Green hydrogen: a beacon of hope on the path to net zero

Industrialised countries intend to massively increase the use of green hydrogen as an energy source – including the EU and Switzerland. This requires a considerable expansion of electrolysis capacities. As a result, the demand for green electricity and/or hydrogen imports will increase immensely. Are these ambitious plans feasible?

Text: Dr Gerhard Wagner

A lot of research has been carried out on the economically efficient use of hydrogen for decades. However, hydrogen has not been able to assert itself as an energy source to this day. The urgent need for decarbonisation has led to a re-evaluation of hydrogen as an energy source and the production processes required for this.

EU: Expansion is a challenge

The European Union aims to raise the production and importation of green hydrogen to 10 million tonnes per year by 2030. Producing this quantity requires electrolysis capacities in the EU to be expanded from the current 0.2 gigawatts (GW) per year to between 65 and 80 GW. This will take around 500 terrawatt hours of electricity. Is this feasible? According to the International Energy Agency (IEA), around 1,100 terrawatt hours of electricity were produced with renewable energies throughout the EU in 2021. Renewable energies therefore need to be massively expanded for hydrogen production. Subsidies are intended to help with this

EUR 300 billion in the REPowerEU Plan

In the EU, the ambitious targets are to be promoted by the REPowerEU Plan. The plan was presented on 18 May 2022 – as the EU's response to the Russian invasion of Ukraine. The REPowerEU Plan envisages an investment volume of EUR 300 billion and consists largely of uncalled coronavirus loans. These are now being repurposed to support the "net-zero industry" (wind power, solar cells, heat pumps, batteries, electric cars and hydrogen). The aim of the REPowerEU Plan is to safeguard the EU's energy supply in three dimensions in the long term:

1. Cutting energy consumption

2. Producing clean energy

3. Diversifying the European energy supply

Hydrogen has a key role to play here, diversifying energy supply and decreasing dependence on fossil fuels, especially natural gas imports.

Reliance on imports

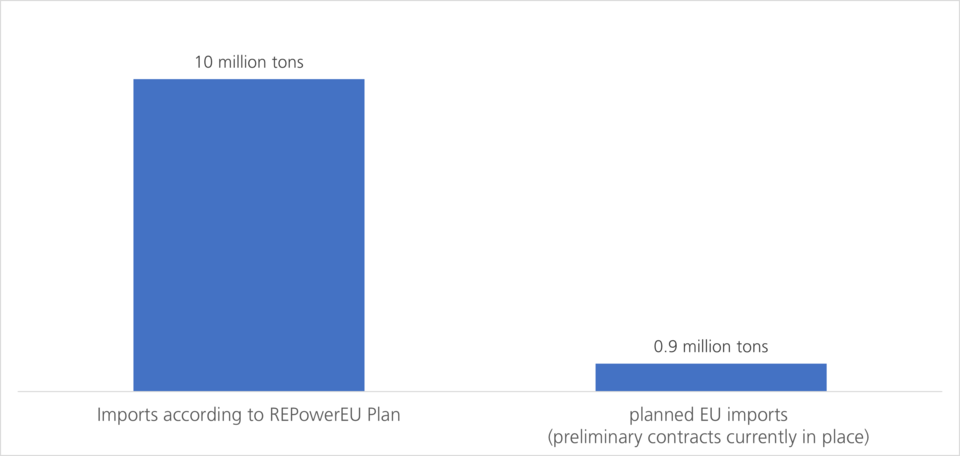

The EU wants to import a total of 10 million tonnes of hydrogen by 2030. All countries that can generate large quantities of renewable electricity on the one hand and have water on the other could be of relevance here, as hydrogen is produced by electrolysis using electricity and water. Discussions are underway with countries such as Mauritania, Angola, Namibia, Chile, Iceland and Norway – some of which are very advanced – regarding a long-term cooperation for hydrogen. The first framework agreements have already been concluded IEA (2022), Global Hydrogen Review 2022, Licence: CC BY 4.0. However, less than 1 million tonnes of H2 imports from these countries are planned so far. It remains to be seen whether there will be enough countries that will produce enough hydrogen by 2030 and also want to export it to the EU.

EU hydrogen imports - strategic target versus current preliminary contracts (figures in million tons)

Competition between the US and the EU

A subsidy race has begun between the US and Europe in the fight for domination over the resources required for the energy transition: with the Inflation Reduction Act (IRA) and the REPowerEU Plan respectively. For stakeholders in the hydrogen economy, the following question will remain central in the coming years: Will the EU raise subsidies if it realises that the expansion of the hydrogen economy is lagging behind ambitious expectations? Brussels' willingness to do even more for the energy transition was reflected in the EU's response to the US Inflation Reduction Act (IRA). The EU aid rules are to be relaxed in such a way that the 27 governments can now pay green funds to companies also in the form of tax breaks. However, from today's perspective, it is highly uncertain whether the EU will be able to import 10 million tonnes of hydrogen per year from 2030.

Switzerland's Hydrogen Roadmap

The Federal Ministry of Energy is in the process of developing a "Hydrogen Roadmap" (availabe in DE, FR, IT). The plans are expected to be announced in the spring of 2023. The roadmap is intended to provide investors and public institutions with a reliable framework. There is agreement that hydrogen must be an indispensable element of the Swiss net-zero strategy for 2050. Former Federal Councillor Simonetta Sommaruga made an appeal to achieve progress in this area. The discussion includes, among other things, investment contributions, tax relief and the simplification of spatial planning requirements. Examples of Swiss companies that are already on the starting line when it comes to hydrogen: Axpo, H2Energy, Hydrospider, ebs Wasserstoff AG, AVIA/Schätzle.

Investing in hydrogen stocks

Investing in hydrogen stocks has attracted investors worldwide for years. Accordingly, issuers have launched a variety of hydrogen indices, hydrogen ETFs and hydrogen certificates. Their performance is currently sobering. Hydrogen stocks experienced a veritable hype between 2019/2020 and the beginning of 2021 – since then, prices have been continuously moving south, accompanied by considerable volatility. The reason for this is that hydrogen technology will not earn any money for years to come. The fountain of subsidies on this side of the Atlantic and beyond has not changed this. Conclusion: The energy transition and the path to net zero will be an economic feat that will reveal winners and losers – including in the special theme of hydrogen. The theme is therefore only suitable for very risk-conscious investors with careful research on individual companies.

Hydrogen: green, blue, grey or pink

Hydrogen and its "colour" depending by kind of production:

- Grey hydrogen: hydrogen is obtained from water vapour and carbon-containing energy sources (usually natural gas). The resulting CO2 escapes into the atmosphere.

- Blue hydrogen: the same procedure as for grey hydrogen, however, the CO2 is captured and stored via carbon capture.

- Green hydrogen: water is split into hydrogen (H2) and oxygen (O) using electrolysis and renewable electricity. The amount of CO2 emissions is virtually zero.

- Pink hydrogen: like green hydrogen, but with the additional use of nuclear power.