Green Bonds: The key to financing sustainable growth

The growth of green bonds continues. In 2022, 39 new bonds have been issued in the Swiss bond market to date. Currently, 98 green bonds are already included in the Swiss Bond Index AAA-BBB. We provide sustainable investors with clear classification of the universe of sustainable bonds to facilitate their investment decisions.

What are green bonds? What are sustainable bonds? How can I reliably assess a single bond or a fund that operates under the label of sustainable bonds in order to meet my investment needs as a private or institutional investor? Sandro Grimm, Head of the Swiss Franc Fixed Income team, has received numerous awards from rating agencies for the quality and performance of his fund management and, together with Portfolio Manager Christopher Radler, provides information as an expert in the market of sustainable bonds and the Swiss market of green bonds.

The universe of sustainable bonds consists of four main types of bonds

The term "ESG bonds" is now used interchangeably for sustainable bonds. Investors are confronted with four types of sustainable bonds.

- Green bonds

- Social bonds

- Sustainable bonds

- Sustainable-linked bonds

How can these different types of bonds be classified so that an investor can make the right investment decision?

Green bonds

These are traditional bonds that the issuer invests exclusively in projects that protect or reduce the impact on the environment and climate. Examples of such projects are climate neutrality, electromobility, investments in energy-efficient technologies as well as circular economy projects. The structure and risk profile of a green bond are similar to that of a conventional bond from the same issuer, i.e. the expected return. The biggest issuers are from the public sector. Other major issuers come from the financial sector or the energy supply sector.

Social bonds

Green bonds are not the only way to provide money for sustainable financing. Social bonds finance projects with social purposes. Many of the coronavirus-related measures were financed with social bonds in 2020. Their issue volume multiplied. At the end of 2020, the EU Commission decided to finance its labor market programme SURE (Support to mitigate Unemployment Risks in an Emergency) via social bonds, which has made the EU the largest social bond issuer in the world.

Sustainable bonds

The proceeds of the bond are used by the issuer for a sustainable project, which can consist of a mix of green and social purposes or is characterised by a contribution to the achievement of at least one of the UN Sustainable Development Goals.

Sustainable-linked bonds

In the case of sustainable-linked bonds, the issue proceeds of the issuer are not used specifically for projects, but for general corporate purposes, which serve to track identified sustainable KPIs (key performance indicators) and sustainability performance targets (SPTs). Target achievement must be presented by the issuer at the specified time and be verifiable for investors. Penalties are usually defined in case the targets are not achieved, for example in the form of a coupon increase. The following are used as KPIs, for example:

- The CO2 emissions or a defined path to cut CO2 emissions

- The proportion of recycled waste and an improvement in the recycling rate

- Social factors such as the proportion of women among managers.

In addition, there are now instruments known as transition bonds. These bonds also give the big polluters among companies and institutions access to financing with the sustainability label. The requirement is that they commit to the principles of the International Capital Market Association (ICMA), which are today the most common market standard for green bonds (see below). For institutional investors, this transparency is sufficient and their acceptance of such transition bonds is increasing accordingly. Generally, they are not consistent with the ethical and ecological understanding of private investors today.

