Investment year 2023: a good environment for private equity?

Central banks are responding to the high inflation figures with interest rate hikes and are therefore risking recession. This environment offers good entry opportunities for long-term private equity investments, which can also provide protection against inflation. Nevertheless, the risks must not be ignored.

The combination of unexpectedly sharp rises in inflation and interest rates as well as fears of recession has caught many investors on the wrong foot. Both equities and bonds lost value significantly in the past year. Inflation is likely to weaken over the course of the year and thus at least curb the rise in interest rates. In the medium term, however, increased volatility and systemic risks are still to be expected. Moreover, inflation is strongly anticipated to remain above the levels of recent years.

It is precisely this situation that provides a good starting point for new exposures to private equity investments as an addition to portfolios. In the search for positive real returns, they have so far proven to deliver net returns significantly above inflation rates and equities.

Using recessionary years as an entry point

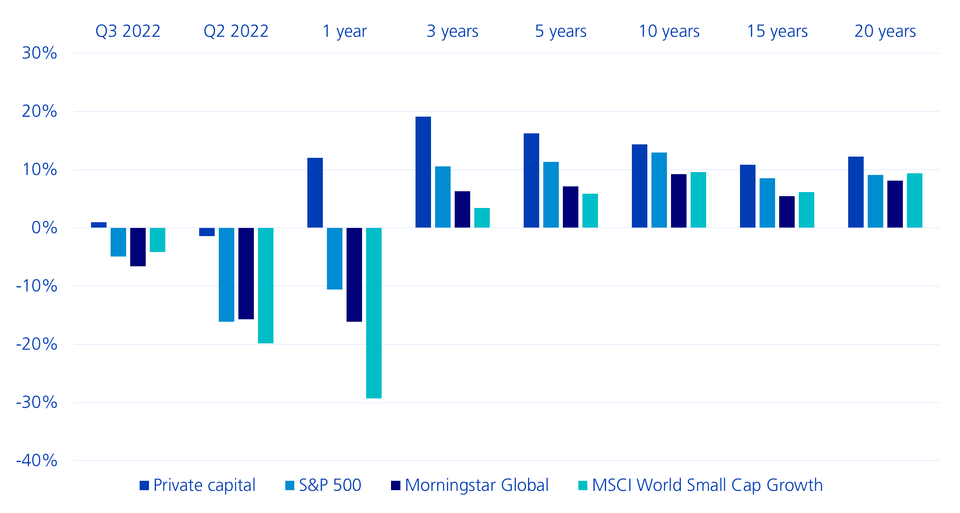

A look to the past reveals that private equity tends to correlate less strongly with traditional asset classes. Private equity outperformed the average performance (internal rate of return, IRR) of global equity indices, such as the S&P 500, in both the short-term and long-term comparison. Private market investments also performed better compared to listed smaller companies (small caps).

Comparing the performance (IRR) of private capital vs. equity indices

Private market investments were more resilient relative to listed companies, especially in recessionary years. This is because private equity-owned companies can often respond more quickly to operational problems and a changing market environment. In addition, investments in innovation and growth are often considered to be more long-term than companies listed on stock exchanges.

Interestingly, many of the most profitable private equity funds with a focus on buyout transactions were launched in recessionary years. According to surveys by the investment data company Preqin, the average annual return was over 14 percent per year, based on data since 1980.

Professional investors should therefore consider incorporating or maintaining private market investments in portfolios over the next few years in view of the expected total portfolio return, inflation protection and capital preservation and, if their risk capacity allows, expanding them if necessary.

