Benno, the Swiss small and mid caps indices SMIM and SPIEX have boomed much more strongly in the past quarter compared to the SMI. Will this outperformance continue?

The two small and mid caps indices have outperformed the SMI since the beginning of November 2022. This is a counter-movement to the underperformance since mid-2021. In the long term, however, small and medium-sized companies, or small and mid caps, perform better than big-cap companies. This is due, among other things, to the fact that small caps have a risk premium because they are more illiquid than big caps. In addition, smaller companies usually grow more strongly than larger ones. They are often global niche players with pricing power. However, I think that the current outperformance will soon come to an end.

Why is that?

I am expecting a global recession this year which, according to my analysis, has not yet been fully priced in. One indication of this is the comparatively high levels of indices at the moment. The S&P500 is currently 13 percent below the all-time high at the end of 2021. We are even currently at an all-time high for the Euro Stoxx 50! Based on experience, equity analysts consider companies' earnings to be too high. Accordingly, valuations are also likely to be too ambitious.

Can you be more specific? Are we awaiting a correction such as at the turn of the millennium or during the financial crisis?

The correction could be significant. Inflation, high interest rates and economic prospects all indicate this. I do not expect it to match the severity of the financial crisis.

In addition to the danger of recession, what also makes me act cautiously, at least in the short term, are consequential developments of the coronavirus pandemic.

How so?

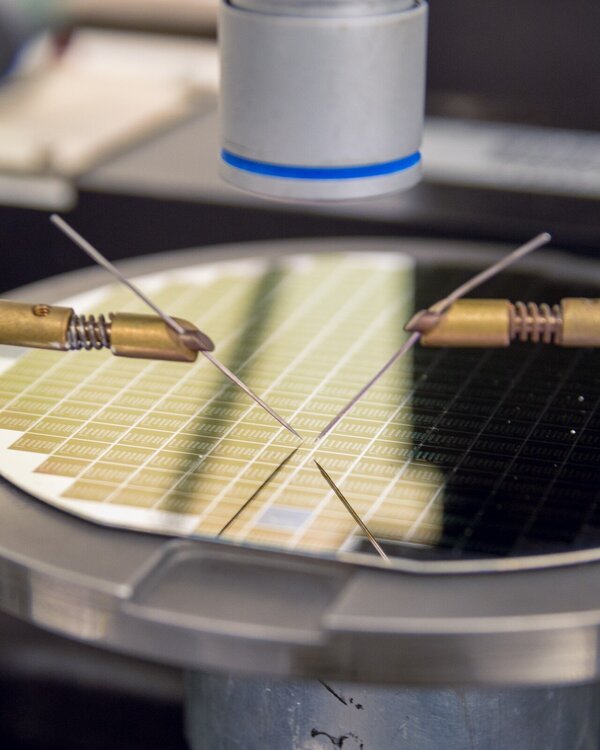

The coronavirus pandemic has highlighted the vulnerability of international supply chains. For example, prices for microchips increased hundreds of times over in some cases during the pandemic. Companies responded by diversifying their supplier network. Moreover, they raised their inventories at an early stage in anticipation of higher prices and delivery delays. This created artificial demand. Before the companies then place further orders, they will first draw down on their inventory levels. As a result, production is likely to be reduced both now and in the near future.

Recession abroad, fears of recession in Switzerland, rising interest rates and persistent inflation all point to a shift to defensive stocks. Where in the defensive sector is the greatest potential?

Investors like to fall back on the 'soul food' chocolate, especially in uncertain times. For example, the world's leading chocolate producer Barry Callebaut comes to my mind. Its securities are favourably valued in an industry comparison and also in a historical context with a ratio of enterprise value to operating profit (EV/EBITDA24E) of 12.1x. In addition, Barry Callebaut has structured the contracts in such a way that customers have to accept higher raw material prices – a proven business model in inflationary times. Lindt&Sprüngli should also be immune to inflation. The brand is so strongly anchored internationally that higher sales prices can be enforced. Another resilient business model can be seen with SIG Combibloc...

...the machine manufacturer specialising in milk packaging.

That’s right. Milk is consumed constantly and in higher and higher amounts, for example in China or India. SIG Combibloc has gained a foothold in both markets. With a global market share of around 25 percent, SIG is clearly the number two behind Tetrapack, which dominates the market. This market situation should offer attractive prices and sufficient growth potential.

And what about the giants like Nestlé, Unilever or Mondeléz?

Nestlé is likely deliver solid organic growth, more than the market anticipates. The large company has adjusted its business portfolio in recent years and positioned it more optimally for the future.

Energy prices are surging. What does this mean for Switzerland's largest utility company BKW?

We are convinced that BKW will benefit greatly from the high energy prices. The company has certain "hidden reserves" and its market position with production and distribution is excellent.

The development of Swiss pharmaceutical and healthcare stocks is surprising. Measured against the SPI Health TR, these have lost around 11 percent within a year (as of: 20 April 2023). This is 5 percent more than the overall market.

In my opinion, this has led to pharma stocks currently being valued too favourably.

Which cyclical stocks defy recession, inflation and higher interest rates?

Let's look at these three. First: Forbo. The customer base of this flooring and conveyor belt manufacturer includes many state-owned companies that also place orders in recessions. Secondly: Burckhardt Compression. The world's leading supplier of piston compressors for compressing or liquefying gas is very well positioned in the hydrogen sector. Hydrogen is considered a key element in the energy turnaround. Thirdly: bank stocks. Banks profit from higher interest rates. Nonetheless, the bank quake triggered by Silicon Valley Bank may not be over yet. There is a certain probability of further seismic waves.