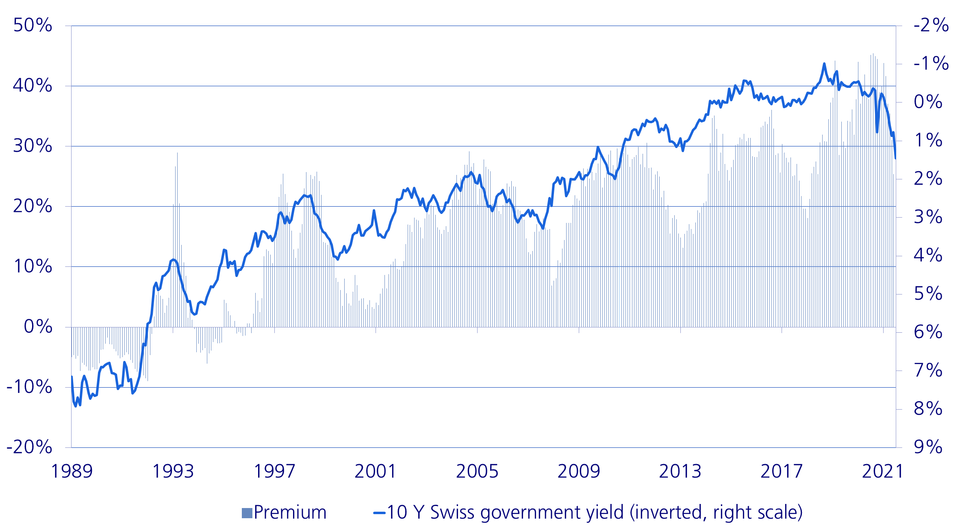

The chart shows that the average yield for ten-year Swiss Confederation bonds are inversely correlated with the premium/discount of the real estate funds. This means if interest rates rise, premiums fall. As can also be seen, certain swings such as 1993, 2001, 2008, 2015 and 2018 cannot be explained by the interest rates alone. The other factor that had an impact in these years was the performance of the Swiss equity market.

Since we now see rising interest rates and falling equity prices again, premiums are likely to decline further.

Summary

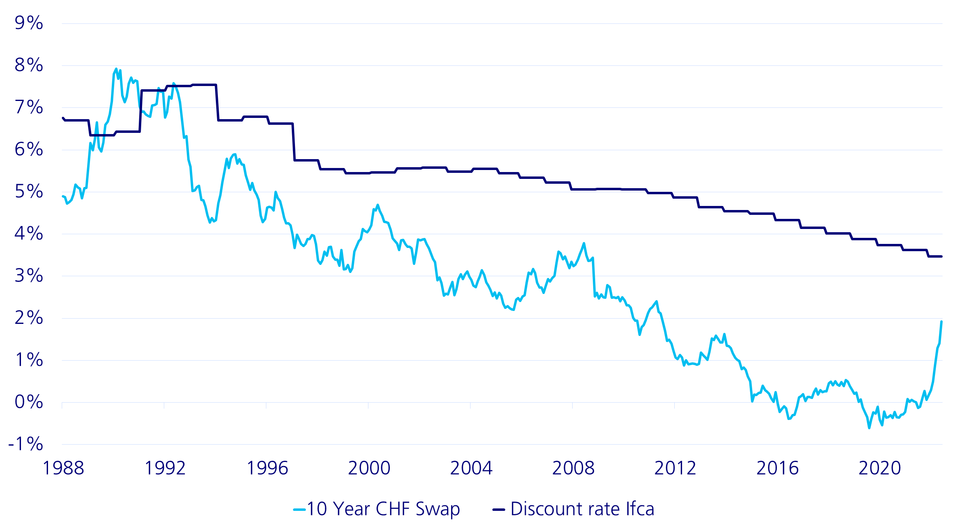

Higher interest rates will slow down the persistently higher valuations of real estate, but as long as the long-term interest rates remain below the discount rates of the valuers, there will be no significant valuation corrections. The premiums of listed funds are already suffering from rising interest rates and this is likely to continue. What's more, real estate offers good protection against inflation. On the one hand, inflation makes construction more expensive, and on the other hand, many rental contracts in the commercial sector are linked to inflation. Returns therefore rise with inflation. Over time, real estate thus proves to be a stable return anchor in a portfolio.

