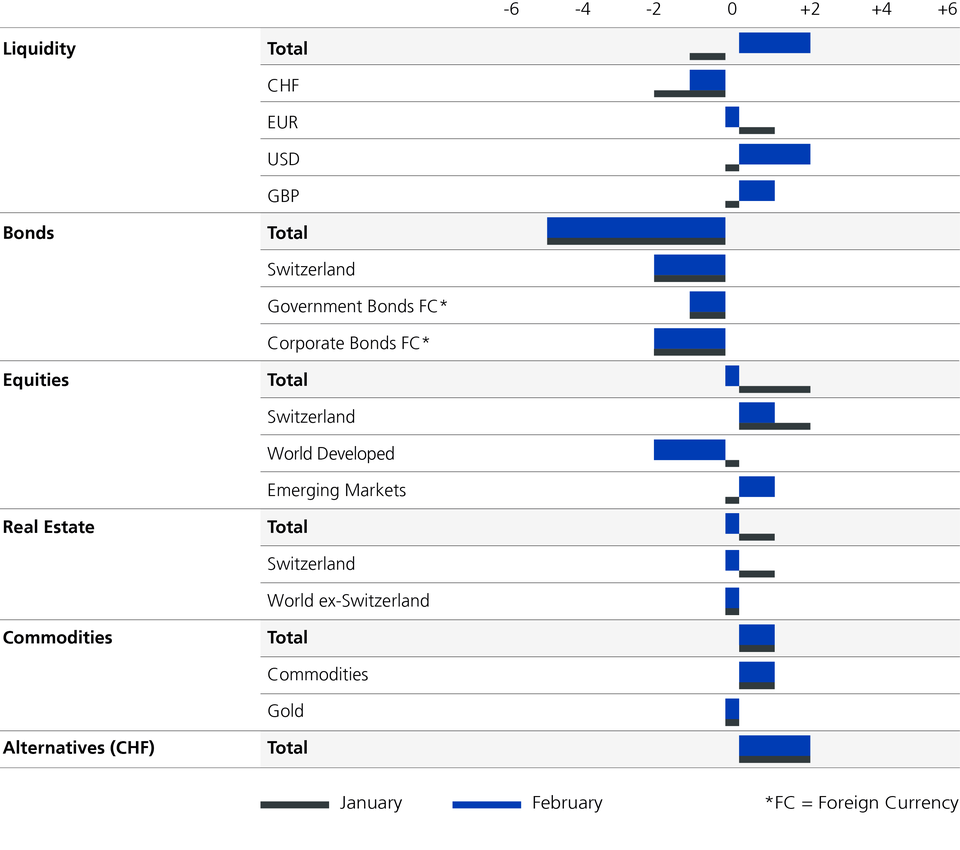

Value stocks were also dragged down. Global equities consolidated to 10% in January’s low and the 200-day moving average in the MSCI World Index was breached. The reason: the Fed was unequivocally clear that it was on course to raise base rates and reduce its balance sheet. Its new narrative, the successful balancing act between the labour market and inflation, including firm anchoring of inflation expectations, has not yet quite reached the market.

We see risks that the economy will weaken, and believe the stock market has not yet fully digested the change in monetary regime. The environment for equities has deteriorated. We now prefer a neutral equity allocation and reserve the right to purchase equities in the near future. We continue to be overweight in commodities, as supply shortages tend to rise and commodity investments also act as a hedge against geopolitical tensions.