Swisscanto Growth Fund: Companies we are invested in

The Swisscanto Growth Fund has so far invested in 18 promising Swiss and international growth companies. A successful exit was achieved with three of them.

The Swisscanto Growth Fund was launched in autumn 2018 and offers qualified investors exclusive access to unlisted growth companies. Due to the strong innovative power of the portfolio companies, new successes are constantly being reported. Below is a selection of companies from the portfolio that have recently attracted attention:

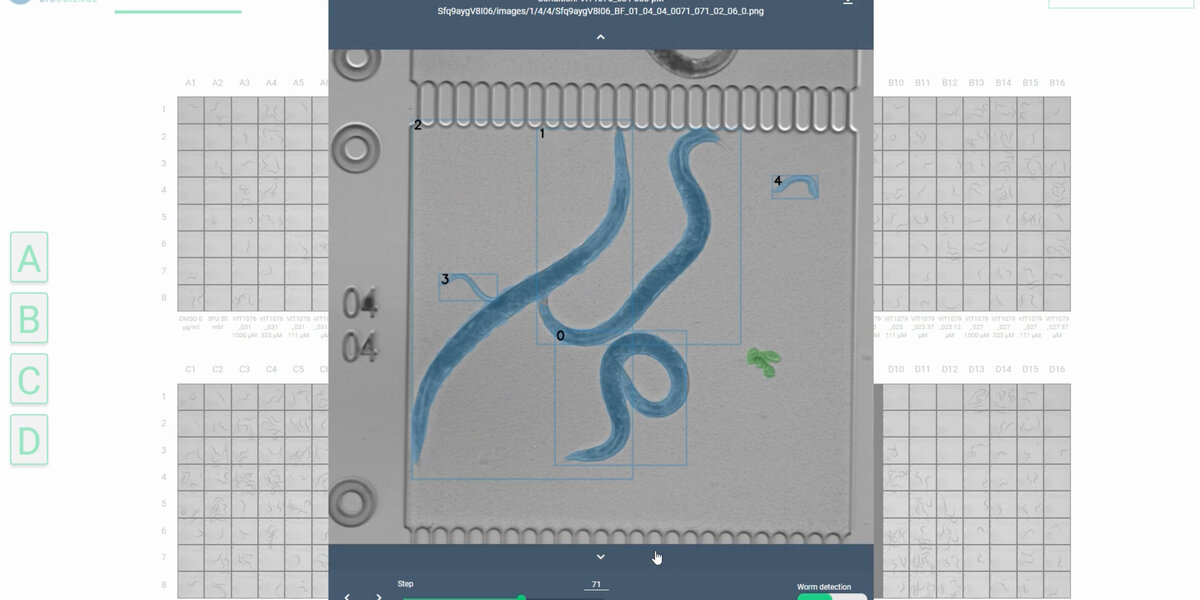

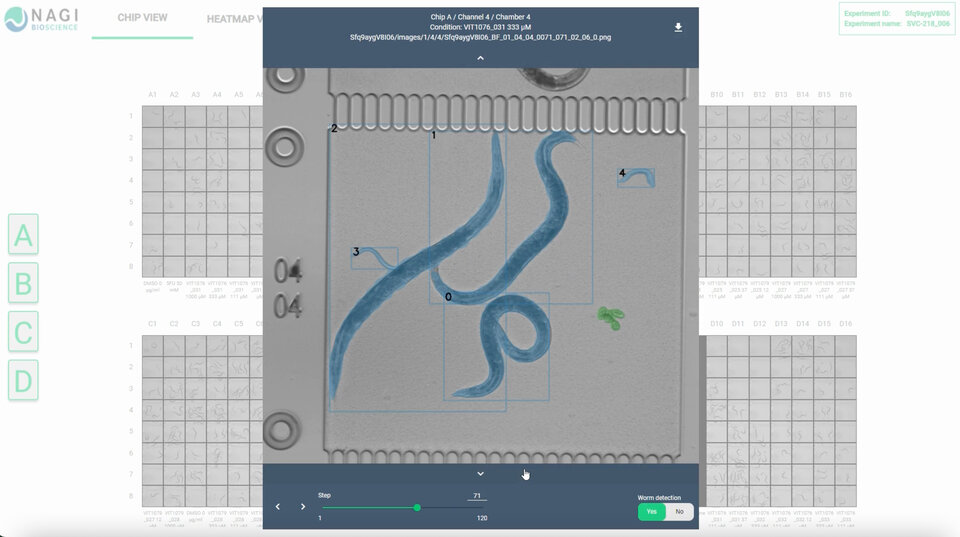

Nagi Bioscience

Nagi Bioscience

Nagi Bioscience - mini worms instead of vertebrates. The biotech company domiciled near Lausanne uses innovative laboratory equipment to make tests on vertebrates obsolete in many cases. Instead, novel drugs are tested on pain-resistant nematodes. One experiment can perform dozens of tests. Analyses and evaluations are carried out digitally. Last September, the Swisscanto Growth Fund participated as a co-lead investor in a CHF 12.4 million financing round. Zürcher Kantonalbank has been on board as an investor since the start-up phase in 2019.

