How the real estate of the pension fund is becoming climate-neutral

Zürcher Kantonalbank's pension fund has been committed to sustainability for over 15 years. It not only engages in sustainable investments, it also prepares its existing properties for the future. How the 73 residential and commercial properties are to become climate-neutral by 2050 is clearly regulated.

Melanie Gerteis

Real estate is responsible for around one third of CO2 emissions in Switzerland. Greenhouse gas savings can therefore make a difference. Existing properties hold great potential – especially those in need of renovation. But there are also ways to optimise new buildings.

The path towards net zero

In order to make the properties of Zürcher Kantonalbank's pension fund climate-neutral by 2050, Zürcher Kantonalbank's Asset Management, which is responsible for the administration of the pension fund properties, has analysed the individual properties in the portfolio and defined corresponding reduction measures. The focus was on reliable data on energy consumption and the respective emissions of the properties. Based on this, targeted measures were taken to reduce greenhouse gas emissions.

"The consistent tracking of energy performance indicators and the continuous monitoring of CO2 emissions are very important," says Marcel Konrad, Portfolio Manager Real Estate in Asset Management at Zürcher Kantonalbank. For this reason, energy and CO2 monitoring has been set up for the properties. For each property, the area, energy and consumption data – including heating energy, electricity, greenhouse gas emissions and water – are systematically measured and recorded in an energy management system. An independent third party validates the data.

The CO2 emissions of the pension fund properties amount to around 3,500 tonnes or 19.4 CO2e/m² of energy reference area. This corresponds approximately to the average annual greenhouse gas emissions of 1,500 European cars.

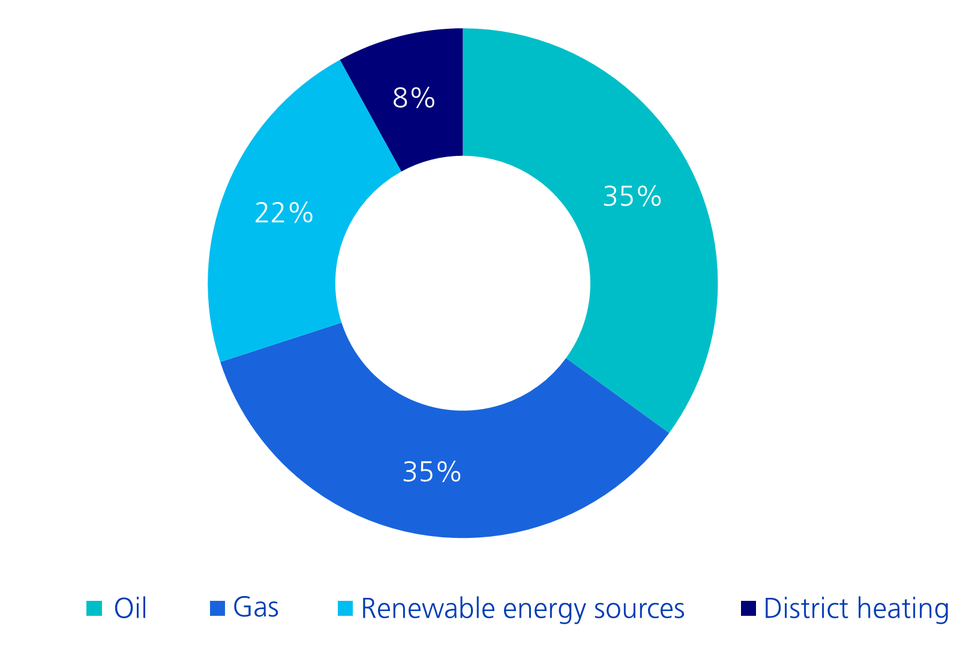

The share of renewable energies in the energy source mix has doubled in the past ten years – from originally 11 percent in 2011 to 22 percent in 2021. "In heat generation, we have consistently switched fossil fuels such as oil and gas to environmentally friendly technologies or renewable energy sources such as pellet heating, heat pumps or district heating," explains Marcel Konrad. The proportion of heating oil in real estate was correspondingly reduced from 52 percent in 2011 to 35 percent in 2021. "In the case of upcoming renovations, we are looking at the installation of photovoltaic systems in each case," says Marcel Konrad, as the conversion to renewable and more CO2-efficient energy sources is being consistently advanced.