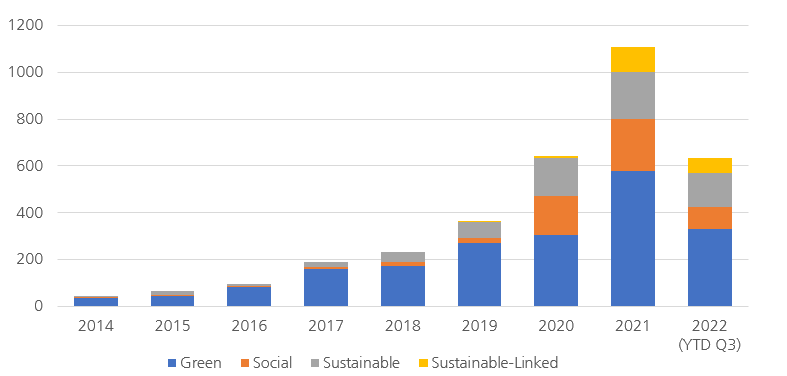

Demand is boosting supply

Globally, the issue of sustainable bonds increased rapidly through to the end of 2021. The chart below shows how strong this increase was. In 2022, issue activity remained subdued due to the difficult situation on the bond markets. A major theme for these green and social issues by companies as well as national and supranational institutions can be seen in the Herculian issuance activity of the 21st century: the financing of the international economy towards dealing with climate change. The coronavirus pandemic also provided significant impetus for the financing of projects in the form of social bonds. The total amount of outstanding bonds worldwide with the sustainability label is published as part of the market statistics of the Climate Bonds Initiative. At the end of Q3 2022, this totalled up to around USD 2 trilllion. That sounds like a large amount. However, the sustainable share of the total global outstanding bond volume is only around 3% – but the trend is rising sharply from a low level. Green bonds are considered catalysts for the global economy's shift to lower carbon consumption. Companies and states that miss this transformation will become economic losers in the medium term. Financing sustainable growth, on the other hand, promises yields that are roughly in line with the market. On average, green bonds pay a slightly lower yield. This is referred to as the greenium.

Global issue volume of sustainable bonds in US-Dollar

In fact, there is still no legally binding definition or regulation of what green, social or sustainable bonds are. However, some principles and guidelines have been established and are used by issuers and investors as frameworks. The greatest reach is enjoyed by the Green Bond Principles (GBPs) of the International Capital Market Association (ICMA). They are considered the international market standard. The Swiss Federal Government was also guided by the ICMA standard when developing its framework for green Swiss government bonds. In addition to the ICMA, the EU is primarily seeking to establish its own EU Green Bond Standard (EU GBS), which is intended to adapt the use of proceeds from a bond issue to the provisions of the EU taxonomy. The EU wants to prevent companies from using the green bond label in highly polluted sectors without pursuing a credible path towards the climate goals of the coming decades.

How do I invest in sustainable bonds as an investor?

Investors want transparency. They want to know whether the issuer’s environmental strategy is credible and can be verified. Apart from sustainability, returns remain the most important investment motive. Who can reliably help responsible, ambitious investors in answering these questions?

Our answer to this question

Today, besides our own expertise based on research and personal contacts, we always obtain an independent second opinion from international agencies such as Sustainalytics, ISS or Vigeo Eiris. We do not buy a bond for our bond portfolios that is not "certified" by such a second-party opinion. Can investors feel confident that they are not exposed to greenwashing? We see potential for improvement. Here's an example: In Europe, according to the standard recommendation, 95% of the green bond volume of an issue must flow into sustainable projects. It remains to be seen how strictly this demanding recommendation is actually implemented.

Green bonds on the Swiss bond market

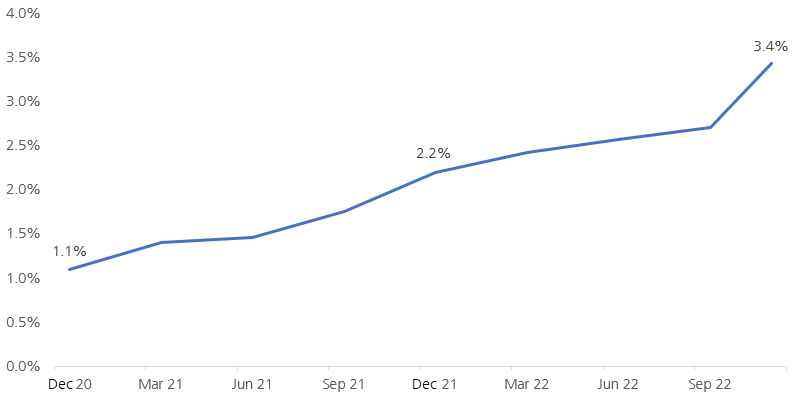

Sandro Grimm and Christopher Radler provide information on the Swiss green bond market on a regular basis. At the end of 2022, the share of green bonds in the Swiss Bond Index is currently 3.4%, compared to 2.0% 12 months ago. In absolute terms, this share still appears modest – but it is clearly trending upwards. More and more issuers are seeking to present themselves on the market with green bonds and are meeting with a demand that is willing to consistently accept a credible, sustainable supply of these bonds.