Selection of the fund manager is key

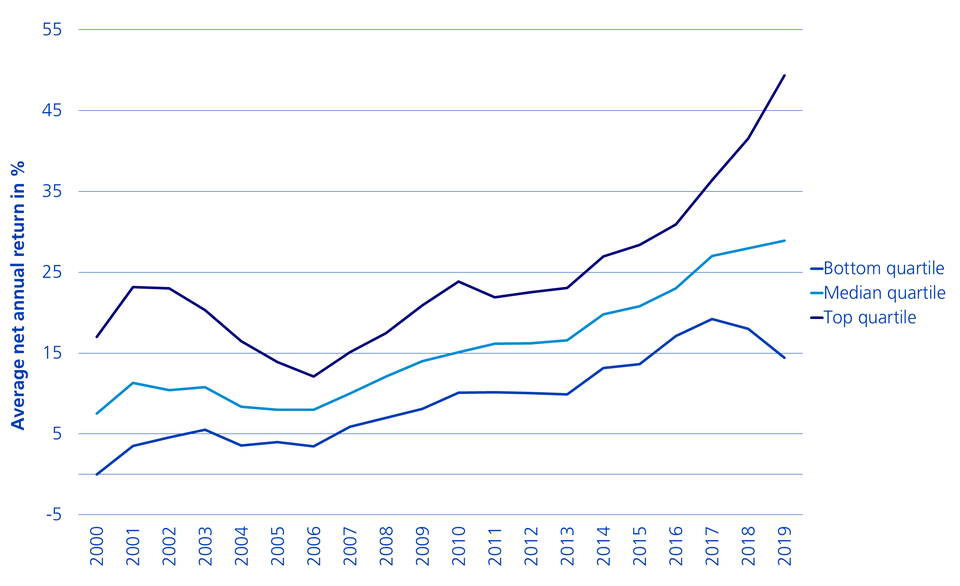

Nonetheless, there are major differences in the implementation of the investment strategy among the respective private equity managers. This leads to a wide range of performance results. In 2019, the return difference between the best and worst private equity funds was around 35 percentage points. For this reason, the selection of and access to the best fund managers is crucial for investors to successfully invest in private equity.

Differences in returns of private equity funds

Decarbonisation solutions with strong momentum

The private asset market has grown enormously. According to the Bain & Company industry report, the capital raised amounted to 108 billion dollars in 2003 and climbed to over 1.2 trillion dollars in 2021. The dry powder, i.e. idle investment capital, amounted to around 500 billion dollars in 2003, compared to 3.4 trillion dollars in 2021.

There is currently also a rapid development in private market funds with a focus on environmental issues. We concentrate here on sectors characterised by mega-trends that generate disruptive innovations to challenge existing business models. We expect higher premiums to be generated with specific themes. In this context, it is all the more important to find active management that masters the art of finding growth companies and funds in the jungle of the private equity industry, which benefit most and sustainably from mega-trends.

The focus is on companies that strategically position themselves as solutions providers for ecological transformation through their product or service offering and can therefore profit from the mega-trend of decarbonisation. The decarbonisation of the global economy is experiencing increasing societal support and has strong financial support from policymakers. Last year, for example, the Inflation Reduction Act was passed in the USA. This has massively increased tax credits for companies that are active in sustainable energy production, for example. The European Union also supports solutions low in CO2, or those which prevent emissions altogether, under the EU Green Deal.

Beware of companies with high levels of debt financing

Private equity investments have different degrees of immunity to interest rate hikes. In particular, there is pressure on those transactions that are usually heavily financed by debt capital and cannot generate high growth. However, debt plays a minor role in the areas of growth and venture capital. The funds specialising in buyouts for very highly capitalised transactions also have difficulty executing transactions at high sales prices.

Generally, an environment of persistent and high inflation will challenge the private equity industry as a whole. Ultimately, the key question is: How high is profitable growth and how well can the relevant company pass increasing costs on to customers? In this context, direct access to the most promising companies and above-average securities selection capabilities is crucial.

Private equity – something just for professionals?

Until now, the private equity asset class was primarily suitable for professional investors with high investment volumes due to the illiquidity and the long holding period of the investment of eight to ten years. However, a form of «democratisation» has now taken place. For example, the minimum deposits for private equity funds have fallen from several million Swiss francs to around 100,000 Swiss francs on average, with some of these funds allowing limited redemption options.

Financial products and digital platforms continue to spring up, enabling individual investments in unlisted companies and funds at even lower entry volumes. But here too, it is important to note: the lower the diversification, the higher the potential risk of loss.

The article first appeared in the Neue Zürcher Zeitung on 27 January 2023.