Digression: comparison with the 1970s

How did real estate investments develop in the turbulent 1970s and what can be learned from this for the current market situation? We would now like to briefly examine these questions.

In 1971, there was a turnaround in monetary policy. The trigger was US President Richard Nixon, who detached the dollar from gold. Since then, the world's reserve currency has only been a paper currency that can be arbitrarily inflated. Nixon needed more liquidity. The USA had to finance the Vietnam War and the comprehensive "Great Society" social programme.

In 1973, another serious event followed, namely the Yom Kippur War between Israel and a coalition of Arab states led by Egypt and Syria. Since the USA provided military support to Israel, the Arab states issued an oil embargo against the West. This led to sharply rising commodity and gold prices and an inflation shock. The central banks initially only acted tentatively to counteract this. A wage-price spiral started with the greatly expanded money supply. Inflation started to run off by itself and was only stopped by Paul Volcker, then President of the Federal Reserve, with drastic interest rate hikes.

Parallels to today

The situation back then is similar to that of today. The central banks fired up the printing presses to mitigate the financial and Covid crisis. Moreover, the war in Ukraine is pushing oil and gas prices up sharply. Inflation is currently as high as it was in the 1970s. As was the case at the time, the central banks' countermeasures are hesitant today.

Like then, rising interest rates are currently leading to price losses in bonds. The increased cost of raw materials resulted in a recession in 1974, with inflation remaining high. As a result, Europe, Switzerland and the USA slipped into stagflation. Companies suffered from high raw material and interest costs and declining sales. Consequently, equities went through a bear market for two years.

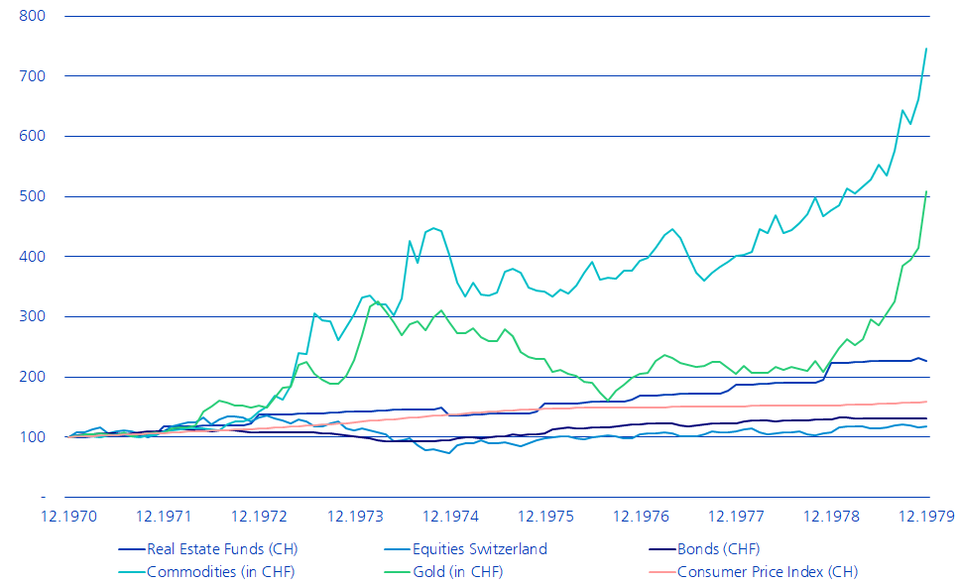

Real estate – solid as a rock

Nonetheless, in contrast to equities and bonds, Swiss real estate funds delivered a relatively stable return. Only in 1974 were there price reductions for real estate funds (the interest rate for first mortgages had risen to over 8 percent), which were greater than rental income. However, thanks to the easing of interest rates, a positive overall return was achieved again as early as 1975. Apart from gold and commodities, real estate was the only asset class that more than compensated for inflation in the 1970s. Contrary to commodities and gold, real estate also achieved a positive performance in the following decade.

Development of inflation and various asset classes in the 1970s