Share of green bonds in the Swiss Bond Index AAA-BBB

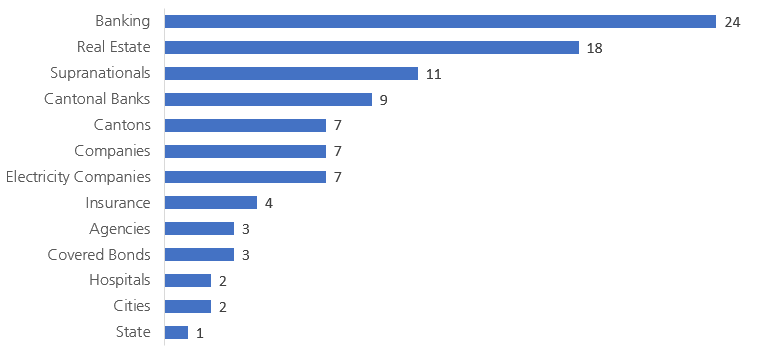

Most borrowers issuing sustainable bonds in Switzerland come from the financial industry – from the banking sector, including cantonal banks and insurance companies. In addition, the real estate sector is increasingly becoming a major issuer of green bonds. Energy-saving renovation projects of existing buildings (replacement of oil heaters, improved thermal insulation, etc.) or solar projects are ideally suited as green assets.

Switzerland: Number of green bonds by sector

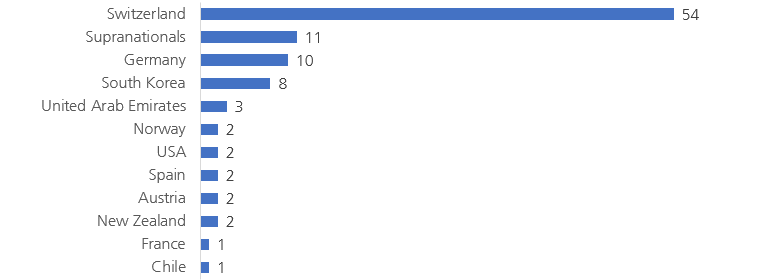

The majority of bonds are launched by Swiss issuers. Development banks (supranationals) also frequently act as issuers of sustainable bonds with their development projects. As a single issuer, the real estate company PSP Swiss Property stands out on the Swiss market with ten outstanding bonds. Other regular issuers are Zürcher Kantonalbank, Berlin Hyp AG and the Canton of Geneva with five bonds each.

Switzerland: Number of green bonds issued by issuer origin

New borrowers in 2022

During the year 2022, 17 new issuers of green bonds were welcomed to the market. The first green bond from the Swiss Confederation with an issue volume of over CHF 1 billion was particularly well received. We expect this bond to be topped up in the coming months as the Swiss Confederation has enough green projects that need financing.

PSP Swiss Property classifies all its outstanding bonds as green bonds

PSP Swiss Property is the second largest listed Swiss real estate company. The company invests exclusively in commercial real estate in Switzerland. The real estate portfolio amounts to more than CHF 9 billion.

On November 8, 2022, PSP Swiss Property announced that all bonds already outstanding will be classified as green bonds. This reclassification comprises 10 bonds with a volume of CHF 1.83 billion. The weighting in the CHF bond universe is 0.3%.

PSP has had two independent external expert opinions – known as second-party opinions – from Moody’s and ISS prepared for this purpose. The projects financed with the bonds are allocated to the areas of "Affordable and clean energy" (UN SDG 7), "Sustainable cities and communities" (UN SDG 11) and "Climate action" (UN SDG 13). The prices of the freshly greened bonds remained constant in the days following the announcement. There were no significant transactions, which can also be attributed in part to the illiquidity of the segment. A greenium – premium or price discount of green bonds compared to the conventional counterpart – could not be observed here.

