CHF Bonds: Back on Stage

Bonds were avoided for a long time due to the low interest rate environment. Following the price losses since the beginning of the year, bonds are now being re-assessed. Fixed-income investments have become significantly more attractive and are "back on stage".

Record-high inflation rates are forcing central banks to raise interest rates dramatically. This has led to a sharp rise in yields. Inflation – triggered by the consequences of the coronavirus pandemic and the Russian invasion – has brought the phenomenon of negatively yielding bonds to a halt within a very short time. (negative interest rates – threatened with extinction (zkb.ch))

Switzerland is also struggling with a rise in inflation

In June, inflation reached its highest level in three decades at 3.4%. Inflationary pressure is therefore still significantly lower than in neighbouring countries, but this did not prevent the Swiss National Bank (SNB) from raising the key interest rate in June by half a percentage point from -0.75% to -0.25%. It has also promised further interest rate hikes if inflation continues to exceed 2%.

Government and corporate bonds are affected

The current market turbulence has not only led to an increase in government bond yields, but has also significantly changed the environment for corporate bonds. The year 2022 will increasingly be characterised by economic uncertainties the longer this continues. This is why creditors are now demanding higher credit premiums, which increases the yields on corporate bonds. In addition, high inflation reduces purchasing power and devalues consumer savings. Consumer sentiment is declining and consumers are holding back on purchases, which in turn is putting pressure on companies' sales and profit expectations.

Changes in yields and credit risk premiums

A corporate bond can be divided into two risk dimensions: interest rate risk and credit risk.

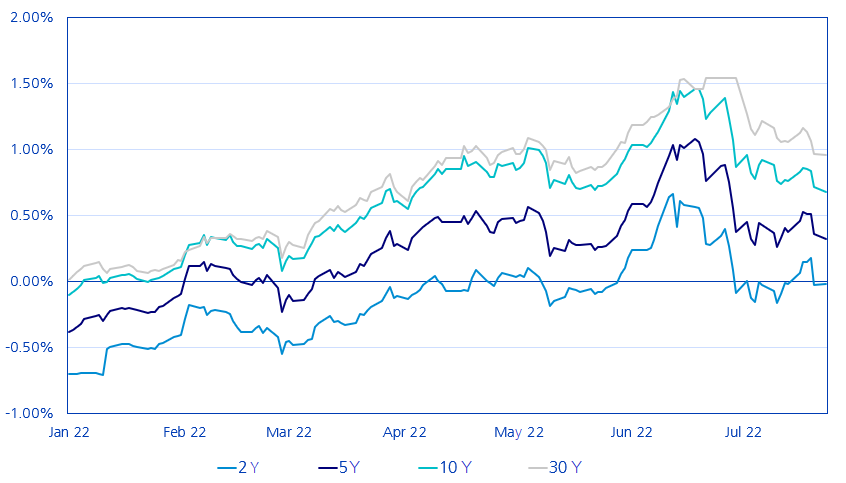

Interest rate risk refers to the dependence of a bond's return on the change in interest rates. Chart 1 shows the development of the yield to maturity (annualised yield achieved by an investor when holding the bond to maturity) for bonds with various remaining maturities. While the yield to maturity of a 10-year Swiss government bond was still -0.11% at the beginning of the year, the value at the end of June was over one percent.

Chart 1: Yield of CHF Bonds with various remaining maturities

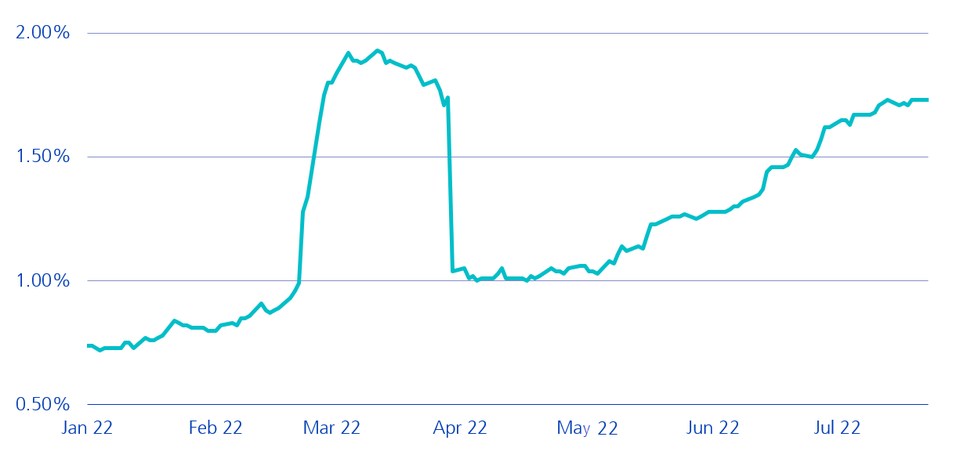

- Credit risk reflects the risk of default by the issuer and is reported as a credit risk premium compared to risk-free government bonds. Chart 2 shows the increased credit risk premiums for CHF corporate bonds with a BBB rating. The sharp increase followed by the sudden drop in premiums in February and March 2022 is attributable to the CHF bonds issued by Russia. As of the end of March 2022, these bonds are no longer represented in the index universe. It can be observed (when excluding the Russian effect) that credit risk premiums of companies have risen continuously since the beginning of the year. In the second quarter of 2022, the increase accelerated.

