Parking money in money market funds is worthwhile again

Money market returns shine in a new light again at last with the turnaround in interest rate policy. This finally gives investors a lucrative alternative to the traditional account.

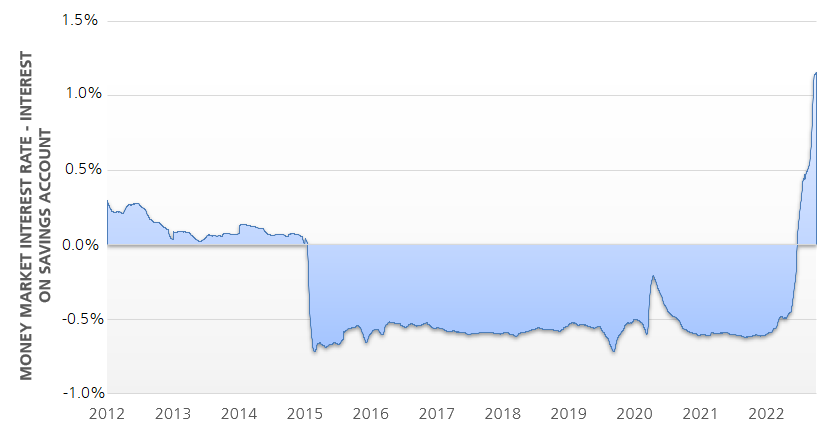

Several central banks raised key interest rates again significantly in September in order to counteract inflation, which has risen to new highs. The Swiss National Bank (SNB) is no exception. It recently raised key interest rates by a whopping 75 basis points to 0.5%. This marked the end of the era of negative interest rates that began in 2015.

With the turnaround in interest rates, the SNB has raised hopes among some investors that they will finally receive interest again when parking money in (savings) accounts. However, reality paints a different picture. Interest on amounts held in accounts remains unchanged at commercial banks in Switzerland at 0%. Depending on the bank, there may be a slightly higher interest rate on savings deposits. Moreover, real interest rates remain significantly negative due to the current high rate of inflation. Nonetheless, there are interesting alternatives for investors. Money market investments currently offer a historically high surplus return compared to the traditional account solution.

The current market turbulence has not only led to an increase in Swiss government bond yields, but has also significantly changed the environment for corporate bonds. Credit spreads rose significantly in some cases with the Ukraine-Russia conflict and most recently due to the increased fears of a global recession. The credit spread measures the surplus return of a bond compared to the risk-free government bonds of the Swiss Confederation. For issuers with a high credit rating and thus a low default risk, this currently offers an attractive credit risk premium, which additionally increases the expected money market return. We highlighted the new attractiveness of bonds in Swiss francs in our blog posts from 28 July 2022 and 11 August 2022.

Money market solutions are also a good alternative for risk-averse investors. Only fixed-income securities with a short remaining term are held. The short duration reduces the sensitivity to interest rate changes, while the high credit quality of the debtors reduces the default risk and at the same time guarantees daily liquidity.

In view of this new attractiveness of money market investments, Zürcher Kantonalbank’s Asset Management is opening a retail class for the Swisscanto (CH) Money Market Fund Responsible Opportunities FT CHF, ISIN CH1220495068 on 14 October. This also offers private investors the opportunity to benefit from the new attractiveness of money market funds.