GetYourGuide

GetYourGuide

GetYourGuide – An investment from the very beginning: The former ETH spin-off provides travel experiences, tours and entry tickets around the world. The Growth Fund has been an investor since December 2018, and Zürcher Kantonalbank already participated in the company in 2009 in the very first round of financing. GetYourGuide regularly sets new sales records, winning over investors. In a recent round of financing, GetYourGuide received a commitment of almost USD 200 million. With a market value of over CHF 1 billion, the company belongs to the small group of Swiss "unicorns".

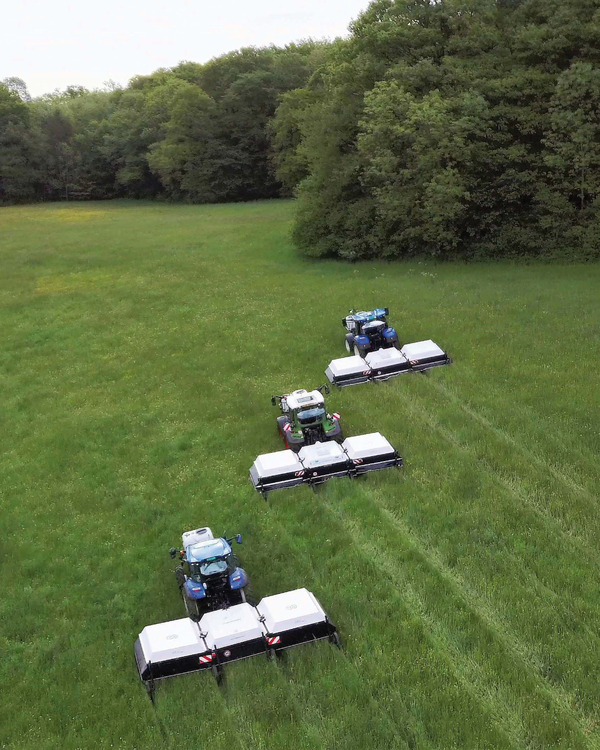

Ecorobotix

Ecorobotix

Ecorobotix – AI-driven plant treatment: The Growth Fund entered the agri-tech company based in Yverdon-les-Bains last October. The flagship product is called ARA. This is an AI-powered plant recognition system that treats plants in a specific manner. This allows agriculture to be conducted more efficiently, while at the same time protecting the environment. A further round of financing brought in CHF 46 million last May. Among other things, the money is to be used to expand business on the American continent.

