Carbon Capture is a promising investment theme

As part of international efforts to mitigate the effects of climate change, the market for the capture, recycling and storage of CO2 has great future potential. The opportunities are therefore promising.

Text: Dr Daniel Zimmerer

Limiting global warming to 1.5 degrees Celsius above pre-industrial levels requires reaching net zero by 2050. By then, it must be possible to massively reduce the greenhouse gases emitted worldwide and compensate for unavoidable emissions, for example by "suctioning off" CO2.

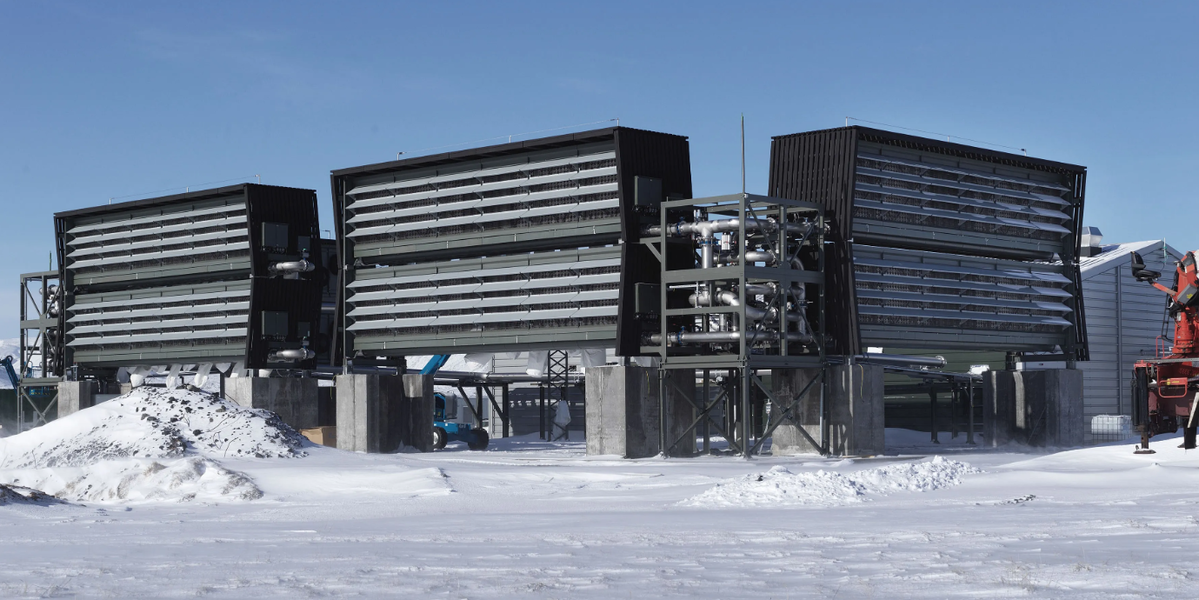

The latter includes what are known as CCUS technologies. CCUS stands for "carbon capture, utilisation and storage". CO2 is extracted directly from the air or greenhouse gases are captured by industrial production processes before they escape into the atmosphere. The CO2 is then stored underground or used in industrial processes such as the production of synthetic fuels, chemicals or building materials.

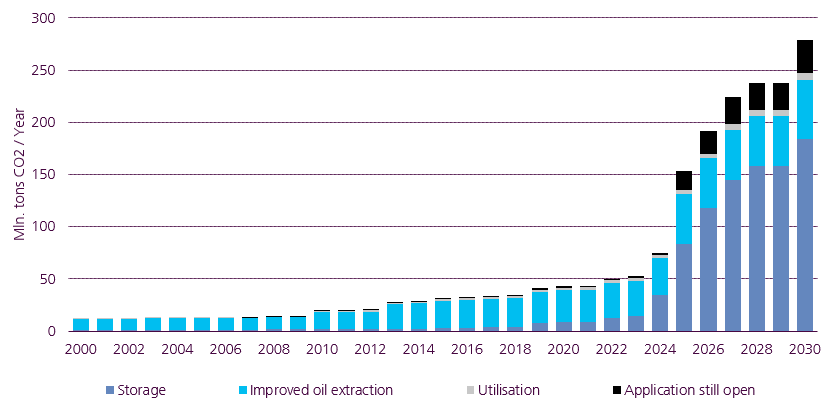

Bloomberg New Energy Finance (BNEF) has evaluated all CCUS projects and calculated a global CCUS capacity of 279 megatonnes per year by 2030. In 2021, this capacity stood at 44 megatonnes. This corresponds to cumulative annual growth of 20%.

