Is the wage-price spiral about to appear?

As a result of higher commodities prices and supply chain problems as well as a surge in economic demand after the pandemic, prices for consumer goods are rising across the board. Upward pressure on wages is therefore increasing, too. This development has consequences for equities.

Text: Stefano Zoffoli and Rocchino Contangelo

«So I would like to see the system return to wage growth starting with a three.» Australian central bank boss Philip Lowe had already expressed this wish in August 2019. Now wage growth has arrived Down Under and is approaching the targeted 3-percent mark. Wages are also climbing in other regions of the world – in some places moderately and others more steeply. In the USA, the increase is around 6 percent. Is this too high and a risk for inflation? We would say yes if the wage growth were structural. However, we are of the opinion that this is merely a temporary flare-up. That's because:

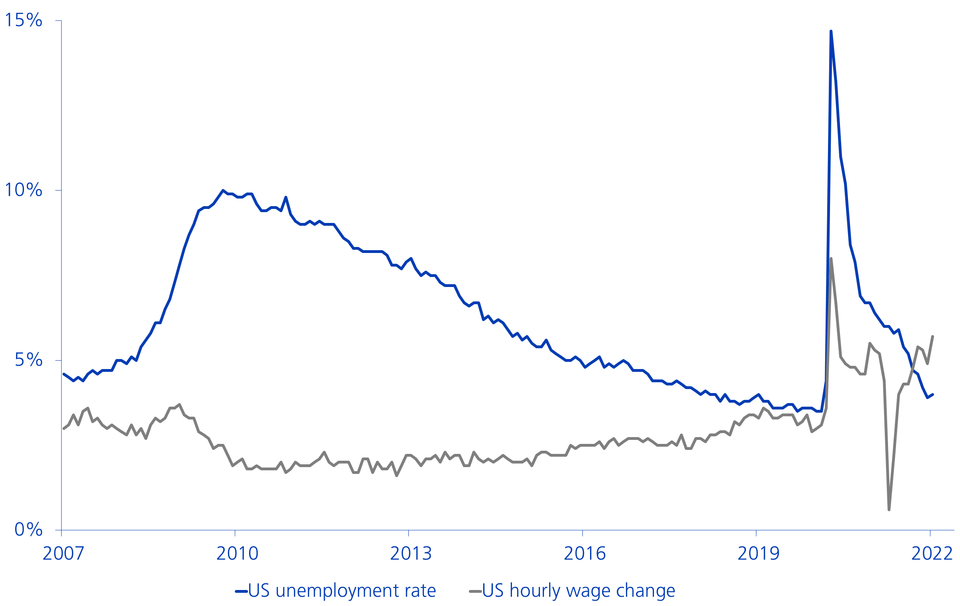

- The increase in wages has so far been particularly pronounced in the USA. The reasons for this are that workers are reluctant to return to the labour market thanks to rising assets (on the stock exchange and in real estate) as well as generous state unemployment benefits. This has also led to the unemployment rate being pushed close to the pre-pandemic low (see the following chart). However, the two factors of «unemployment benefits» and «asset gains» naturally only have a temporary effect. Indeed, we expect more Americans to return to the labour market.

- Trade union bargaining power remains weak despite sporadic increases in minimum wages. Nonetheless, in the long term, the ageing of society will play into the hands of trade unions.

- The economic recovery after the pandemic is unique and will take some time to manage. The increased pent-up demand of consumers currently faces scarcities in production capacities in terms of personnel and raw materials. Demand cannot be completely satisfied in these circumstances.

Development of the unemployment rate and the hourly wage in the USA

Implications of rising wages

In our view, the temporary increase in wages implies two macro effects. On the one hand, consumption increases when incomes rise. This is fundamentally positive for equities from the consumer sector. On the other hand, the production costs of companies are rising. The pressure on profit margins will increase if, at the same time, sales prices cannot be raised or cannot be raised sufficiently. This, in turn, is bad for listed companies with weak pricing power.

So, no effect overall? This depends on the course of events and dynamics. A familiar reflex from the 1970-80s is the dreaded wage-price spiral, as shown in the modified Phillips curve, but this is statistically difficult to prove. In particular, causality is relevant. Rising prices drive wages more than the reverse. At present, however, the increase in prices is significantly higher than the increase in wages (i.e. no increase in real disposable income). We expect inflation to return to 3 per cent by the end of the year and wage growth will subsequently cool.

Focus on pricing power

Based on the assumptions already described and the premise that the Ukraine conflict will not lead to greater problems in global supply chains and that the situation on the commodity markets will normalise, companies with solid business models and pricing power will generally assert themselves.

Companies that fulfil both criteria will be able to pass on inflationary tendencies directly to the customer. On the other hand, they will be able to compensate for higher wage pressure without having to accept major losses in margins.

A comprehensive US analysis by the broker Bernstein shows that equities in companies with strong pricing power achieve an annualised excess return on the financial market of 2.2 per cent in an inflationary environment. In contrast, the annualised return on equities of companies without pricing power is -2.6 per cent.

Analysis of annualised returns on US equities from 1954 to 2021

The following table contains examples of various equities of companies with strong pricing power.

A selection of global stocks with pricing power

LVMH Moet Hennessy |

Infineon |

Merck |

Roche |

Reckitt Benckiser |

US Bancorp |

L'Oreal |

Swisscom |

Marsh & McLennan |

SAP |

Unitedhealth |

Bank of New York Mellon |

Equinor |

Abbott |

Dollar General |

Siemens Healthineers |

Pepsico |

Microsoft |

Richemont |

Costco |

|

A range of industries are sending out warning signals

Companies have sent out warning signals to the markets in various ways. For example, General Electric (GE) recently communicated that supply bottlenecks are continuing to be problematic and wages are continuing to rise, creating margin pressure. Restaurant operators, as well as labour-intensive sectors such as logistics and transport, have also warned of rising wage costs. Traditionally, in this environment with rising commodity prices and higher wages, food retail also comes under pressure in countries with strong competition. This includes the United Kingdom, for example.

The publications were prepared by the Buy-Side Research department of Zürcher Kantonalbank's Asset Management and not by the «Financial Analysis» department in the meaning of the «Directives on the Independence of Financial Research» issued by the Swiss Bankers Association. The publications are therefore not subject to these guidelines.