Tracking down attractive Swiss equities

The search for promising Swiss equities requires a structured investment process. The focus here is on quality, value and sustainability.

Text: Michael Häberli, Luca Riboni, Rocchino Contangelo

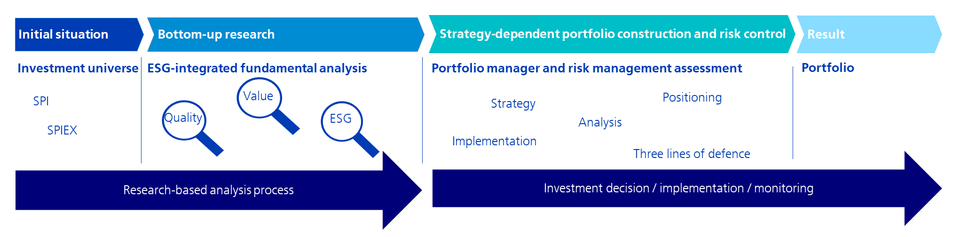

The investment universe provides the starting point for our investment process (see figure below). The universe includes the 220 stocks from the Swiss Performance Index (SPI) or the 200 stocks from the Swiss Performance Index Extra (SPIEX). Our ESG-integrated fundamental analysis focuses on the more liquid Swiss equities. A comprehensive bottom-up research process examines the individual equities according to defined criteria. Depending on the strategy, portfolios then count between 40 and 65 stocks. The portfolio is then constructed in line with the strategy and managed in a risk-conscious manner.

Investment process for Swiss equities

A fundamental bottom-up analysis means that companies are examined separately according to various criteria. Three factors play a decisive role here: quality, value and the integration of ESG into our investment process. ESG stands for Environmental, Social and Corporate Governance. The aim is to identify companies with an attractive risk/return profile.

Quality has many facets

In order to determine the quality of a company, a variety of characteristics are analysed. Particular attention is paid to the analysis of the business model, as companies with an excellent market position, high barriers to entry and technological leadership can hold their own in the market in the long term. For the in-depth analysis, not only qualitative but also quantitative key figures such as the total return on capital, cash flow generation and the company's debt are taken into account.

The "soft" criteria, which also represent important decision-making parameters in the investment process, include the track record and the stability of management.

Choosing sustainably fit investments

Every stock is given an ESG score. This expresses how much a company does to protect the environment, society and good governance. The ESG score is important for the sustainability analysis. Questions on topics such as compliance with the Paris climate targets or corporate governance are considered in more detail in this step of the process and discussed with company representatives in direct dialogue. In this way, those equities that benefit from the sustainability movement can be identified at an early stage. We are convinced that this has a positive effect on the risk-adjusted return.

You can find more information on the integration of ESG into investment decisions on our website.

Casting an eye over favourably valued equities

In the case of the value criterion, the enterprise value obtained by various methods is compared with the current market price. This makes it possible to determine whether and to what extent a company is overvalued or undervalued. A corresponding undervaluation would lead to an excess return in a security. In the long run, prices for equities develop according to their fair value. As a result, rising prices are to be expected.

Value securities are currently in demand, as we noted in a recent blog article.

Risk-aware portfolio strategy

Following the comprehensive, ESG-integrated fundamental analysis of the individual companies, the portfolio managers implement their portfolios in accordance with strategy requirements, taking into account the current investment environment, price potential and market liquidity. The portfolios are always assessed and monitored by three different risk instances.