SAA III: More balanced thanks to robust return forecasts

The traditional starting point in strategic asset allocation (SAA) is a point forecast for the expected return. In our approach, on the other hand, return forecasts are the natural result of the optimal weight and expected risk – and the last part of our current SAA series.

Text: Roger Rüegg

Even financial experts agree: return forecasts are subject to great uncertainty. Traditional strategic asset allocation often starts with this most difficult part, the point forecast for the various asset classes. In our approach, we deliberately take the opposite path.

This leads to more robust return forecasts and a more balanced investment strategy. Our sound return forecasts are the natural result of the risk model (see first article) and the substantiated market opinion (see second article). Economically speaking, our return forecast is the compensation for the risk taken. This derivation also allows us to coordinate the decisions made for the risk model and the market opinion.

Risk model and optimal weighting as inputs

In order for us to derive the expected economic return, we need the risk and the optimal weighting. We estimate the risk for the future with our factor risk model, which comprises nine risk factors.

We start with a neutral portfolio for the optimal weighting. The market-weighted portfolio of the asset classes, also known as the market portfolio, is suitable for this purpose. It represents the portfolio held by an average investor. We adjust this with an average Swiss home bias. Local investors typically hold a higher proportion of Swiss equities and bonds. We apply our underweights and overweights from the substantiated market opinions to this market portfolio with a "Swiss finish" and thereby obtain the optimal portfolio for Swiss investors.

Robust expected returns as the output

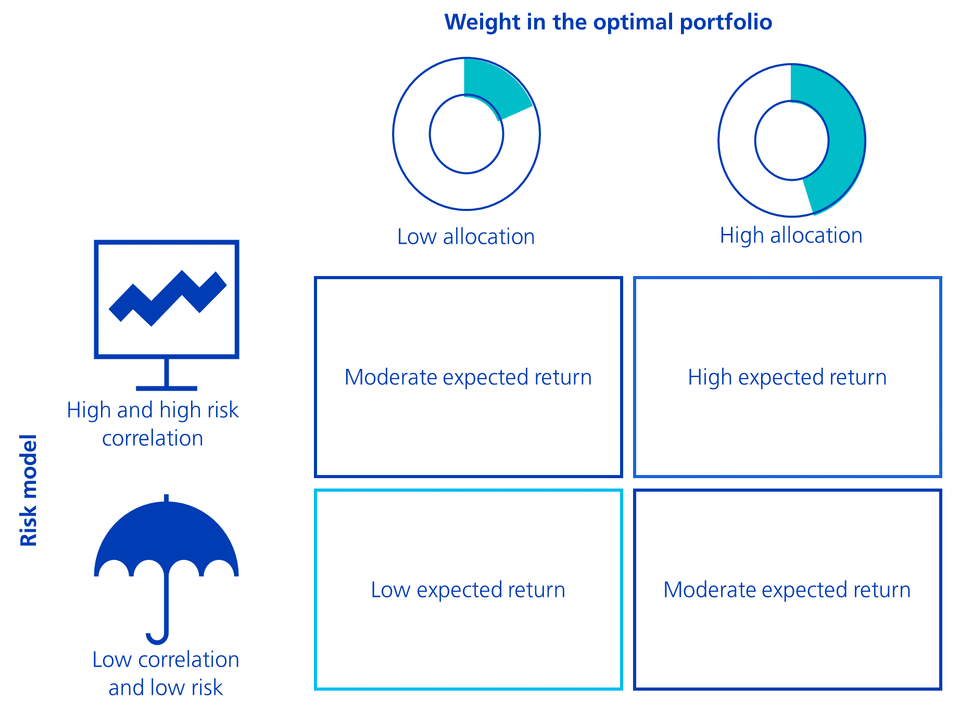

Knowing the risk model and the optimal weighting, we can derive the expected returns per asset class. From an economic standpoint, the expected return of an asset class increases with greater risk and correlation to the market (see figure below). Both factors increase book losses in the event of a correction.

Moreover, as a rule, the higher the share of an asset class in the optimal portfolio, the higher the required return to compensate for the risk. This implicit derivation guarantees consistent compensation for the risk in the portfolio context for the expected return.

Economic derivation of the return forecast

Balanced investment strategy instead of corner solutions

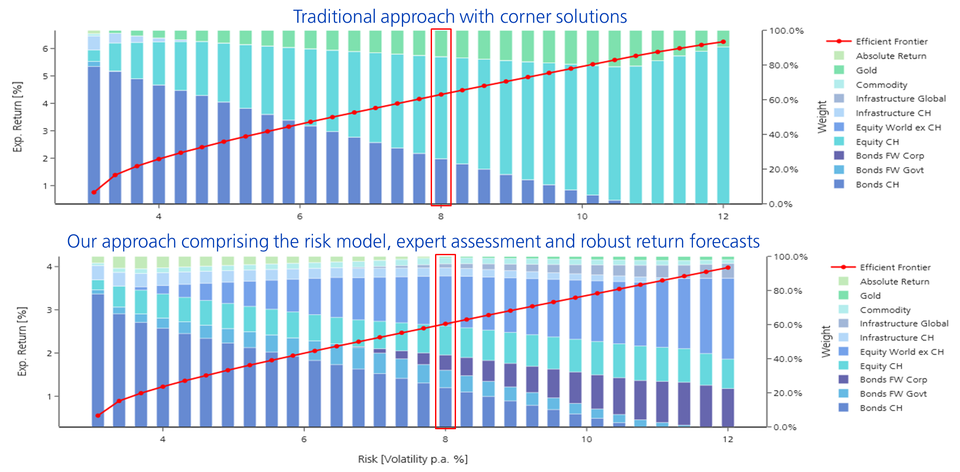

Thanks to the robustly derived returns, it is now possible to calculate the optimal investment strategies according to the risk appetite and individual restrictions for our customers. The big difference to the traditional approach which starts with the point forecast is that optimisation suggests a broad-based allocation. Another advantage of our SAA is that there is no need to additionally model the uncertainty of the forecasts, as is the case with other approaches – such as resampling.

The figure below shows efficient investment proposals based on the traditional approach and the one presented here. While the former only allows for gold, Swiss equities and Swiss bonds for an investor with a risk budget of 8% volatility, our practised approach proposes an optimally diversified investment strategy with additional asset classes such as global equities, global bonds, commodities and real estate: robust, future-oriented and balanced.

Our SAA approach in comparison

Our strategic asset allocation is also explained below in the form of a video explainer (only in German).