Chart 2: Credit risk premium of BBB bonds in CHF

12-months yield expectations

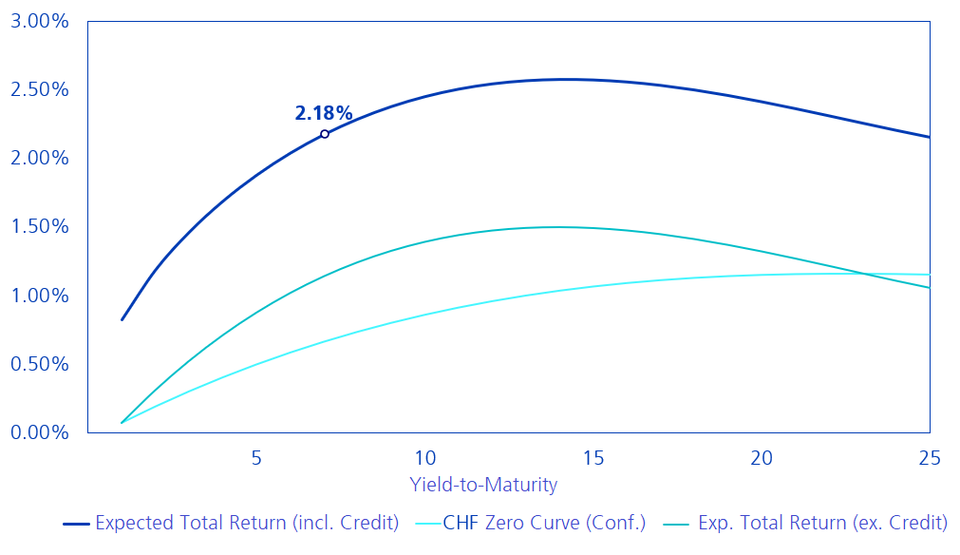

In view of the increased interest rates and higher credit premiums, the yield expectations for CHF bonds have changed significantly. The expected total yield has increased sharply. For the most commonly used Swiss bond benchmark, the Swiss Bond Index AAA-BBB (SBI), the annual expected yield is now 2.18%. As can be seen in Chart 3, the total yield results from the two yield drivers: credit premium and interest income. If you only invested in safe Confederation bonds, the expected annual yield would be around 1% without changes to the yield curve.

Due to the more attractive premium for corporate bonds, the expected yield of the Swiss bond market represented by the Swiss Bond Index is around 2.18% with an average duration of 7.03 years. Only investment-grade bonds are included in the index universe, i.e. issuers with a high credit rating and low probability of default. Moreover, if the bonds are held to maturity, price fluctuations due to rising or falling interest rates are irrelevant. This stability is often missing with other assets.

Chart 3: Expected CHF bond yields of various maturities

Positive returns with a buffer

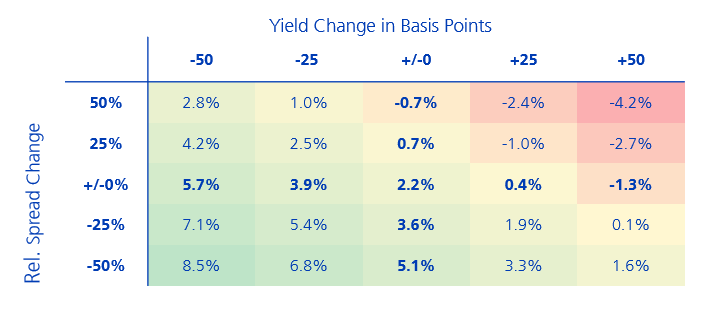

The income for the next 12 months depends on the expected movements of the interest rate and credit curve. Rising interest rates and credit spreads would reduce income. Following the rise in yields in recent months, however, there is now a "buffer" that protects against further interest rate hikes and further rising credit premiums (see table). What the table shows is that interest rates could reach 30 bps before the total yield of Swiss bonds becomes negative over the next 12 months.

Credit premiums may rise by 50% before negative total yields can be expected. Such a significant increase would only be expected in connection with a recession. An increase in credit premiums due to a recession would most likely be partially offset by falling interest rates.

Chart 4: Expected return (%) in the event of changes in the yield/credit curve

Active management is important

With active management, interest rate and credit positioning is controlled in a targeted manner.

The rising yield curve is not equally attractive in all maturity ranges. This allows active investment vehicles to take advantage of the steepness of the curve, thereby increasing the return of the actively managed portfolio compared to the average return of the investment universe. Bonds also do not have to be held until maturity, but can be substituted by attractive new issues at any time.

The currently increased credit premium can be extracted in a targeted manner. The default rates of highly creditworthy Swiss and international CHF issuers are likely to remain low, as companies have recovered well since the slump of the pandemic. As an active manager, we remain selective due to rising inflation, economic uncertainties and the war in Ukraine. In an environment characterised by increasing fears of recession, in-depth credit analysis with strict issuer selection is crucial for investment success.