Interest rate sensitivity V/V: Bottom-up view of bond investments

In the market, it is often said that bond investments should be avoided in an environment of rising interest rates. But a look behind the scenes shows that attractive risk/return profiles can also be implemented in the event of rising interest rates through the targeted selection of individual investment segments and active management. Part V of our five-part series on the interest rate sensitivity of various asset classes.

Hagen Fuchs , Daniele Paglia

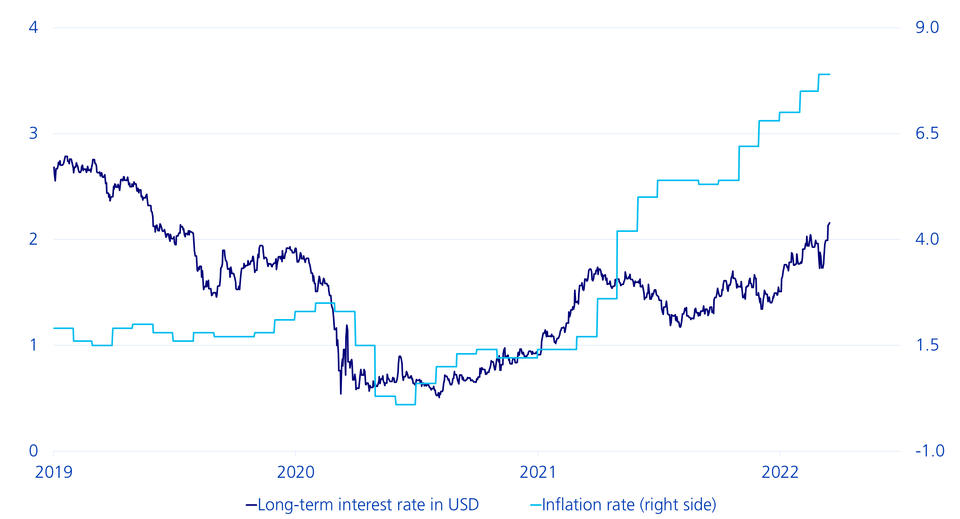

As early as the beginning of 2021, long-term interest rates in the USA reached the pre-pandemic level of around 1.6%. Following volatile sideways movement, the rise has continued recently due to higher inflation rates and the expectation of a more restrictive monetary policy. Market volatility triggered by the invasion of Ukraine was only able to halt the upward trend in the short term. In recent weeks, ten-year US government bonds have hit the 2.2% yield level, reaching a three-year high. However, as shown in the chart below, interest rates remain very low compared to the development of the inflation rate.

Low interest rate compared to the inflation rate

An increase in interest rate sensitivity is the main risk

Due to the decline in interest rates since the 1980s, interest rate sensitivity (duration) in bond benchmarks or in ETF bond funds has increased sharply. One of the main reasons for this is the continuous efforts of bond issuers to fix the respective lower interest rate level by issuing bonds with the longest possible time to maturity over many years.

From the investor's point of view, however, the longer average duration with rising interest rates has a negative impact on performance. An example calculation: Global government bonds currently have an interest rate sensitivity of around 8.3 years. If interest rates increased by one percentage point, this would result in a performance of -7% per year.

Attractive level of credit risk premiums

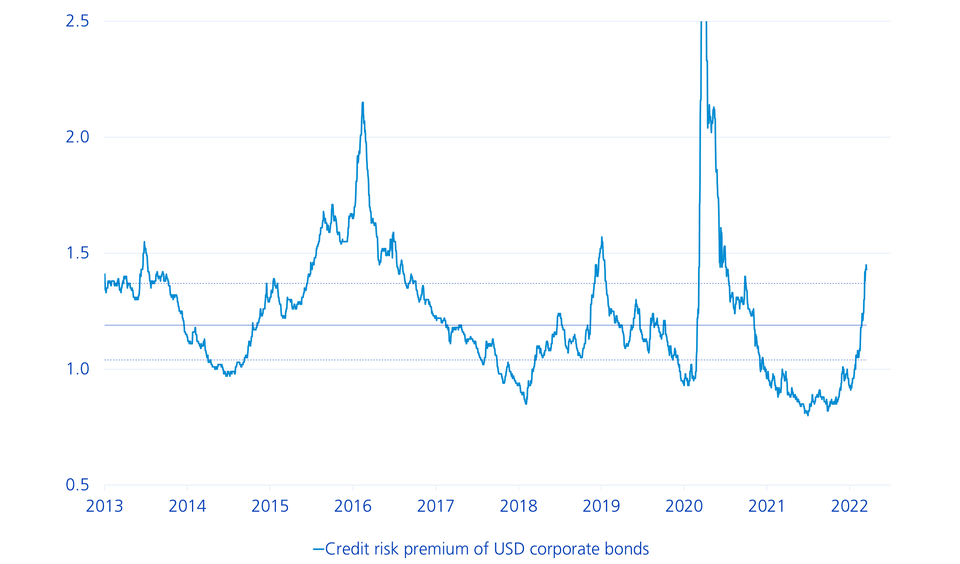

In the blog post published in December 2021 (only in German available), we showed that companies have used the economic recovery since the pandemic-related slump to significantly improve their creditworthiness and heal their corporate balance sheets. Nevertheless, credit risk premiums (spreads) rose to a historically attractive level of 1.43 percentage points during the Russia-Ukraine conflict.

Development of credit risk premiums

Assuming that no global recession will occur in the foreseeable future, the credit risk premium is likely to fall from the current level – with a positive impact on the performance of corporate bond portfolios.

Three scenarios under the microscope

To better estimate which combination of interest rate and credit risks has the most promising risk/return profile in the current environment, Swisscanto Invest has subjected various fixed-income investment segments to a scenario analysis and estimated their expected performance over a year (see the table below).

SCENARIO I (50%) Low growth, high inflation |

SCENARIO II (25%) Interest rates according to futures, spreads unchanged |

SCENARIO III (25%) Less restrictive monetary policy |

WEIGHTED (100%) Weighted |

|

|---|---|---|---|---|

| Global government bonds (W0G1 Index) | -2.8 | 0.7 | -2.6 | -1.9 |

| Global corporate bonds (G0BC Index) | -1.9 | 2.5 | 2.6 | 0.3 |

| Global corporate bonds 1-5 years (GVBC Index) | 0.9 | 2.3 | 3.7 | 1.9 |

- Scenario I: Slowing economic growth accompanied by high inflation rates. In this environment, the US interest rate curve, which is currently flat, would move to a higher, parallel position and credit premiums would rise moderately. Estimated probability of occurrence: 50%.

- Scenario II: Current market expectations according to interest rate futures with a flattening of the interest rate curve with constant spreads. Estimated probability of occurrence: 25%.

- Scenario III: The US Federal Reserve acts somewhat less restrictively than currently priced in by the market and inflation remains elevated. As a result, the interest rate curve would become steeper and the credit risk premiums would fall slightly, particularly for short-term corporate bonds. Estimated probability of occurrence: 25%.

Corporate bond portfolio with low interest rate risk as the sweet spot

If the three scenarios are weighted with their estimated probability of occurrencethe result is a total annual performance of around -1.9% for a global government bond portfolio. A performance of +0.3% is expected for corporate bonds.

Global corporate bonds with a focus on bonds with shorter maturities have the best estimated performance of +1.9%. The main reason for this is the lower duration, which dampens the negative price effect of rising interest rates, but also leads to relatively large repayments over time and these can be reinvested directly at higher interest rates.

Against the background of very good fundamental data, it also makes sense to exploit the currently increased credit risk premium in a targeted manner through active management in order to additionally increase the performance potential.