The Swisscanto Growth Fund has become a lead investor of Distran. Distran's sensors can detect gas leaks up to ten times faster than conventional methods. The company thus makes a direct contribution to reducing greenhouse gas emissions. With its technology, Distran aims to save more than 100 million tonnes of CO2 equivalent by 2026. This is equivalent to the volume of greenhouse gases emitted by around 21 million cars annually.

«We were impressed by the ambitious team of founders, the multi-patented technology and the excellent economic outlook,» says Nils Granath, Senior Investment Director for the Swisscanto Growth Fund. He will also sit on Distran's Board of Directors.

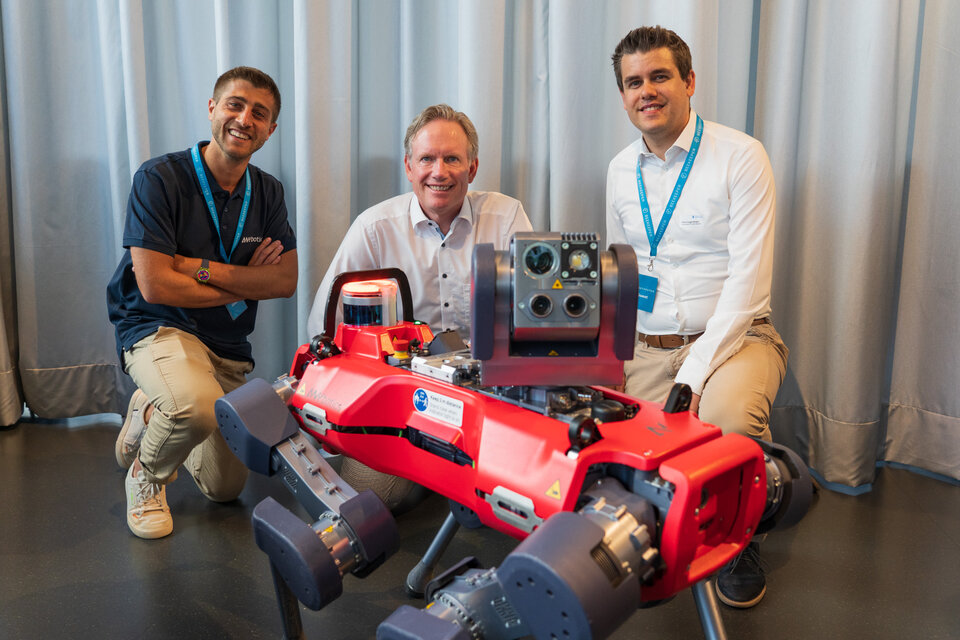

Distran has produced a video on the round of funding.

The Zurich-based ETH spin-off develops ultrasonic cameras. These are equipped with 124 microphones, which acoustically register the smallest leakages from gas lines, for example. The noises in the ultrasonic range are then visualised on the camera image. These Distran "super ears" are even used on a NASA space mission. Their job is to detect leaks in the space capsule at an early stage. In May 2023, the company received funding from the federal government as part of the Swiss Accelerator programme for its great innovation.