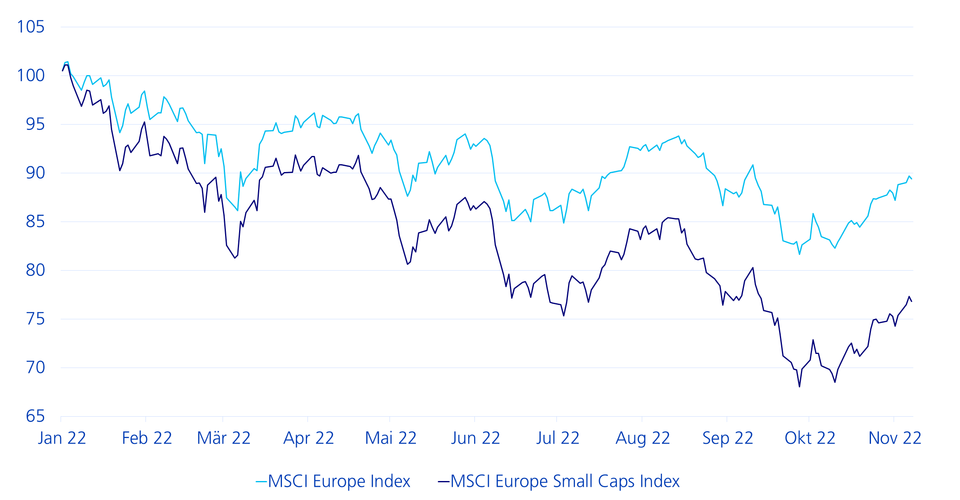

Small caps have lost around 23% of their value since the beginning of the year. The price declines were almost twice as high compared to the MSCI Europe Index, which lost 11%. This index is widely used as a benchmark for European equity investors.

Small Caps Europe: Baked very small rolls this year

It is not only the baker who suffers from high energy prices and tries to sell his rolls a little more expensively. High energy prices, followed by record high inflation rates, and a tightening of financial conditions by the ECBan economy heading into recession are a horrible mixture. For the equity markets and especially for small caps. European small caps suffered disproportionately from these difficult market conditions.

Roland Koster, Senior Portfolio Manager

Why small caps suffer disproportionately

Small companies tend to lack global diversification moiro9e than large ones. They are severely affected by the record high energy prices in Europe and have fewer opportunities to shift production to cheaper countries. Besides higher energy prices, there is a general higher level for prices for inputs: Higher commodity prices, higher labor costs and/or capital cost are all denting margins. With raising interest rates, refinancing risks are in focus again.

Focus on pricing power

Inflation started to rise as early as 2021. Due to the signs of a turnaround in interest rates, we were very cautious about small cap stocks throughout the year. Our investment process combines a disciplined valuation approach with fundamental quality analysis. This helped us to avoid overvalued stocks. Expensive stocks were hit the most during this market correction. Our fundamental quality assessment puts a special focus on pricing power which is one of the most important factors in an inflationary environment.

What conditions should be in place to enable small-cap prices in the Old Continent to rise again?

The most important precondition for a positive price development of European small caps is a trend reversal in electricity and gas costs, as well as an end to the Ukrainian-Russian conflict. That would help European consumers und would keep European companies competitive in the global markets. Lower gas prices would lead to lower inflation and a less restrictive ECB. Europe urgently needs a credible energy strategy for the next few years. Without competitive energy costs, there is a risk of a prolonged recession and de-industrialization of the continent. An end of the current conflict would. - in our view – lead to a major re-evaluation of European asset prices.

Any investment opportunities out there?

For the time being, in Europe, we continue to favor defensive, less cyclical sectors such as communications, consumer staples and health care companies with pricing power We remain cautious on small caps stocks, but we see attractive investment opportunities in high-dividend stocks. In the cyclical sectors, we prefer companies that benefit from the expansion of power grids, renewable energy or investments in energy efficiency. These companies should benefit from the European Green Deal. On Europe's agenda for sustainable growth, there are planned multi-billion dollar investments in European energy independence. These structural themes offer quite a good visibility. Equity positions should be established during periods of relative weakness if they are accompanied by attractive valuations.