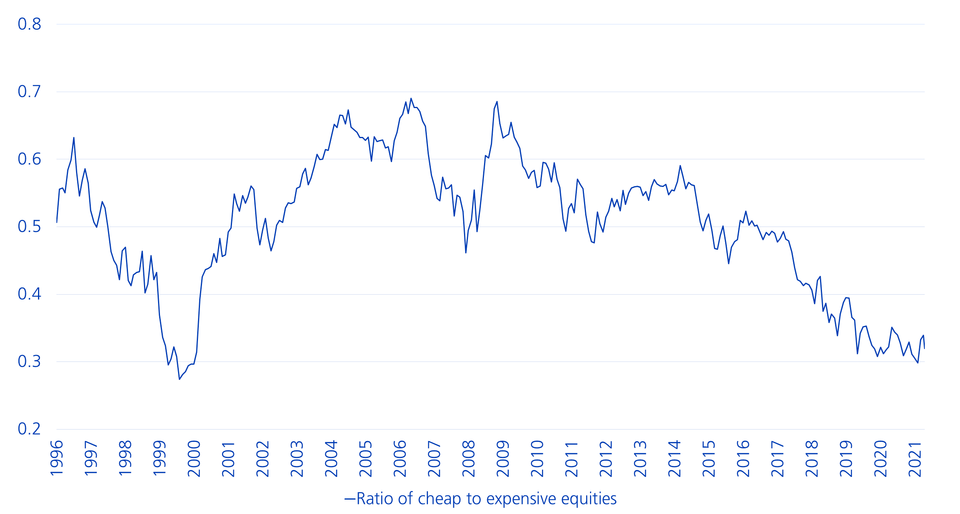

Although we are only a few months into the current year, it has already brought several eventful weeks. For example, the US Federal Reserve caused a stir at the beginning of the year with the announcement that it may wish to dampen the expansive monetary policy in March with the first interest rate hikes. This has meanwhile occurred. Against this backdrop, growth stocks had a particularly difficult time, and the rotation towards value once again picked up significantly. With the outbreak of war in Ukraine and the associated rise in the oil price, the plans of the Fed are seen in a critical light. New, short-term liquidity injections and more reluctance to raise key interest rates are viable alternatives to support the economy. The strength of the value factor premium, on the other hand, does not deflect from this. Low-valued securities remain relatively sought-after in this correction phase and confirm the trend reversal that began last year. This may be due, among other things, to the unchanged expectations of a long-term normalisation of the global economy. Experience has shown that value pearls shine more brightly in the face of a more restrictive monetary and fiscal policy. What's more, the race for the value premium to catch up is far from over, as the following chart shows.

Outlook for value stocks remains attractive

The chart visualises the value premium as the ratio between cheap and expensive stocks over time. The lower this figure is, the more value stocks are neglected and the greater their potential is compared to high-priced stocks. At present, the line has only just moved away from its lowest level, which means that the outlook for value remains encouraging.

Momentum: stabilisation after correction

The momentum factor has so far been the weakest in the current year. In January, in particular, the factor lagged behind the market. The sharp correction on the global stock markets certainly did not help here and contributed to the below-average performance. Recently, however, the factor has stabilised again.

Quality in balance

Quality stocks have moved roughly in line with the market since the beginning of the year. Investors who detached themselves from overpriced quality likely balanced out those who paid more attention to quality criteria in an increasingly volatile environment. Surprisingly, the Russian invasion of Ukraine has not resulted in any notable rise in the quality factor premium so far. Uncertainty surrounding the consequences for the global economy persists as the conflict becomes increasingly severe and continues to drive up inflation rates. In such an environment, more trust is generally placed in quality stocks.

Outlook

Economic forecasts do not just appear from nowhere. However, they are particularly challenging at present. It is difficult to estimate how long the military conflict in Eastern Europe will continue and how consistently the central banks will take countermeasures against rising inflation. In this environment, a long-term perspective is necessary. Systematic multi-factor approaches with proven return premiums such as value, quality and momentum help with this. They are proving to be extremely robust in the current year and, above all, offer the prospect of added value over entire economic cycles.

Legal notice: The publications were prepared by the Buy-Side Research of the Asset Management of Zürcher Kantonalbank. The information contained in this document has not been prepared in accordance with any legislation promoting the independence of financial research, nor is it subject to any prohibition on trading following the dissemination of financial research.