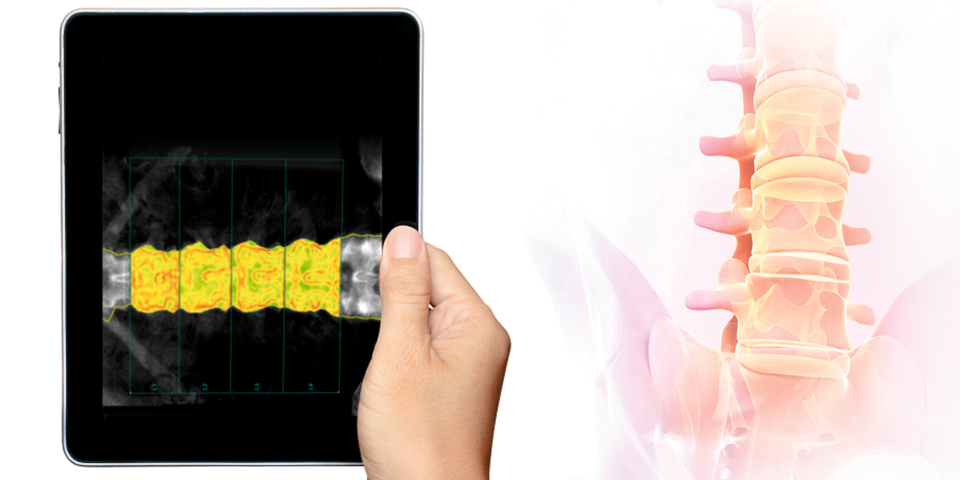

Medimaps Group

Medimaps Group

Medimaps Group – Deep-learning algorithm improves osteoporosis diagnosis: Medimaps Group is a Geneva-based med-tech company that has developed image processing software to assess bone health. Thanks to the patented deep-learning algorithms osteoporosis diagnosis becomes faster and more comprehensive, allowing up to 30% more patients at risk of fracture to be detected. The core technology is being further developed for additional medical indications in the field of orthopaedics and for primary screening from X-ray and CT images. The Swisscanto Growth Fund has been invested since November 2021.

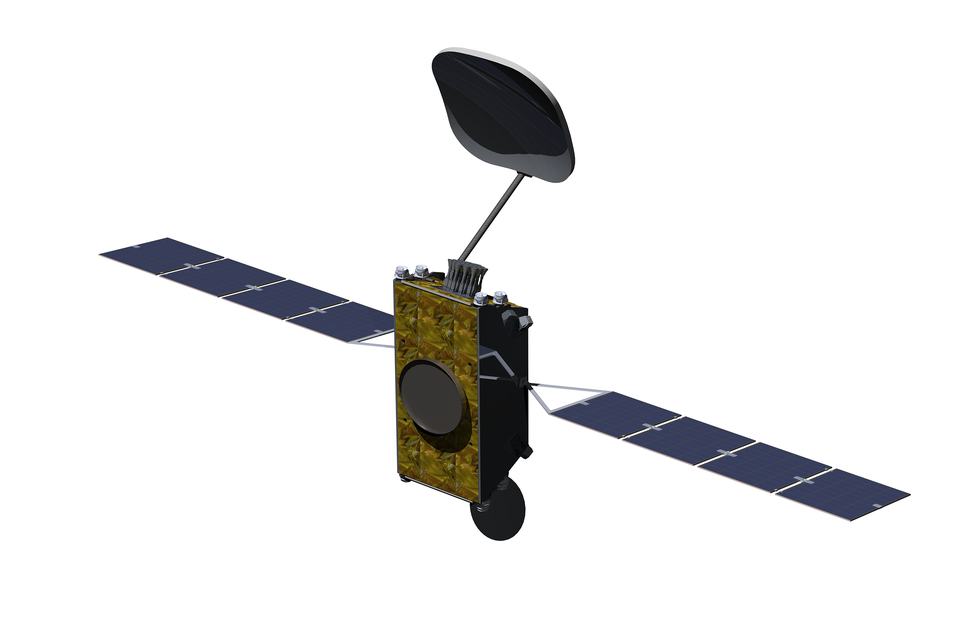

Swissto12

Swissto12

Swissto12 – Satellites made in Switzerland: Founded in 2011 by EPFL graduates, the Swiss technology company produces satellite components using the 3D printing process. Their patented technology allows for a high degree of flexibility with relatively low production costs. Swissto12 cooperates with the European Space Agency (ESA). At the end of last year, Intelsat, the world's leading provider of satellite services, was acquired as a customer. Another deal was recently concluded with Inmarsat. The company is on a strong growth path and offers investors excellent economic prospects.

