2023 study – disillusionment following previous year's records

Every year, the Swisscanto Pension Funds Study points out important developments from previous years. The current study was able to determine surprisingly robust results given the market pressures. Following the study, the ongoing recovery continued with the support of stable market developments.

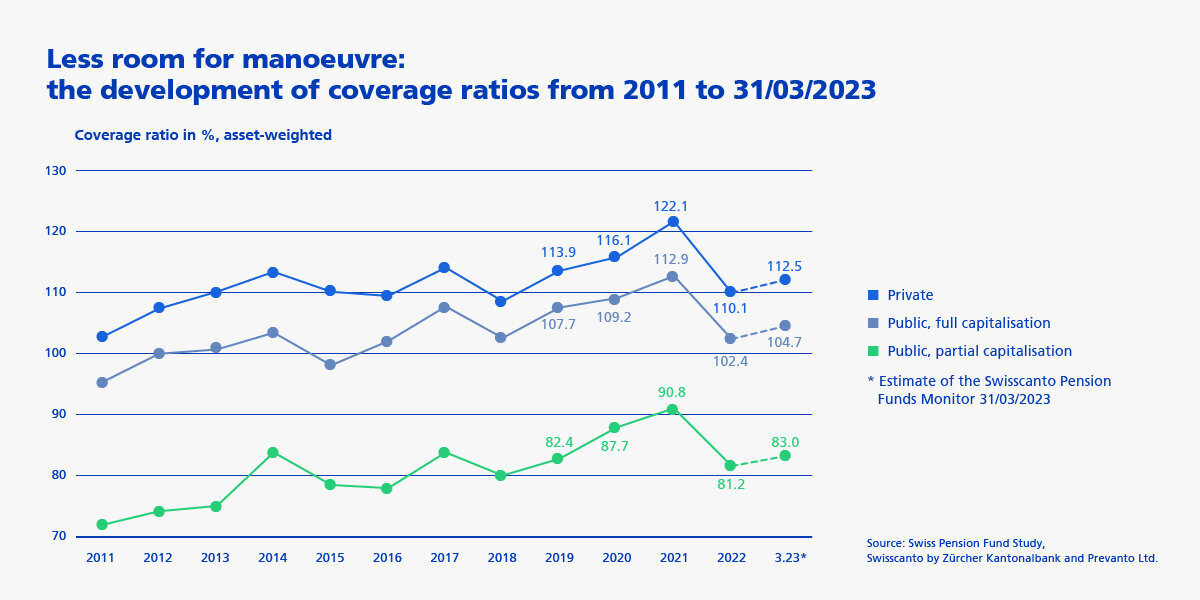

The health of pension funds was put to the test in 2022

2022 was a difficult year for the pension funds and their insured members. The reason for this was the negative development on the financial markets, which also impaired the price performance of equities and bonds. After the year's low in autumn 2022, a steady recovery began, which was temporarily affected by ongoing inflation and an increasing probability of recession. Nevertheless, Europe's equity indices reached new record levels in spring 2023.

The pension funds achieved an average return of -8.8% on assets in 2022 – the second worst performance in the last 20 years.

Despite the negative performance in a turbulent investment year, the assets of active members are subject to positive interest rates. However, real interest rates are negative for the first time in 30 years due to the high inflation.

The performance range is twice as high as in previous years and ranges from -1.0% to -16.2%.

After decades of continuous cuts, the technical interest rate rose slightly for the first time since the BVG came into force in 1985.

Meanwhile, 37% of pension funds have anchored ESG criteria in their investment policies.

Funds with relatively high proportions of illiquid assets performed above average in 2022. Illiquid assets include alternative investments, private equity and infrastructure investments.