Energy source mix as at the end of 2021

Reduction path as a control tool

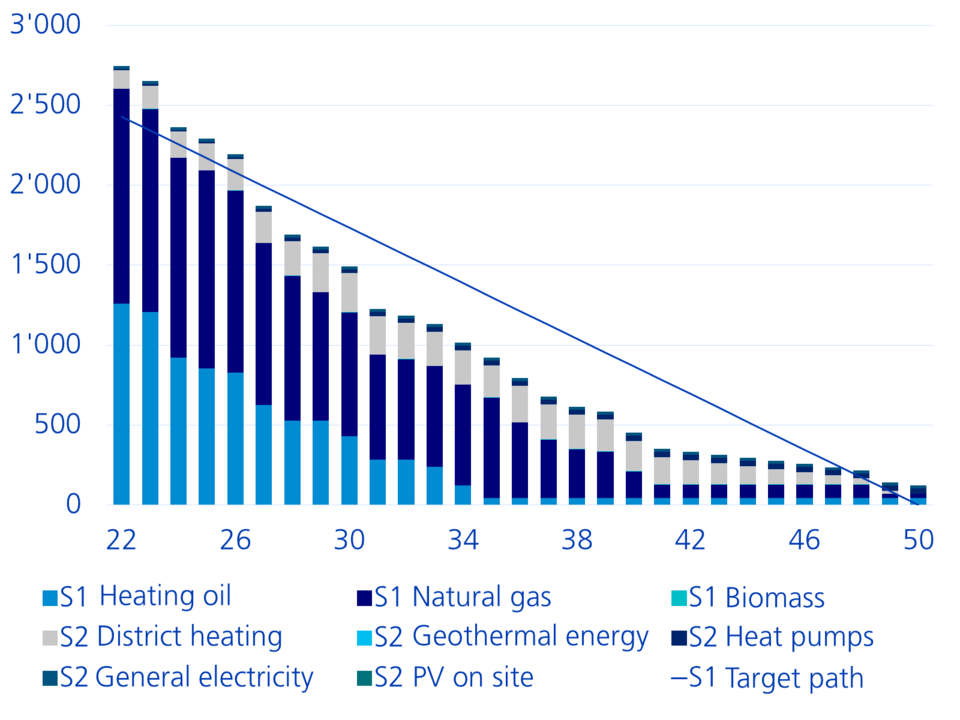

The properties of the pension fund are set to become climate-neutral by 2050. This net-zero target concerns the direct (Scope 1) and indirect (Scope 2) emissions of real estate operations. The CO2 reduction path developed for this purpose works as follows:

- All existing properties are assessed according to economic and ecological criteria. The specific characteristics of the property and its lifecycle are included in the analysis, and the optimal energy source of each property, the solar power potential and the renovation cycle are assessed, among other aspects. Property-specific repair measures are derived from this.

- The individual measures are aggregated to the property portfolio and optimised in terms of time, with the aim of staggering the activities both financially and in terms of personnel as effectively as possible. This makes it possible, for example, to take into account any future technological advances in the existing planning.

Return aspects remain key

Zürcher Kantonalbank's pension fund has set itself ambitious targets with the CO2 reduction path. As the following chart shows, the Scope 1 and Scope 2 emissions from real estate operations should be significantly below the defined target path from 2027 already. The additional investments required to achieve this by 2050 amount to an average of around CHF 0.5 million per year. This is equivalent to 1.4 percent of the current annual rental income.

Control through this reduction path enables timely compliance with the Paris Agreement. "Our main responsibility is to generate an attractive return for our insured members," notes Reto Portmann, Managing Director of Zürcher Kantonalbank’s pension fund. That's because the ecological objectives are to be aligned with the return expectations of active insured members and pensioners – and could be optimally safeguarded with the new reduction path.

CO2e reduction path for Scope 1 and 2 greenhouse gas emissions from the operation of the real estate of the Zürcher Kantonalbank pension fund

Direct Swiss real estate investments of the pension fund

Zürcher Kantonalbank's pension fund owns 73 properties in Switzerland with a market value of just over one billion Swiss francs. Almost 80 percent of the properties are located in the canton of Zurich, and more than 80 percent of the portfolio income comes from rental income of the residential usage type.

The real estate portfolio is managed by Zürcher Kantonalbank's Asset Management in a mandate relationship. Swiss real estate investments achieved a performance of 8.5 percent in 2021. They are also expected to generate a solid return in 2022. The rental default rate was very low at 2.3 percent in the first 11 months of 2022.