Our three investment trends for 2023

Zürcher Kantonalbank's Asset Management defined three key assumptions for the coming investment year. Two of them are positive. But there is also a risk factor.

Rapidly rising interest rates in response to record-high inflation, an energy crisis as a result of the war in Ukraine and supply chains that continue to falter – this "toxic cocktail" has contaminated almost all asset classes in 2022.

Calculated in Swiss francs, the MSCI World is listed around 14 percent lower than at the beginning of the year (as at: November 7, 2022). The global bond index (Bloomberg Global-Aggregate Total Return Index, unhedged) has also lost around 14 percent. Listed Swiss real estate funds (SWIIT Index) likewise declined sharply. In this case, the drop is a considerable 18 percent.

"This investment year 2022 may go down as the seventh worst in Switzerland's hundred-year financial market history," says Anja Hochberg, Head of Multi-Asset, in a video interview for this year's Market Outlook 2023.

The dark clouds will not disappear completely in the coming investment year. However: "We see some silver linings on the horizon for 2023," says Hochberg.

Trend 1: Renaissance of the multi-asset portfolio

The turnaround in interest rates further highlights the advantages of the bond component in a multi-asset portfolio yet again. A significantly higher contribution to returns from bonds can be expected than in previous years. The total market return for the Swiss market (Swiss Bond Index) is currently around 2 percent.

During the negative interest rate period, a bond portfolio was not only associated with falling returns, but also with rising interest rate risks, i.e. a higher duration. This has now been reversed. Higher yields on the bond markets go hand in hand with lower interest rate risks.

Trend 2: Mild recession anticipated

Recessions, especially when severe, are toxic to equity markets and other risky investments. We anticipate a recession, but only a mild one. The reasons are as follows:

- The US labor market remains robust.

- Consumer debt is within limits.

- The majority of banks are in a solid position and companies demonstrate robust sustainability in terms of debt levels.

- An exaggerated investment boom, as in the 2000s, or a massive overvaluation of real estate, as in 2008, is not evident.

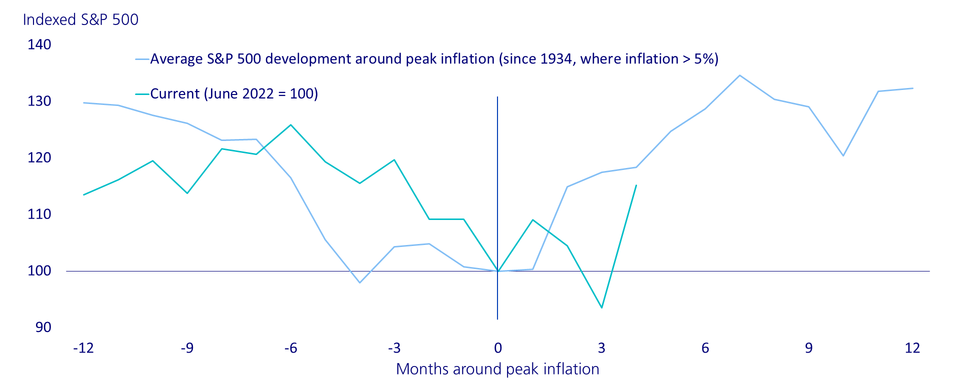

The low point of economic growth is expected to occur around mid-2023. Experience has shown that the equity market is one of the best early indicators of future economic development. Given that inflation has peaked and valuations are still falling slightly, an end to the market downturn and a subsequent recovery in the first quarter of 2023 are to be expected.