Already completed exits

1plusX

1plusX

USD 150 million for 1plusX: The Zurich-based software company developed data-driven analysis for marketing purposes and was successfully sold to the US advertising technology company, Triplelift, in March 2022. The Growth Fund became an investor in 1plusX in December 2020.

Versantis

Versantis

Strategic acquisition of Versantis: The French pharmaceutical company Genfit purchased the biopharmaceutical company, Versantis, last September. If the technology is further developed successfully, the sellers will receive additional milestone payments.

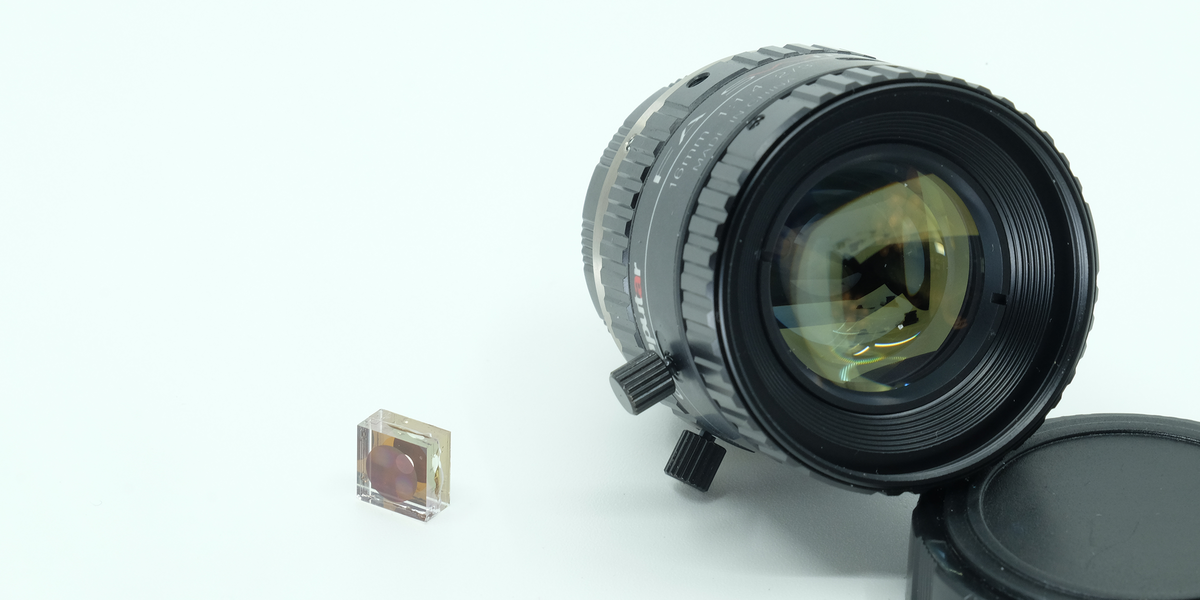

Creoptix

Creoptix

Successful exit out of Creoptix: Health-tech start-up Creoptix was acquired by the British Malvern Panalytical in early 2022. What's special is that Zürcher Kantonalbank was on board as an investor at Creoptix right from the start.

About the Swisscanto Growth Fund

Swisscanto (CH) Private Equity Switzerland Growth I KmGK, or Swisscanto Growth Fund for short, invests in unlisted growth companies. The focus lies on companies with innovative technologies and business models in the areas of information and data services, industry and health. It is envisaged that around 70 to 80 percent of investments will be made within Switzerland. This makes the Swisscanto Growth Fund one of the first investment vehicles under the Swiss Collective Investment Schemes Act (CISA) to concentrate primarily on financing Swiss growth companies in the expansion phase.

The fund is aimed exclusively at qualified investors with a medium to long-term investment horizon and a suitability for illiquid investments. The target return is 10 to 12 percent per year. The subscription period for the fund is concluded with a total volume of CHF 180 million. Follow-up programmes are being planned. Further information on Zürcher Kantonalbank’s current private equity offering can be found here.

Legal notices:

This information is intended exclusively for qualified investors according to CISA, is for information and advertising purposes and does not constitute an offer or a recommendation to acquire, hold or sell financial instruments or to purchase products or services. The subscription period has expired, meaning that this limited partnership is not open to subscription for collective capital investments.