Global annual CCUS capacity

But that is far from enough. According to the International Renewable Energy Agency (IRENA), CCUS capacities of between 1,000 and 2,000 megatonnes are needed to achieve the 1.5-degree target by 2030. 2,000 megatonnes correspond to an estimated 400 billion dollars in cumulative investments. So there is still great potential.

CO2 price dictates the direction

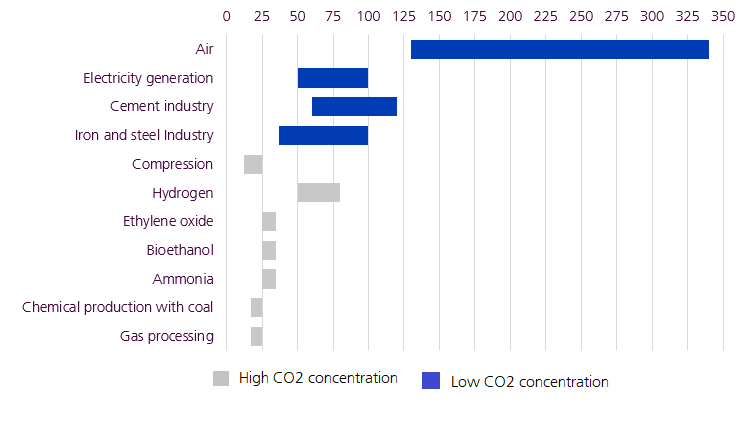

The rapid realisation of this potential is largely dependent on the total costs. Currently, the cost of CO2 capture is between around 330 USD/t for direct capture from the air and around 20 USD/t for natural gas processing. The high variability of costs is primarily due to the different CO2 concentrations. High concentrations typically result in lower costs per tonne.

Cost of CO2 capture by sector and CO2 concentration

In addition to the costs of CO2 capture, there are expenses for transport (around USD 30/t) and storage (around USD 10/t). The total costs for CCUS in the USA are therefore currently around 80 USD/t on average.

This is similar to the price of an EU emission certificate (as of: 3 January 2023). The total cost of CCUS projects is most likely to decrease further in the coming years due to technology improvements, tax subsidies and increased production volumes.

Politically desired and supported

The use of CCUS technologies is becoming increasingly worthwhile due to rising CO2 prices. There is also political support. In the USA, the Inflation Reduction Act was passed in 2022. This has massively increased tax credits for companies per tonne of CO2 separated and stored. The European Union also supports CCUS projects under the EU Green Deal.

Nevertheless, the risks must not be overlooked. On the one hand, there are risks in the safe storage of CO2 in the ground. Leaks due to seismic activity cannot be ruled out. The fear of this is also the reason why resistance to such CO2 storage projects is sometimes formed at the municipal level. On the other hand, a significantly lower than expected CO2 price could impair the commercial attractiveness of CCUS projects.

How to invest?

Professional investors with in-depth know-how in the area of private market investments can invest directly in companies that own and operate CCUS systems. These are usually unlisted, but increasingly require external financing. There are also private equity funds that focus on decarbonisation technologies. In addition, selected listed companies that sell CCUS equipment and services could participate in this area.

More publications by Daniel Fauser

Daniel analyses sustainability issues in asset management at Zürcher Kantonalbank and regularly publishes on our blog - also together with colleagues. Here are more blogs from his pen:

Spotligh on electric vehicles and batteries, October 2022

Climate protection: a turning point in the USA, September 2022

Using renewable energy to mitigate rising inflation and supply insecurity, August 2022

Carbon Pricing in times of high energy prices, April 2022