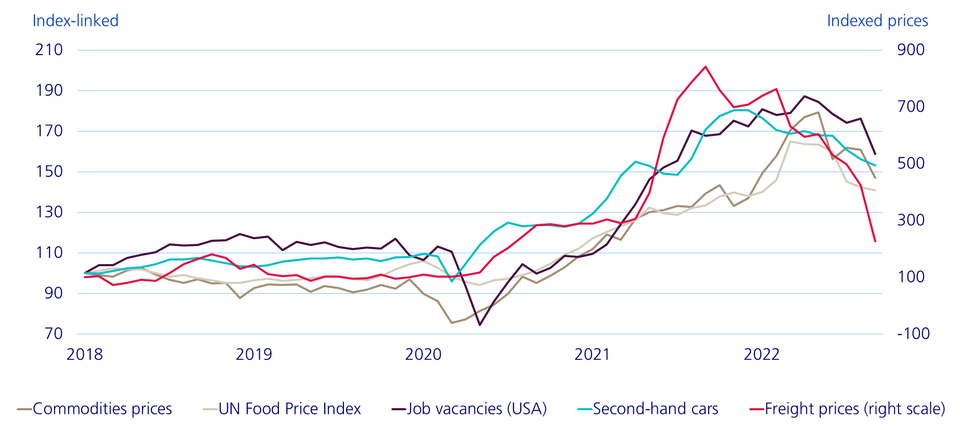

The current trend of inflation supports this cautious optimism. In the USA, the inflation peak has already passed. Price-driving goods such as commodities, food prices, prices for second-hand cars and, in particular, freight prices have all fallen. Even rental prices for US properties have been falling since last October.

Inflation will continue to decline in the coming year, but will remain outside the target range of 2 percent.

When inflation peaks have just been reached, this has always been positive for equities in the past. This is shown by our analysis, which stretches back to 1934 and examined stock market movements during periods with inflation rates of over 5 percent. In the months leading up to the inflation peak, the S&P 500, which comprises the shares of the 500 largest listed US companies, fell by 30 percent in each case. However, once this peak had passed, equities more than made up for the losses in the months thereafter.

Trend 3: Systemic risks

As the length and intensity of the economic cycle increases, it's not only cyclical risks that rise. We also see systemic risks on the rise again. In addition to the ongoing Ukraine crisis, China's geopolitical ambitions are among the greatest threats at present. However, the risks are also increasing in terms of internal politics and harbor the risk of policy errors. Rising unemployment and high inflation are opening the door to populism on the monetary or fiscal side – the UK is one example of this.

But diversification and investing in safe havens can limit portfolio losses if the risks described materialise.

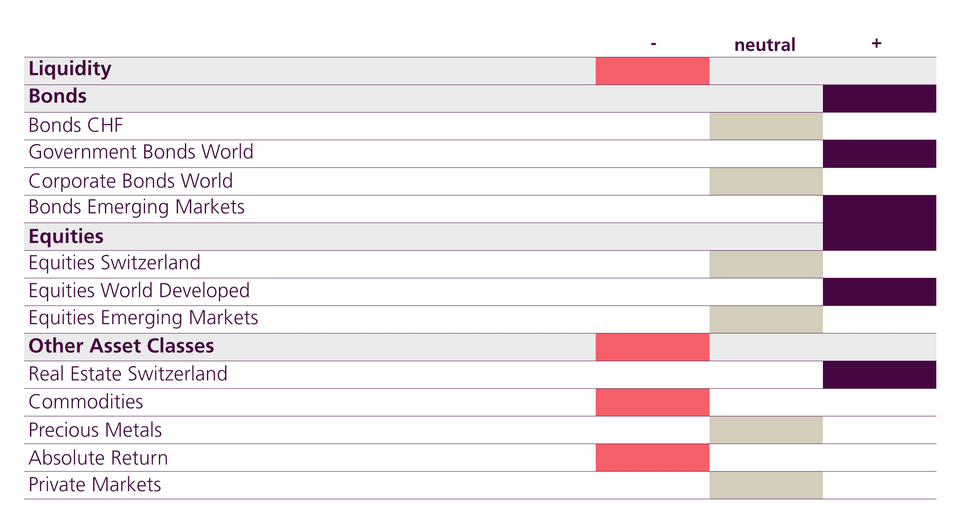

Asset allocation for 2023

Our asset allocation for the coming year consistently reflects our assertion of the return of the multi-asset portfolio. Consequently, we have overweighted bonds and equities at the expense of liquidity. In the case of bonds, we favor global government bonds and bonds from emerging countries. On the equity side, we see opportunities in developed markets in particular. We hold a positive view of Swiss real estate.