We anticipate that other borrowers – particularly from the real estate sector – will launch green bond programmes and will also present existing bonds as green. Companies can thereby demonstrate their commitment to combating climate change. Investors will have to rely on the second-party opinion to assess how "green" the use of borrowed funds is for older issues.

2020 - the "Greenium Year"

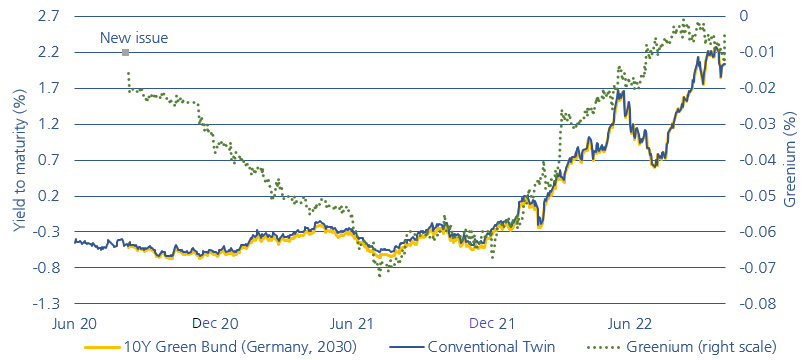

The greenium is the difference in yield between a green bond and a traditional bond with the same maturity. Due to the high demand and the low supply of green bonds, a difference in yields can arise here in spite of the identical default risk. This greenium is variable over time and can be managed and exploited in our active funds.

Germany issued a traditional and green bond for maturity in 2030. The identical term makes it easier to compare the yield difference. The dotted green line shows the greenium. The bond in the summer of 2020 was issued with a greenium of one basis point (bp). This rose to 7 bps by the summer of 2021. Since then, it has moved back towards one basis point. At present, the yield on green bonds is one basis point lower per year compared to traditional bonds.

Greenium based on the example of the German green government bond (2030)

The Swiss Confederation entered the market in October 2022 with its first green bond. Since there is no traditional Swiss Confederation bond with a maturity date of 2038, it is difficult to calculate the greenium in this case. If broker prices are obtained, the green bond in Switzerland – similar to green bonds in other countries – is traded with a greenium of two to three basis points.

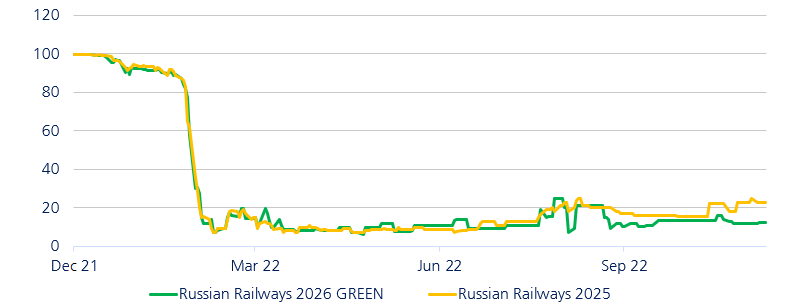

Risky special case: Green Russian bonds

The Russian state railways have always been a regular issuer in the Swiss franc market. The issues are structured as loan participation notes and are issued through Ireland. At the beginning of 2022, the Russian railways had five bonds outstanding in the CHF market, two of which were green, one of which was even a subordinated bond with a perpetual maturity. After Russia's invasion of Ukraine and the Western sanctions, these bonds lost value dramatically. The senior green bond is equivalent to the other bonds in the capital structure and would receive the same payment from settlement as the traditional bonds in the event of default. We have not invested in this senior bond and continue not to invest here.

A Russian issuer also in the CHF market

In our Swisscanto bond funds, we invest in the entire range of sustainable investments (green, social, sustainable and sustainable-linked) only under the condition that there is a sound second-party opinion. Moreover, if an issuer can demonstrate this long-term rating, it or the investment instrument always qualifies for our portfolios only after our comprehensive, fundamental and sustainable investment process has been completed.