CO2 pricing – what investors should keep in mind

Taxing CO2 emissions can have a significant impact on the company valuation. This results in investment opportunities and risks.

Text: Dominik Ladner, Equity Research Analyst, Dr Daniel Zimmerer

The reforms of the EU Emissions Trading System (EU ETS) and the introduction of the Carbon Border Adjustment Mechanism (CBAM) are likely to lead to significant CO2 risks for certain industries and companies in the future – particularly in Europe – due to increasing climate ambitions. For this reason, it is essential for investors to recognise CO2 risks and their influence on the company valuation at an early stage.

China lags behind

CO2 emissions are taxed in different ways. As a result, the CO2 markets are strongly affected by regional differences. In Europe, for example, market-based CO2 pricing using emission certificates is a potentially important incentive to reduce emissions, whereas it plays a subordinate role in the USA. Instead, that country preferentially encourages green investments through tax incentives. Looking at China, the world's largest CO2 market, we can see that the country is still in its infancy in terms of CO2 taxation compared to Europe.

The planned introduction of the CBAM from 2026 and the associated cross-border incentive system should also encourage non-EU countries to price greenhouse gas emissions more intensively in the future. Furthermore, the scope of pricing in most regions focuses heavily on power generation and industry and largely excludes other sectors.

Nevertheless, pricing CO2 has the potential to become one of the most effective technology-independent methods of decarbonising the global economy. However, significant investments in clean technologies will also be required, regardless of the price of CO2 certificates. According to an analysis by the consulting agency McKinsey, this entails annual investments amounting to 8 to 9% of global gross domestic product. That would be between eight and nine trillion dollars (as of 2021).

Focusing on CO2 "sinners"

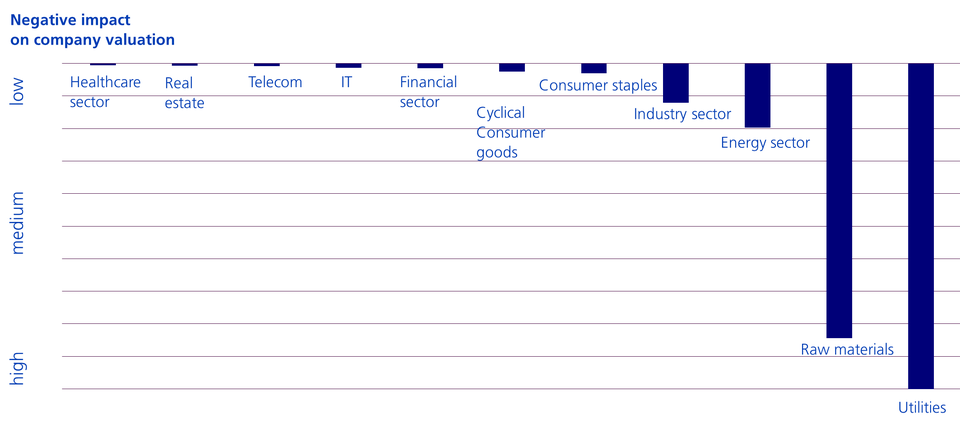

The regional differences in the pricing of greenhouse gases make it difficult to determine a global CO2 price. Putting such a global CO2 price in place would challenge those sectors that are greenhouse gas-intensive in particular.

These sectors include independent electricity suppliers, construction material producers, metal producers as well as oil and gas producers. Considering sector affiliation alone, they potentially face a high valuation risk, to put it very simply.

At the country level, China and India are among the countries with the highest CO2 risks. Both are home to many greenhouse gas-intensive industries such as energy, steel, mining or chemicals. For the USA, which emits the second most greenhouse gases worldwide, the risk is lower. The USA has a broadly diversified economy with a large service sector that can absorb part of the downside risk in high-carbon sectors.

Although the CO2 risk can be estimated based on a company's sector affiliation, the top-down approach should always be supplemented by a bottom-up analysis. This is the only way to holistically determine the CO2 risk. Fundamental analysis is crucial in this context, as other factors can influence the valuation risks of a CO2 price.

How to mitigate CO2 risks?

Below is a non-exhaustive selection of measures on how companies can mitigate their CO2 risks:

- Reduction of greenhouse gas intensity: This requires a clear reduction strategy and the willingness to invest in low-CO2 systems, for example. On the one hand, this willingness is limited by the financial possibility of capital expenditure (amount of expenditure and debt) and, on the other hand, by the lock-in risk, which means how quickly old investments can be replaced by new ones.

- Compensation: Ideally, high operating margins (EBIT) can absorb rising CO2 costs. Pricing power also plays a role: When a company demonstrates high pricing power, it can pass on CO2 and capital costs directly to its customers.

- CO2 hedging: The risk can also be reduced via CO2 hedging, as companies today purchase CO2 certificates (e.g. in the EU ETS) to cover their future emissions and thereby hedge against rising CO2 prices.

Hedging creates time

However, it should be noted that the third option in particular shifts the CO2 risk into the future. It does not actually reduce the company's CO2 emissions. Nonetheless, the reality is not black and white. CO2 hedging gives companies a certain amount of time to achieve short-term reduction targets and implement long-term reduction measures, such as investing in renewable energies.

Good asset management takes into account current and future CO2 risks at the company level as part of fundamental analysis and allows them to be incorporated into investment decisions. Current developments, such as in the area of the proposed trading system with CBAM, have to be closely monitored in order to evaluate the full implications for companies in good time. On the one hand, CO2 risks can have a direct relevance for valuations. On the other hand, increasingly strict CO2 pricing creates opportunities for companies with clean technologies, such as renewable energies, building insulation or heat pumps.

This article was published in a modified form for the first time on 18 January 2023 in Finanz und Wirtschaft / Fonds.